Managing Volatility and Illiquidity in Private Markets

September 6, 2022

The recent market volatility in the public markets has triggered an uneasiness with investors. Previously, we have discussed the importance of manager and strategy selection that can provide differentiated return streams, factors that are less exposed to economic downturns, and philosophies less prone to acute market movements (ex. lower leverage, conservative underwriting, etc.). However, even before one focuses on manager and strategy selection, investors should ensure asset allocation policy is appropriate, reviewed and rebalanced, and aligned with risk/return and illiquidity tolerance.

Manager selection is highly important, particularly in private markets. The dispersion between top and bottom quartile managers is significantly higher than compared to public market managers, given that private markets are a less efficient market. For example, based on a 10-year window ending, the manager dispersion between top and bottom quartile performance in venture capital was 31.5%.1 Despite this consideration, asset allocation policy should be the first step in implementation of an investment portfolio. Extensive studies from 90+ large U.S. pension plans suggest more than 90% of portfolio return is explained by asset allocation policy.2 That means less than 10% of portfolio investment contribution from market timing and security selection, making asset allocation policy ~10x of importance to portfolio returns compared to market timing and security selection. Other studies suggest a lower contribution of asset allocation, but the point remains that asset allocation policy is of utmost importance.

Asset allocation policy is highly bespoke to client risk tolerance and liquidity needs. In times of market volatility, particularly with volatility to the downside, investors often realize their true risk tolerance is not what is reflected in the portfolio until there are market drawdowns. Public market drawdowns can be particularly concerning due to what’s referred to as the “denominator effect.” This occurs when an investors’ public market portfolio balance declines significantly relative to their private market portfolio during a market downturn, causing their private market allocation to then comprise a larger percentage of their overall portfolio. Given the illiquidity of private markets, investors can understandably be concerned about their liquidity position once the denominator effect sets in.

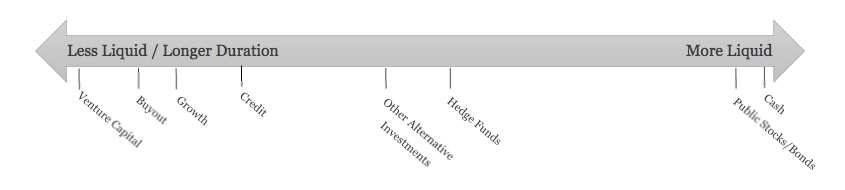

The first step an investor should take is understanding the liquidity spectrum of their investment portfolio and ensure the allocation is consistent with liquidity needs. The below illustrates at a high level the range of the liquidity spectrum.

Private markets allocations should especially be consistent with illiquidity tolerance as once invested the only way out until there is an investment distribution is via secondary markets which will require a discount to value. However, there is nuance even within illiquid investments given the differences in fund terms. For example, approximately 80% of venture capital funds are still active after year 12 of the fund life, whereas some private credit funds have 18-24 month investment periods and 3-5 year total lives. Constructing a private market portfolio is an art and science around diversified return streams, but also liquidity spectrum. Investors should also consider sources and uses of cash outside of their investment portfolio. Often during market downturns or general volatility, operating businesses or other income streams could also be correlated with the broader market further stressing liquidity, therefore a holistic approach to liquidity planning is recommended.

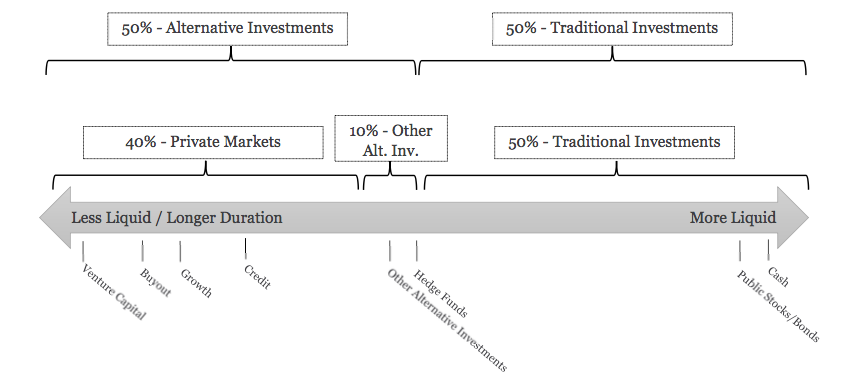

As previously mentioned, an investor’s asset allocation policy should be highly tailored to the individual’s goals, risk tolerance, liquidity needs, etc. To illustrate how one could structure a portfolio with a varying range of liquidity, a reasonable base line assumption could be a 50/50% split between “traditional” and “alternative” investments. Traditional investments are considered the most liquid with most stock and bond funds offering daily liquidity. However, although most liquid, these assets are considered the most volatile due to being an efficient market and frequent pricing. Alternative investments include private equity, private credit, private real assets, hedge funds, Real Estate Investment Trusts (“REITs”), Business Development Companies (“BDC”), cryptocurrencies, lending, and a wide range of non-traditional, or “alternative” investments.

The liquidity within alternative investments can range significantly. Within private markets, venture capital is the longest duration asset class with fund lives extending upwards of 15 years, whereas certain private credit strategies could have fund lives of 3- 5 years. There is a subset of strategies that have liquidity somewhere in between private markets and highly liquid traditional market funds. Most hedge funds offer monthly or quarterly liquidity with some range of notice period for redemption, often 90 days. Aside from hedge funds, there are a host of other alternative investment strategies that offer a semi-liquid profile that provide a happy medium between the illiquidity of private investments, and more liquid and higher volatility of public markets, producing a compelling risk/return option. Some examples of other alternatives include non-traded REITs, BDCs, asset backed lending, hard asset leasing (ex. aircraft, maritime), real estate triple net lease, etc. These strategies often have a yield component which also increases liquidity relative to non-yielding private investments. An important caveat is that were there to be significant redemption requests at once, the funds can “gate” the funds, meaning they restrict liquidity typically at 25% of fund net asset value per year.

The chart below continues the 50/50% traditional and alternative investment allocation, but then distinguishes between illiquid private markets and other alternatives. A baseline allocation could be 40% in private markets and 10% in other alternatives, again dependent on the investor’s specific circumstances. The sample allocation offers the ability to have a diversified portfolio of unique return streams, while giving the investor a tiered liquidity approach to asset allocation.

A compelling characteristic of private markets and other alternative investments is the relatively lower volatility profile. Private assets are typically valued on a quarterly basis, and there is nuance amongst strategies as to if/when they are marked up or down. For example, venture capital may not be marked up or down unless there is a financing round. The valuation methodologies reduce the day-to-day market volatility, or “noise,” one might otherwise experience in traditional markets. Although the denominator effect is a result of the valuation methodology in private markets, they produce a smoothing effect of volatility.

For the other alternatives bucket, the constituents offer a happy medium of lower volatility while offering semi liquidity. Most hedge funds are designed to reduce volatility but having both long and short positions, while offering monthly or quarterly liquidity. The other alternatives such as non-traded REITs, BDCs, other lending and real asset vehicles, etc., also are generally marked monthly or quarterly with similar liquidity profiles. Many of the other alternatives also offer a distributed yield which can provide a liquidity stream.

From a liquidity standpoint, the end result of the sample portfolio enables clients to somewhat offset some of the volatility experienced in public markets, while adding unique and non-correlated return streams, while still providing varying degrees of liquidity. The approach offers an option away from the binary “buy versus sell” question in public markets during uncertain times. As an example, if the view is the market is currently in a bear market rally, one could continue to participate in the markets via a semi-liquid, other alternative investment, which smooths the portfolio volatility until the investor feels more confident adding to more directional, traditional market positions.

Although market volatility can be stressful, its during these times investors can introspectively gain an appreciation of the association between risk and reward in financial markets, and specific investment types. Understanding the risk/return of each underlying position enables avoiding an overly concentrated portfolio of similarly performing assets with overlapping and additive exposure to certain risk factors. For example, high-growth companies performed exceedingly well during the ultra-low interest rate environment over the past decade, and particularly well during the Covid recovery. Observing the steep run up in valuations and therefore returns of these high growth assets triggers the same denominator effect within an investor’s public equity portfolio. After a significant market rally in growth, the investor could be overly exposed to growth factors, and therefore adversely impacted when market conditions change, as exhibited during the first half of 2022. These large swings highlight the need for discipline in re-balancing and adhering to asset allocation policy.

And finally, turbulent markets can drive concerns about specific strategies within a portfolio. Volatile markets can help investors appreciate that a diversified portfolio behaves very differently than the assets in them. Continuing with the growth example, low interest rates and market exuberance drove high valuations and therefore strong performance in growth assets, but the drawdown beginning in January 2022 demonstrated that what goes up can also come down. However, while growth assets fell, commodities and other alternative assets outperformed. When zooming out at the portfolio level, a truly diversified portfolio will have insulation from violent drawdowns.

Market volatility can be stressful. We believe that planning ahead for liquidity needs, implementing a diversified portfolio and adhering to asset allocation policy can reduce volatility, and ultimately the need and impulse to exit positions at inopportune times. Investors should revisit their asset allocation and ensure the portfolio is appropriately structured with diversified strategies, volatility profiles and varying tiers of liquidity.

Sources:

- JPMorgan Asset Management Guide to Alternatives. November 30, 2021.

- “Determinants of Portfolio Performance.” Gary Brinson.

Important Disclosures and Disclaimers

This document is confidential, is intended only for the person to whom it has been provided and under no circumstances may a copy be shown, copied, transmitted or otherwise given to any person other than the authorized recipient without the prior written consent of WE Family Offices LLC (“WE”). WE is under no obligation to update the information contained herein. Certain information has been obtained from sources WE believes to be reliable, but we do not warrant or guarantee the information’s completeness or accuracy.

The views, opinions and recommendations expressed is for informational purposes only and at a point of time and is subject to change without notice due to changes in market conditions. This material is not investment advice or an offer of any security or service for sale and does not consider the specific investment objective, financial situation, suitability or particular needs of any recipient. WE and its representatives are not your investment advisers unless entered into a written advisory services agreement.

When WE provides tailored investment advice to its clients on a non-discretionary basis, there is a chance that such investment advice and investment recommendations will not be successful or will not meet expectations. Subjective investment recommendations made by WE may cause a client to incur losses or to miss profit opportunities. Some asset classes may be less liquid or provide less protection against various risks than other asset classes.

Private market investments are very risky and should only be incorporated in a portfolio after a careful assessment of the private investment’s offering materials and other information in consultation with your investment, tax, and legal advisors. Private market investments are often less liquid than traditional investments and redemptions from such investments often involve holdbacks and other restrictions on the timing of the redemption. Private placements, limited partnerships, hedge funds, funds of funds, or other types of these investment vehicles are typically illiquid, often for long periods of time, i.e., years. The terms governing these investments generally provide for significant redemption notice periods, lock-up periods, and holdbacks upon redemption, resale restrictions, and other provisions that preclude prompt liquidation of these investments Among the primary risks are long term illiquidity, lack of transparency, lack of control of the investment vehicle and investment decisions, and in the worst case, the total loss of your investment.

A particular illiquid fund’s returns typically will vary materially over the life cycle of the fund depending on the particular strategy of the fund; returns may be higher at the beginning, middle or end of the fund’s life cycle. So, the return profile of a private equity fund over the life of the fund will be very different that the return profile of a venture capital, distressed credit, or secondary illiquid strategy.

Certain statements contained herein may constitute “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variation thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions.

This presentation does not constitute the provision of investment, legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.