Resetting Expectations

June 7, 2022

Summary Points

- Investment returns from 2010 to 2021 were historically very high, particularly in equities. The future is unlikely to repeat that level.

- The macro environment of The Great Moderation was underpinned by globalization, exceptionally low interest rates, quantitative easing and deflation.

- We expect the new regime to be an unwinding of the Great Moderation and returns to be driven by fundamentals.

- Longer-term inflation should be higher than in 2010 to 2020 and closer to historical averages.

- Potential US economic growth is estimated at approximately 1.8 – 2.0%.

- As a result, mid- to upper-single-digit US equity returns expectations are realistic.

- Core fixed income is expected to generate low real yield.

- Real assets, particularly commodities and infrastructure, have strong tailwinds.

Generating the same return as in the past will require a much higher level of expertise and effort compared to the past and will require a greater focus on portfolio architecture. For investors looking at the months and years ahead, we believe expectations for future returns need to be reset as the factors that drove the previous decade’s high returns and low volatility are being replaced with a new set of factors with different results. In this commentary, we discuss those factors and how we expect equities, fixed income and real assets to perform in the new environment we are entering so investors can set their expectations and objectives accordingly.

Past Ten Years

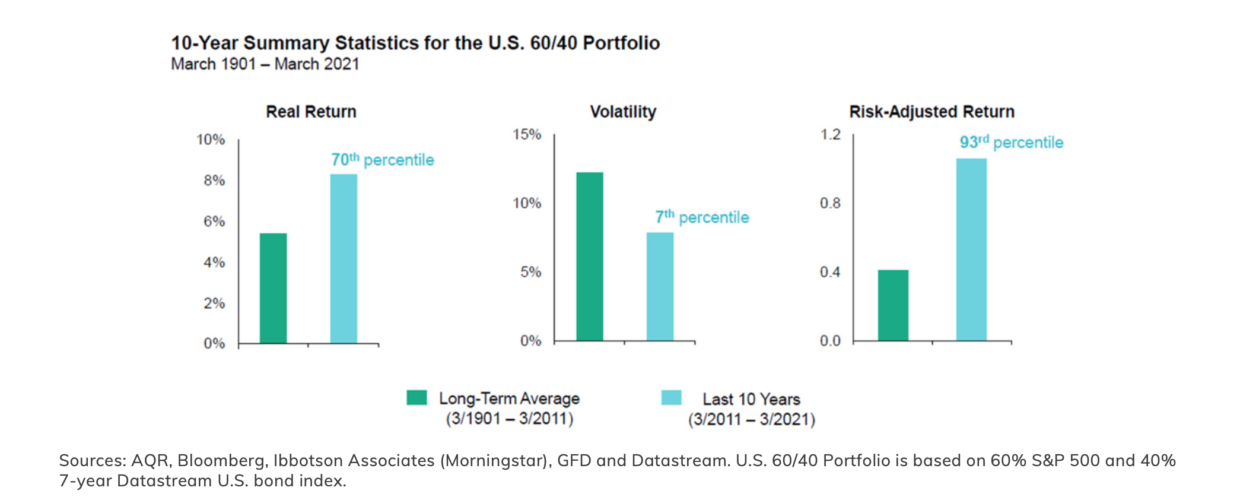

The 10 years from 2011 to 2021, called the Great Moderation, was a very conducive environment to taking risk. This 10-year period saw a much higher rate of return than the average of the preceding 110 years and was one of the better 10-year periods since 1901. Combined with exceptionally low volatility, risk-adjusted returns were at the very high end compared to history.

New Economic Regime

We believe that the economy is in the midst of a regime change that will significantly affect investments. The drivers of the past 10 years – deflation, low interest rates, quantitative easing and globalization – resulted in a strong investment climate for traditional assets from 2010 to 2020. These positive tailwinds led to very low volatility in both economics and markets.

Covid has been a significant catalyst causing the regime shift. It triggered supply disruptions and labor shortages resulting in higher cost inflation. The Federal Reserve is now tightening policy to tamp down inflation.

The new regime will have higher inflation, higher interest rates, less monetary accommodation, and less globalization, resulting in a less favorable investment environment. The result will be lower returns and higher volatility. Economic growth, which has been coming down for a few decades, is expected to fall further. As a result, future returns will be driven much more by fundamental drivers, leading to more modest returns in traditional assets than in the previous decade.

Capital Market Outlook

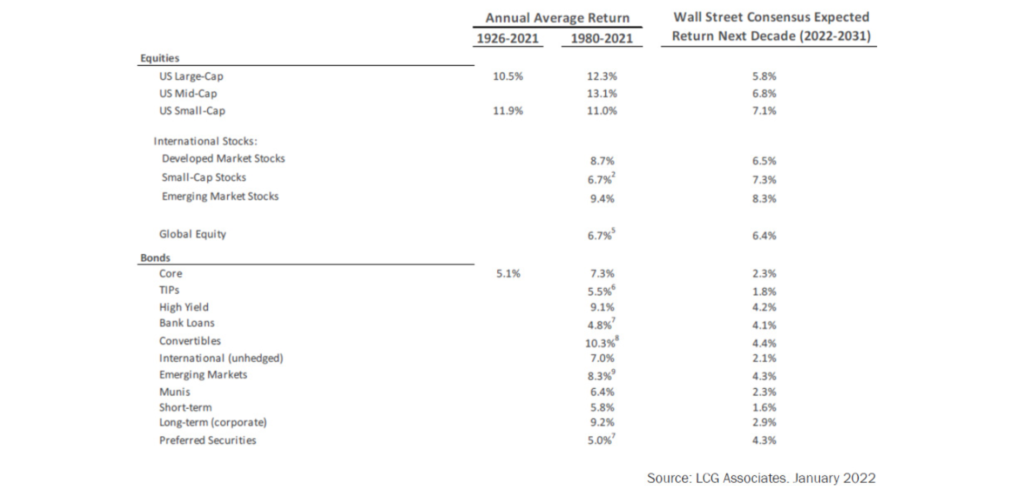

We utilize the capital market assumptions provided by LCG Associates to run in-house analyses on future return vs. risk.

In our opinion, the estimates of future returns over the next 10 years in the capital market assumptions are realistic. This is based on our outlook for economic growth and the fundamental building blocks of returns. The outlook, while not spectacular, requires us to reset our future return expectations.

Long-Term Economic Outlook

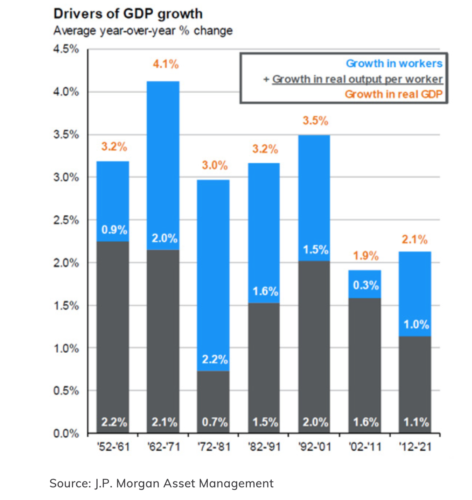

The long-term economic outlook provides the environment that drives yields and earnings growth, which form the building blocks of return. Economic growth is expected to be lower during this decade compared to earlier periods and driven by growth in the labor force and productivity.

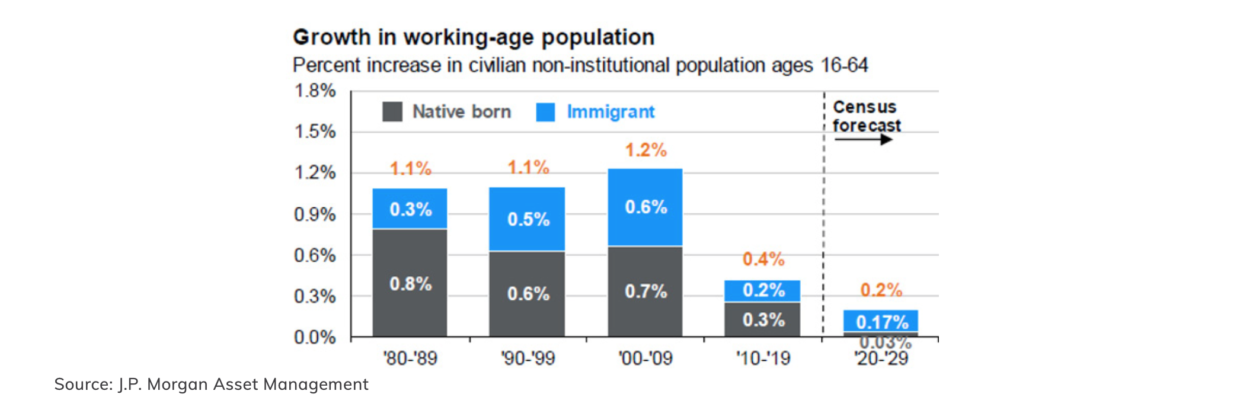

Growth in the labor force and productivity are the engines of economic growth. JP Morgan estimates the US labor force will grow 0.2% from 2020 to 2029 through a combination of low immigration and low native births. Productivity is expected to be slightly less than 2%. As a result, those two factors point to a potential economic growth rate of sub 2% in this decade.

Growth in Workers

The workforce is expected to have anemic growth and be much lower in this decade than in the past, as seen in the following graph:

Productivity

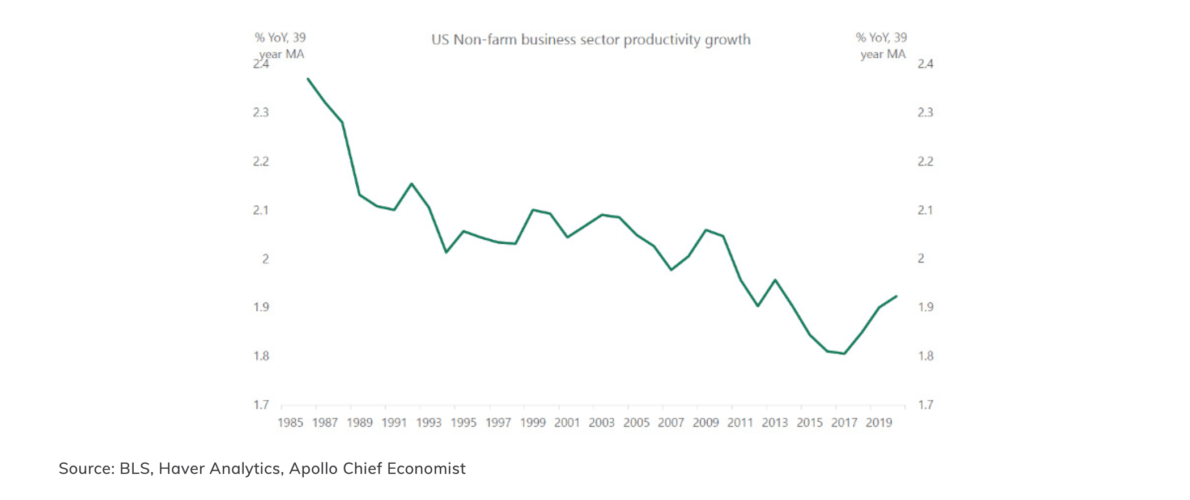

Due to the expected low growth in the labor force, productivity will be the key to economic growth. Productivity is important in driving profit margins and lowering inflation. The economy has seen a steady decrease in productivity, and new technologies will be necessary.

Great Moderation Rewind

The unwinding of the Great Moderation is likely to result in higher inflation and a lower level of globalization along with less supportive monetary policy as the Federal Reserve shrinks its balance sheet and raises interest rates.

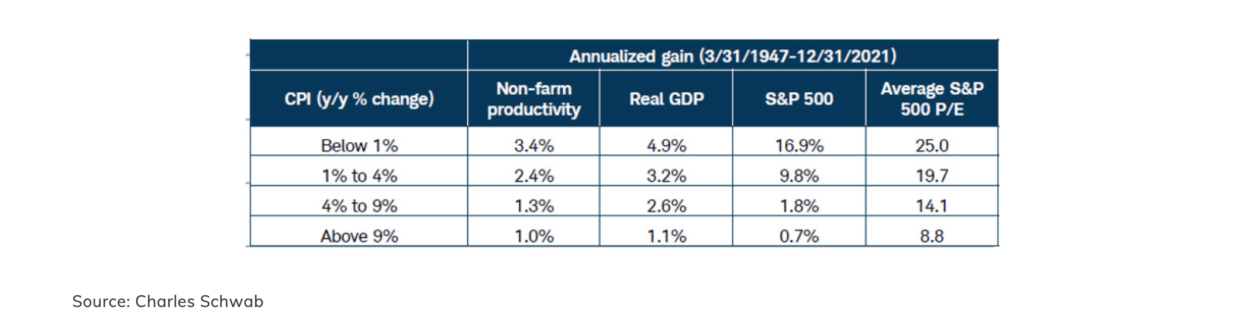

Inflation

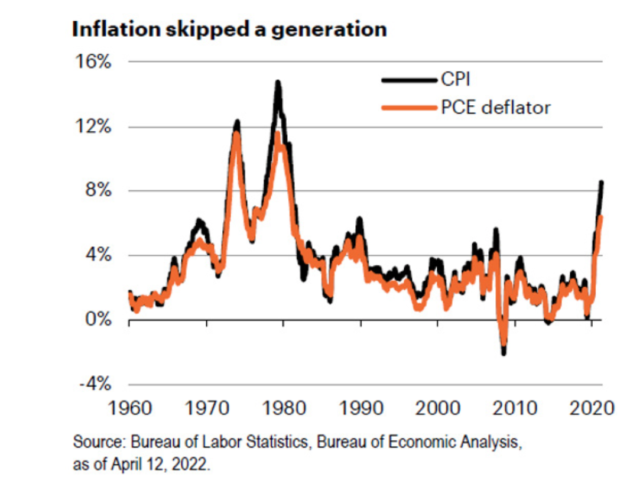

The Great Moderation was characterized by low inflation. This was greatly benefitted by globalization, technology and the low cost of raw materials. The era of low inflation ended as inflation spiked during the Covid-19 pandemic but is expected to be higher going forward.

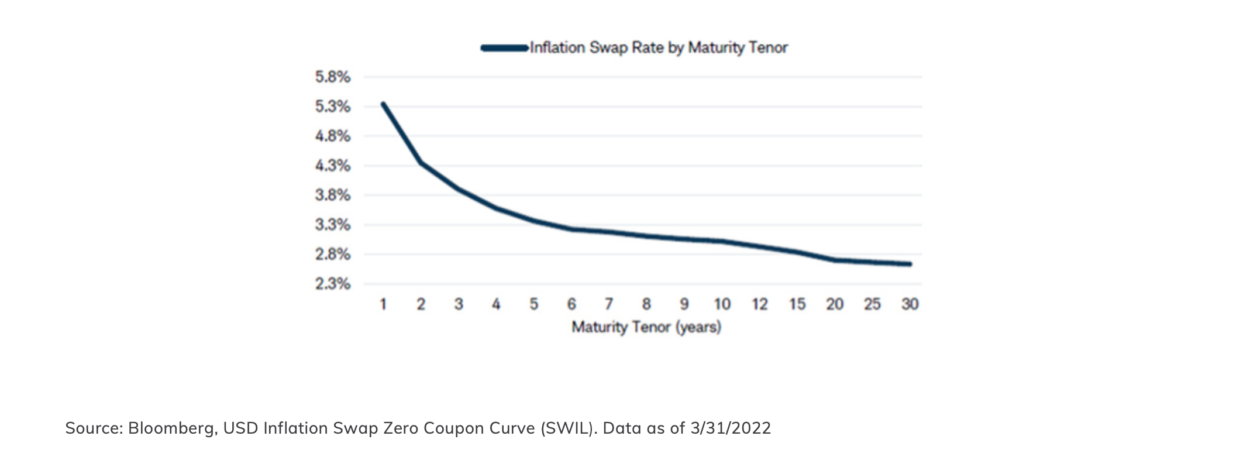

The market is pricing inflation to be significantly higher in the future than was seen during the Great Moderation. It is expected to be in the 3% range for much of this decade, which is nearly double the rate seen during the Great Moderation.

Globalization

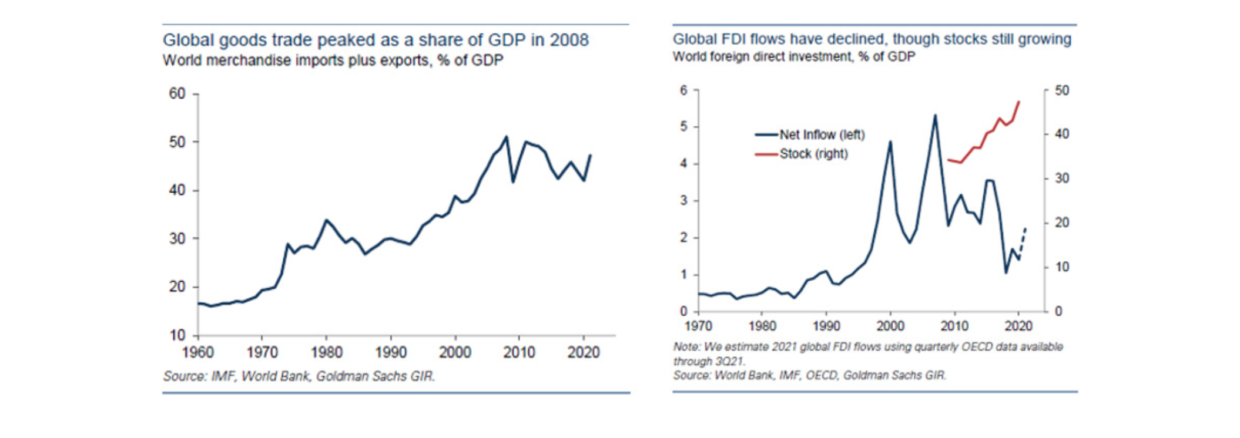

Globalization was a major factor driving asset market returns during the Great Moderation. Globalization allowed corporations to increase their profit margins by lowering labor costs and accessing materials and labor while increasing revenue with growing sales in new markets. However, the Covid-19 pandemic exposed the vulnerability of companies to extended overseas supply chains. Moreover, the Russian invasion of Ukraine shattered the calm in geopolitical risk. Companies and countries will likely start to assess their geopolitical vulnerabilities caused by interdependence.

Global trade peaked in 2008 and has been under strain due to increased political pressure by domestic constituents who were negatively affected. Foreign direct investment also buckled under the pressure. While globalization will not completely unwind, it will likely slow or plateau.

Quantitative Easing (QE)

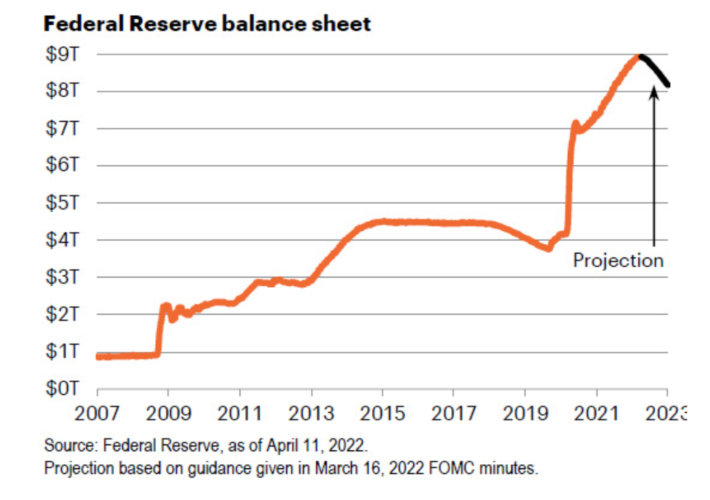

In 2009, the Federal Reserve began loosening monetary policy through quantitative easing by buying bonds, both Treasury and mortgage- backed, and increasing its balance sheet. The result was an increased money supply and lower interest rates which significantly benefitted financial assets until 2018. It started reducing its balance sheet in 2018 but massively increased QE in response to Covid-19.

In 2021 and 2022, it bought approximately $5 trillion of bonds and caused financial assets to surge. It is now in the process of reducing its balance sheet again. Going forward, we do not believe that QE will be an enormous tailwind that lifts asset values. Instead, it will be a headwind, causing stress on valuations and likely impeding future returns.

Long-Term Economic Outlook

Forward returns in equity are driven by both earnings growth and valuation. Earnings-per- share growth is likely to be less going forward than seen in the previous ten years. Valuations approached an all-time high last year but are currently being pressured. As a result, expectations of annualized future returns of the S&P 500 in the 6-8% range are appropriate. QE will no longer be the powerful tailwind pushing up valuation.

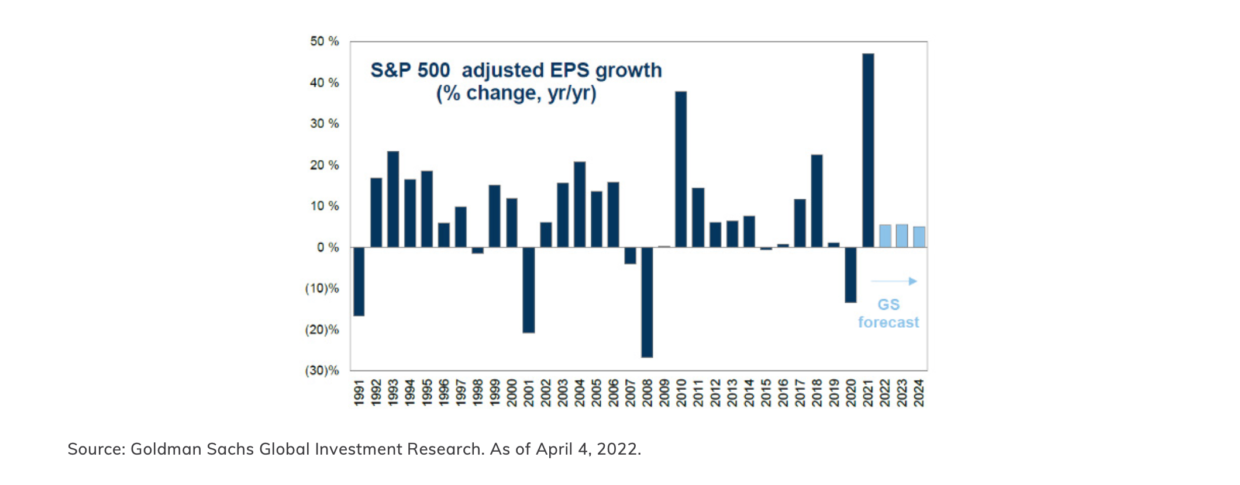

Earnings Growth

Post-Great Financial Crisis, gross profits were weak due to the low economic growth. In fact, the 2010s saw the lowest level of economic growth since the 1930s. While profit growth was anemic, earnings per share growth (EPS) was extremely strong.

Corporations refrained from investing due to weak growth and used the cash flow to buy back shares instead of reinvesting in the company. In addition, many corporations took advantage of the low interest rate environment to increase debt and buy back shares. By reducing the number of shares, EPS growth was very strong and helped boost stock prices in the 2010-2020 period.

Looking forward, higher interest rates make levering the capital structure to buy back shares more difficult. Second, companies will be required to reinvest to increase productivity, thereby combatting inflation, and to increase local production to shorten supply chains. Combined with lower expected economic growth rates, profit growth may endure another anemic decade. Looking ahead, earnings per share will track gross profit growth more closely at a lower rate in contrast to the Great Moderation.

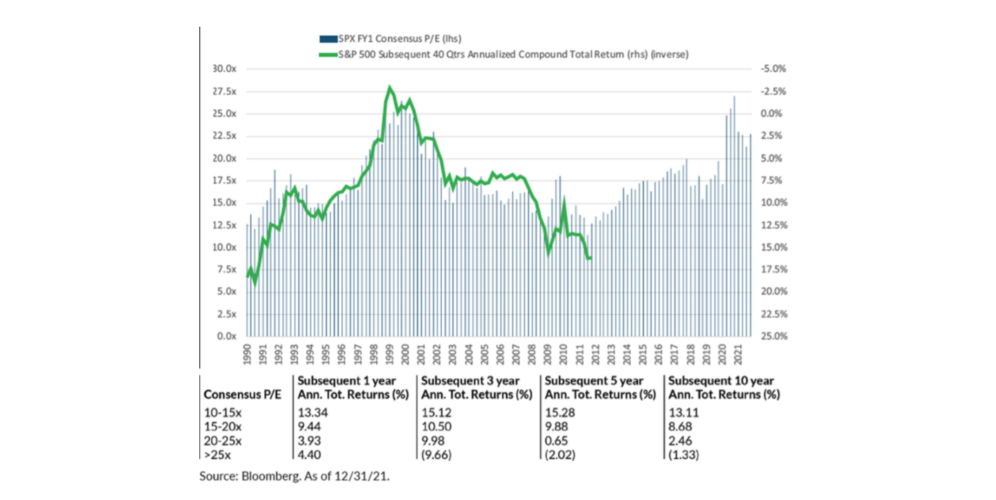

Valuation

Historically, there has been a strong link between starting valuation and longer-term returns (10 years). Buying stocks at a high valuation creates a high wall with which to climb and increase returns. In contrast, buying stocks when the market is cheap, all else being equal, helped returns. The P/E multiple has decompressed this year due to higher interest rates. Given the Fed’s posture, rates are not likely to be lower in the future than during the 2010-2020 period.

With S&P 500 forward P/E multiples currently around 17x, the market is expensive despite having fallen from 24x last year. With higher expected inflation and interest rates and less Federal Reserve support, valuation multiples can likely fall further and move toward a more historically normal valuation.

The following graph shows the historical performance of the S&P 500 by valuation range:

In summary, looking historically at S&P 500 returns and their drivers (inflation, productivity, growth and valuation), a mid-to-upper-single-digit return (6-8%) is a reasonable expectation.

Long-Term Fixed Income Outlook

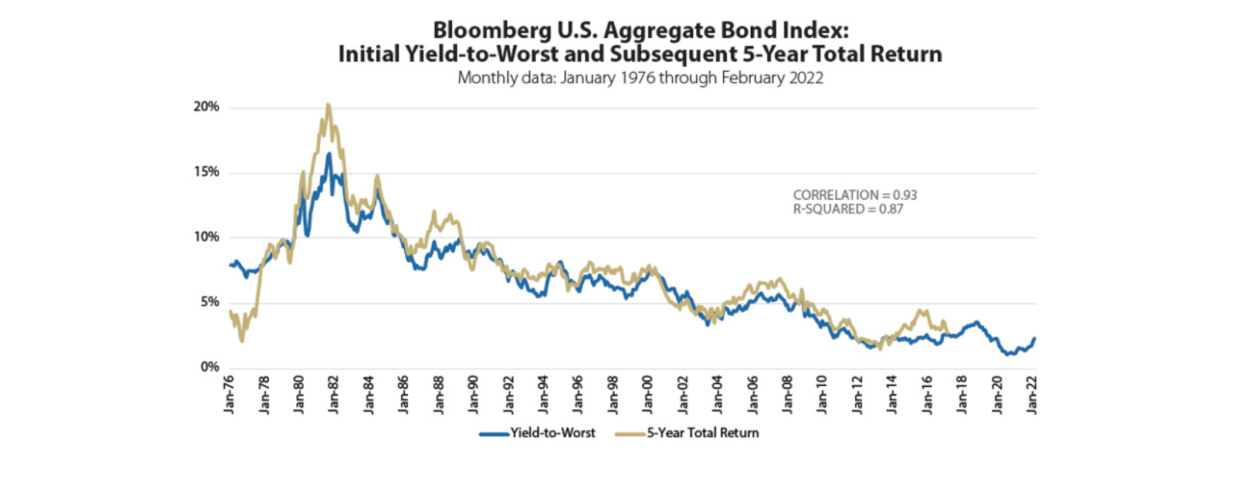

Similar to the case with the S&P 500, future returns in core bonds are likely to be muted. There is a strong link between starting yields and forward returns, as seen:

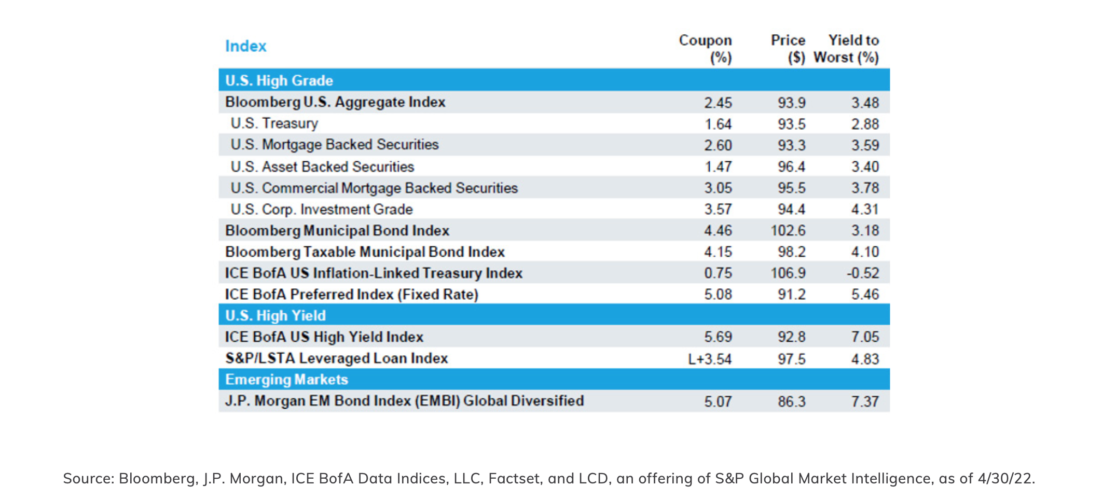

Currently, core bonds, represented by the Barclays Aggregate Bond index, are yielding 3.5%. This serves as an approximation of future expected return. Other fixed income sectors can also use yield as a starting point for future returns (but a more refined analysis would also need to adjust for roll yield and changes in credit). Yields for other sectors are summarized in the following monitor from Eaton Vance:

During the Great Moderation, the Federal Reserve provided accommodative monetary policy, lowering yields and pushing bond values up. Going forward, the bond market will not have such support, and future returns are expected to be muted due to current low yields.

Long-Term Real Asset Outlook

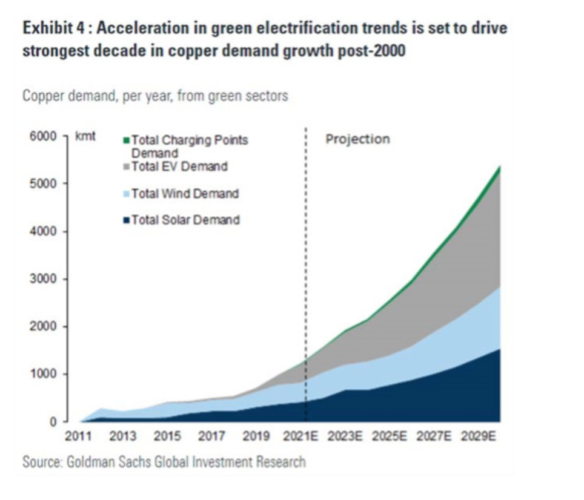

Real assets, particularly commodities and infrastructure, are areas where we believe future secular returns will be better than seen in the 2010-2020 time period due to increased growth prospects. Both commodities and infrastructure have climate change as a strong catalyst for that growth.

A wide range of commodities is needed for electric vehicles, power generation and other clean applications. The switch to renewable energy (for example, solar and wind power) and electric vehicles will require significant amounts of commodities, for example, copper:

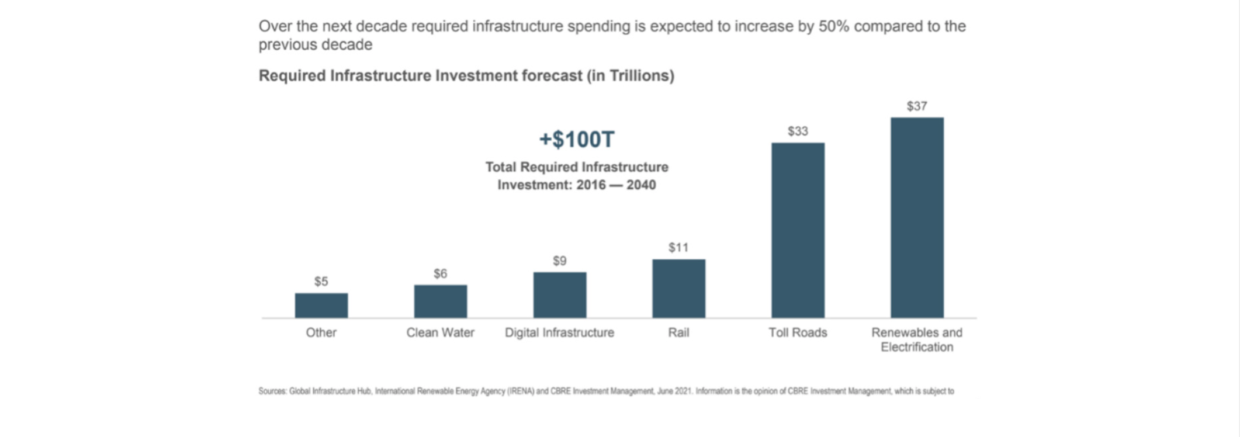

Infrastructure is also expected to have a strong growth runway with an expectation of $100 trillion in investment over the next twenty years, according to CBRE Investment Management. A significant amount of capital is needed globally for:

- modernizing/repairing aging assets

- a digital transformation, as exponential growth in data requires more investment for storage and transmission

- decarbonization, with energy decarbonization driving the shift to renewables.

Portfolio Implications

Portfolio Implications

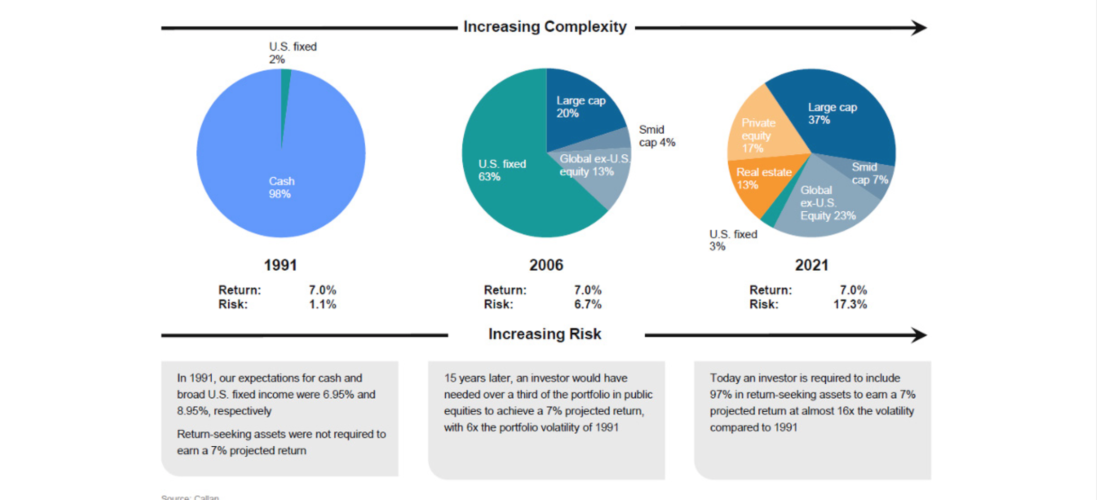

In the past, investors could count on a simple portfolio to generate a 7% return, which was possible by riding lower interest rates as inflation fell. This provided a multi-decade tailwind. As valuations rose and lowered future returns, increasing risk by adding more volatile investments has been necessary to obtain the same 7% return:

Today, there are many more asset classes to consider, including private investments, alternatives such as hedge funds, more narrow slices of investable asset classes within public equities, etc. In addition to the availability of additional asset classes, each with its own unique risk and return profile, each specific investment in a portfolio comes with its own unique set of risk drivers that should also be considered when building a diversified portfolio. In fact, we view diversification not just through the lens of asset classes but, more importantly, through “risk and return drivers,” which we believe make for a truly diversified portfolio. Diversification of risk and return drivers are primary factors for portfolio construction.

Additionally, adding investments with differing risk factors provides a broader number of return drivers. Having many sources of returns means that the portfolio is not dependent on just a few sectors. Instead, a well-diversified portfolio has some cylinders firing at all times. The key is finding less correlated returned streams, which can have a much more significant impact due to having different reactions to different factors. You can learn more about our approach to “true” diversification here.

Click here to download the PDF.

DISCLAIMER

This document contains our current opinions and commentary that are subject to change without notice. Our commentary is distributed for informational and educational purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient. Information contained herein has been obtained from sources we believe to be reliable, but we do not guarantee its completeness or accuracy. The information contained herein does not constitute legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.

As used herein, investment classification terms such as “real assets”, “private investments and “alternative investments” generally encompasses investments other than traditional stocks, bonds and cash, and includes hedge funds, funds of funds, private placements, private equity and real estate funds. These investments will often be less liquid than traditional investments and redemptions from such investments often involve holdbacks and other restrictions on the timing of the redemption. Private placements, limited partnerships, hedge funds, funds of funds, or other types of these investment vehicles are typically illiquid, often for long periods of time, i.e., years. The terms governing these investments generally provide for significant redemption notice periods, lock-up periods, and holdbacks upon redemption, resale restrictions, and other provisions that preclude prompt liquidation of these investments.

Certain statements contained herein may constitute “forward-looking statements.” Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. Certain hypothetical market situations herein are based on historical data.