What to Do About Rising Inflation? Commodities Enter the Conversation

July 13, 2021

Whether inflation is short-term or here to stay, investors should consider incorporating natural resource equities and commodities to take advantage of low relative valuations and inflationary tailwinds.

As a family office company, our investment mandate often focuses on finding strategies that can drive returns in a rapidly changing and often-volatile environment. In many recent conversations with clients, the topic of inflation is a focus. When is it coming? How will it affect portfolios? And most importantly, what can we do about it?

Inflation, which lay dormant for several decades, has recently started to emerge. According to Bloomberg, the April Consumer Price Index came in much higher than expected, causing both equity and bond markets to pull back. Some key considerations are whether the increase is temporary, if we are shifting to higher long-term inflation, and of course, how to respond in portfolios.

Despite the Federal Reserve cautioning markets about the volatility in inflation since last summer, the markets have only recently become apprehensive about it. However, most of the upturn in recent inflation data can be explained by a combination of temporary (or “transitory”) factors due to the reopening and base effects from comparisons to last spring’s depressed levels.

According to the Bureau of Labor Statistics, much of the increase in inflation figures in the CPI were caused by sectors with pent-up demand that were heavily affected by the COVID-19 pandemic. Two of the largest increases came in hotel room rates and airline fares. Travel was dampened during the pandemic, and due to the reopening, demand has surged, which has lifted travel-related prices. Areas not affected by COVID did not change much in price.

Using a low base for comparison is another cause for inflation anxiety. During the COVID shutdown last spring, there was not much demand for oil. With the reopening, as people are driving more, the price of oil has risen 250% from $19/barrel in April 2020 to $65/barrel in April 2021, according to CNBC. Energy is a significant part of the headline CPI index, so it had a very large impact on one year inflation. How concerned should we be given that the price of oil was $64/barrel in April 2019 and $68/barrel in April 2018? The base effect was very strong but says nothing about the future price of oil.

It comes down to a sudden increase in demand over supply. Demand has been supported by several rounds of generous stimulus checks. Combined with the effective vaccine rollout and a year of social distancing, consumers have the ability and willingness to consume. With the economy opening up, the result has been very strong GDP growth.

While it has been relatively easy to stimulate demand, restarting supply has been much more difficult due to disruptions. Supply chain bottlenecks, labor market imbalances, and commodity and component shortages all may take much more time to smoothen out. The large increase in demand without the commensurate increase in supply has caused prices to rise.

The key to solving the near-term inflation problem is the labor supply. The recent JOLTS survey showed the large number of jobs that need to be filled. This tells us that businesses are witnessing high demand as seen by the “help wanted” signs. The issue is the workers’ willingness and ability to get back into the labor force. After COVID-related unemployment benefits expire in September and schools resume in the fall, the labor market supply is expected to increase.

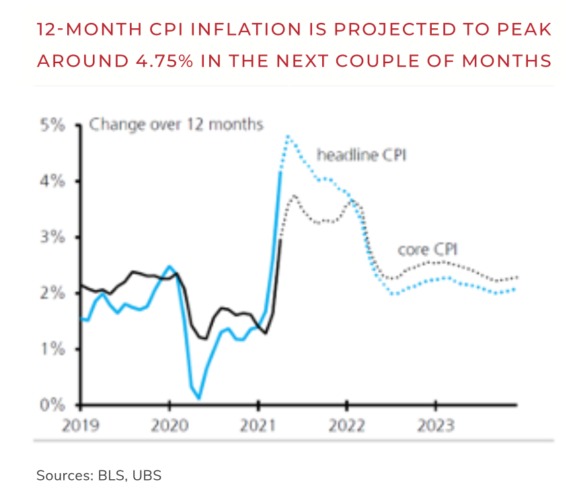

As the US economy fully reopens, inflation should diminish as supply catches up to demand. Therefore, the current inflation spike due to base effects, supply chain disruptions and one- off fiscal stimulus spending should be transient. Both headline inflation (which includes food and energy) and core inflation are expected to spike in the second quarter before starting to normalize and fall toward the Fed’s target range as seen in the following graph:

However, inflation is very difficult to predict, and a major risk is that it is not as transitory as expected. Financial markets have embedded inflation expectations over the next five years of 2.2% to 2.4%. This is still a moderate level, despite being the highest in a decade. One of the major causes of inflation in a service-based economy is wages, and thus far, wage inflation has been kept in check. The forces that kept inflation in check over the past 30 years – technology, globalization and demographics – remain in force.

Resources and Commodities Enter the Conversation

The combination of fiscal stimulus, increased infrastructure spending along with accommodative monetary policy points to higher inflation compared to the past. Inflation was far too low in the last decade and the Federal Reserve would like it to run hotter. Raw materials gained through exposure to natural resources and commodities could benefit from this shift.

According to the White House, President Biden’s American Jobs Plan proposes allocating $2.2 trillion to infrastructure. Moreover, the AP reported that Europe is planning to invest nearly $1 trillion in green infrastructure as part of a “Green Deal,” and a report by Wood Mackenzie estimates that China is expected to spend over $6 trillion on green power transitioning. New infrastructure spending is resource intensive. Repairing traditional infrastructure, investing in green infrastructure and the trend toward clean technologies such as alternative energy will require new resources (e.g. lithium and copper are large inputs in electric vehicles). This could signal an opportunity for investors to make a shift towards commodities ahead of these policies.

Natural resource equities can benefit from both growth in demand and an increase in inflation. Resource equities tend to perform well during times of higher inflation. Many commodity-related companies can pass through higher costs via pricing power, potentially leading to higher margins. Real assets, such as commodities and natural resource equities, tend to be closely linked to economic inputs such as labor, capital and materials. As the prices of those economic inputs increase, the value of real assets also tends to rise.

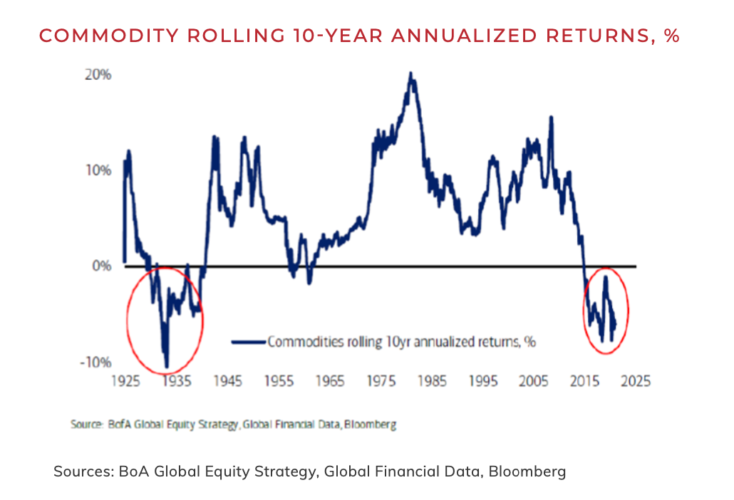

Over the past decade, commodities suffered from oversupply and a decade of lethargic economic growth. The combination of low demand and oversupply led to over 10 years of poor returns. Commodities rolling 10-year returns were the lowest since the Great Depression of the 1930s as seen:

With financial assets such as stocks and bonds having done extremely well over that period while commodities languished, relative valuation of commodities is currently cheap as seen in the commodity index compared to the S&P 500 Index:

While no one knows for certain if inflation is transitory or here to stay, a strong case remains for considering incorporating natural resources into your portfolio. With a long runway of growth ahead, strong catalysts and low valuation, natural resource equities and commodities can capitalize on the increase in inflation. As we discuss above, long-term inflation may very well indicate the start of a new economic cycle, during which natural resources perform well, potentially providing investors with opportunity in those tail winds.

Click here to download the PDF.

Disclaimer

This document contains our current opinions and commentary that are subject to change without notice. Our commentary is distributed for informational and educational purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient. Information contained herein has been obtained from sources we believe to be reliable, but we do not guarantee its completeness or accuracy. The information contained herein does not constitute legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.