COVID-19 Next Steps

May 1, 2020

The COVID-19 virus and the ensuing economic shutdown have forced businesses, governments and households to reassess new business models, new business relationships, new technologies and new public policies.

This global pandemic will also have an effect on the investment landscape: distinct investment opportunities in the short and long term, a return to fundamental analysis and the role of active managers in investment portfolios, and emerging investment themes in the private markets are just a few areas that we will be focusing on as a firm in the coming months.

The sharp market pullback and uncertainty around the impact of the pandemic on the real economy (GDP, corporate earnings, etc.) has led to significant short term dislocations, while at the same time setting in motion new investment opportunities that will play out over the long term.

Short Term (April – August)

Uncertainty about the duration and magnitude of the self-imposed economic shutdown has caused many asset classes and sectors to pullback dramatically. This has provided an opportunity to rebalance portfolios to their strategic allocations; but beyond rebalancing, we see several investment opportunities that can emerge in the next several months.

However, it is important to keep in mind that when allocating into dislocated opportunities during a time of exceptionally high macro uncertainty, risk management is paramount.

Therefore, we are dividing the short term in three time segments, each affected by different risk factors and levels of uncertainty, but each also providing distinct investment opportunities.

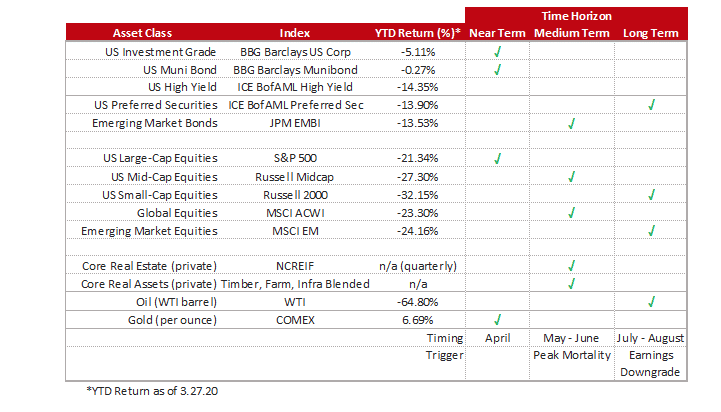

- April– during this time, uncertainty is at its highest. The number of new COVID-19 cases curve is growing exponentially, the steepness of the infection curve, and the duration until the curve flattens is yet unknown. We see two investment themes emerging during this time:

o Fixed Income, particularly Municipal Bonds and Investment Grade Corporate Bonds. Due to the liquidity shock in the fixed income space, we believe these are the highest quality dislocated fixed income sectors.

o US Large-Cap Equities – we have seen a recent improvement in valuation for this asset class and in general believe US Large-Cap stocks have stronger business models, better access to capital, more diversified business lines and pricing power, which can result in less volatility than other equity cap sizes.

- May to June– during this time, uncertainty begins to decline. The infection curve begins to flatten and we have a clear sense of the duration of the self-imposed economic shutdown. As uncertainty declines, riskier investment assets become more attractive, including:

o US Mid-Cap Equities

o Global Equities – strategies that invest in both developed international markets and in the US.

- July to August– uncertainty related to the health impact of COVID-19 fades, companies begin to report earnings revisions and the scope of the economic impact of the past few months is better understood. With uncertainty declining, look at the two most volatile asset classes:

o US Small-Cap Equities

o Emerging Market Equities – emerging market economies are heavily dependent on the developed world so waiting for developed economies to re-open is important for risk drivers.

During this time, there could also be an opportunity to add to preferred securities, but only if the impact on credit risk is better understood.

And finally, although spreads in the high-yield market have become more attractive, we believe investors should avoid investing in this asset class in the short term until there is more visibility on the default cycle.

We believe that utilizing this risk averaging approach allows for both investing at lower valuations while also being better protected if the markets were to drop again.

Below a summary of the asset class investment opportunities during each time period:

Long Term

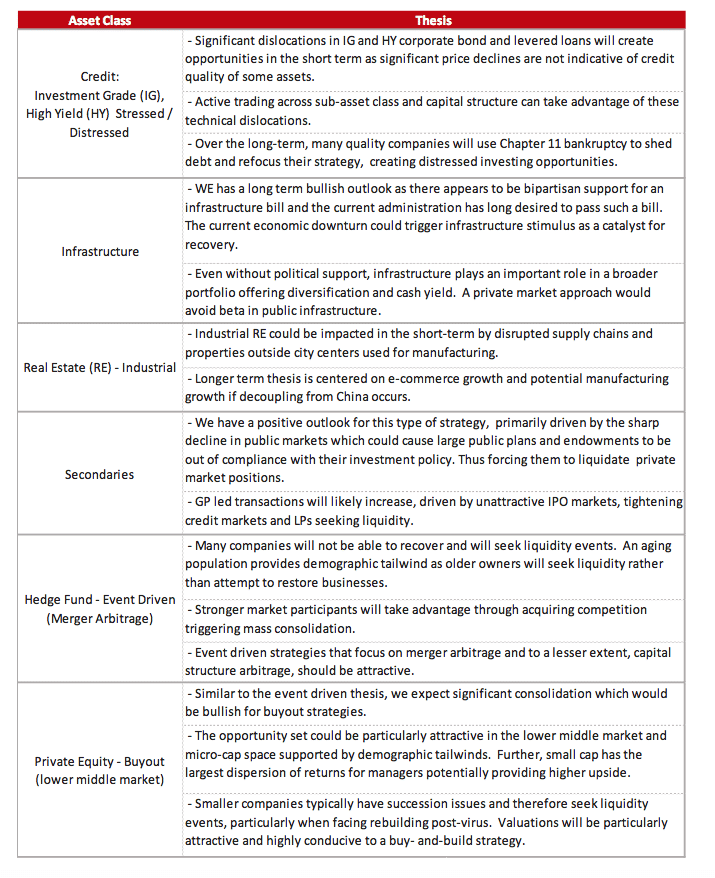

We have identified the following investment themes, some of which are a continuation of themes existing before the crisis, while others are a reflection of a new set of opportunities. We will initiate manager due diligence on emerging thematic opportunities, such as:

- Technology: increase in demand for web related services to enable better and more efficient ways to work remotely and shop on-line

- Health: higher investment in biotechnology to increase speed of cures and disease testing

- Infrastructure: increase in investment for power transmission, surface transport, rail, ports & waterways

- Precious Metals: as a hedge against higher inflation caused by de-globalization and the increased national debt.

Active Manager vs Passive Indices

We believe that the longer term market environment will favor managers who are experienced, better able to manage risk and have investment expertise in specific sectors or geographies. Utilizing in-depth analysis, skilled active managers should be better able to take advantage of the “alpha” opportunities ahead. In contrast, passive ETFs, while cheaper, allocate indiscriminately to all holdings which can leave investors holding less than ideal securities or bonds.

Asset Classes to Avoid

So far, we have focused on investment opportunities brought upon by the changing economic and market landscape, but just as we are analyzing and are sourcing emerging investment opportunities, we are also spending time identifying those we should avoid. European equities and US Treasuries are two areas we are currently cautious about. The forces that strained European economics, politics and markets before the virus outbreak are likely to have been exacerbated. This is the basis for our recommendation of investing in a global equity manager, in order to access select European equities rather than an exclusively international manager. Due to the COVID-19 outbreak, US Treasury yields have fallen to levels below those seen during the Great Depression. The immense cost of the recent support programs will add several trillion dollars to the national debt and worsen the country’s debt dynamics. As a result, the rising risk vs. paltry returns (currently 0.75% for a 10 year Treasury bond) make Treasury bonds unattractive.

Private Markets

It is difficult to assess the full impact to the private markets until there is more clarity around the depth and extent of the health crisis. WE has been in contact with numerous private market managers, all of which have similar messages: they expect an adverse impact on valuations but are unsure of the extent and do not anticipate having clarity until later this year. However, most managers had the view, pre-crisis, that we were in a late-cycle economy, and were therefore positioning their portfolios in a defensive manner. This risk mitigation should provide some levels of support, but declines in values will be unavoidable for most positions.

While there are still significant unknowns, inevitably there will be opportunities in the private markets to take advantage of dislocations in the short term, consolidations, liquidity needs, restructurings, bankruptcies, and potential government subsidized growth over the medium and long term. The following chart highlights some of the key themes and asset classes we are currently exploring.

CIO & Managing Partner

Disclaimers

WE Family Offices LLC (“WE”) is under no obligation to update the information contained herein or to correct any inaccuracies. Certain information provided herein is based on third-party sources, which information, although believed to be accurate, has not been independently verified. This material is static at a point of time, subject to change without notice and, due to the rapidly changing nature of the securities markets, may quickly become outdated.

This review contains our current opinions and commentary, and does not represent a recommendation of any particular security, strategy, asset allocation, investment product or manager. The views expressed here are subject to change without notice. Our commentary is distributed for informational and educational purposes only and should not be considered as investment advice or an offer of any security or service for sale. This material does not consider the specific investment objective, financial situation or particular needs of any client.

Certain statements contained herein may constitute “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variation thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions.