2023 Outlook for Alternative Assets

January 19, 2023

2022 was a challenging year for stocks and bonds. The S&P 500 entered bear market territory and stayed there throughout the year, and the correlation of stock and bond returns turned significantly positive. With a backdrop of high inflation and rising interest rates, bonds’ lost their efficacy as a hedge for stocks in investment portfolios. Both asset classes posted negative returns for the year.

As we enter 2023, inflation remains elevated and the Federal Reserve’s campaign to tamp it down suggests ‘higher for longer’ rates. As such, volatility in the stock and bond markets appears likely to continue, giving alternative investments—which provide uncorrelated returns and diversification away from the broader public markets—a key role in client portfolios again in 2023. In this commentary, we share our outlook on specific alternative asset classes, the risks associated with certain illiquid assets, and our playbook for asset allocation in this space.

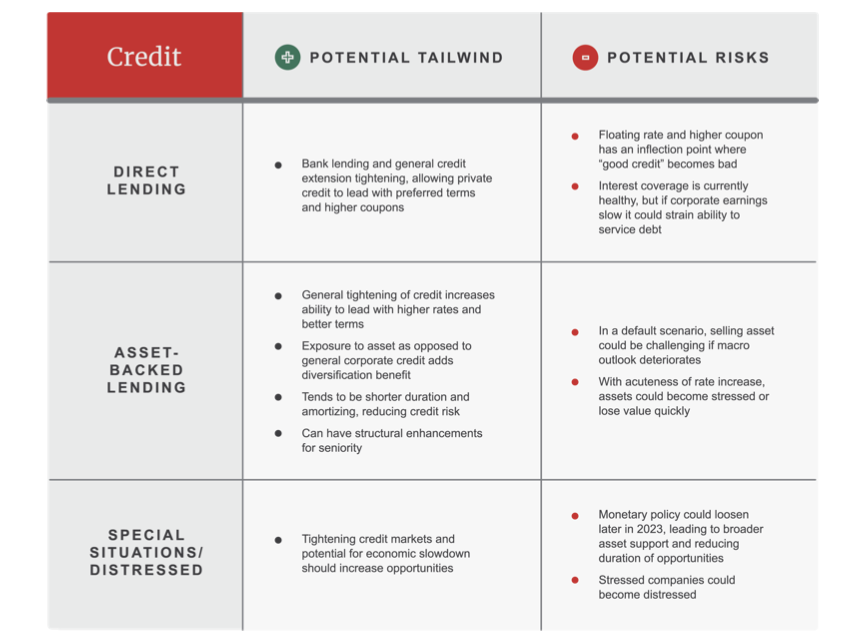

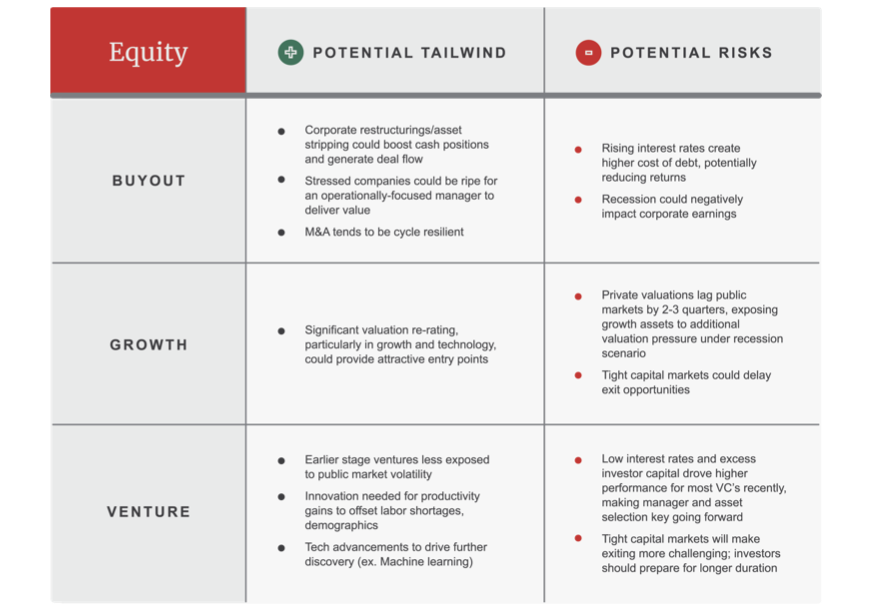

Illiquid Assets Outlook

WE Family Office Playbook

In consideration of the potential tailwinds and risks described above, we are approaching alternative asset allocation with the following factors in mind.

1. Yield-oriented strategies providing income can mitigate expected equity and fixed-income volatility.

As mentioned above, forward capital market assumptions creates a relatively unattractive risk/return outlook for equities. We therefore believe that locking in attractive yields reduces capital at risk and should add stability during volatile markets.

High-yield bonds, although producing attractive yields, could be impacted in a recessionary environment due to credit risk and market beta.

- Diversifying yield strategies can help mitigate against uncertainty, allow diversification away from corporate credit risk, and reduce portfolio volatility.

- We recommend being flexible in fixed income and credit beyond ordinary investment grade and high-yield corporate bonds, looking also to loans, securitized credit, emerging markets debt, mortgages, corporate hybrid securities, semi-liquid credit markets, etc.

2. Real asset overweight can provide stabilized yield, serve as an inflation hedge, and capture structural tailwinds.

Here there can be a few areas of focus:

Commodities: De-globalization appears likely to drive raw material hoarding, and the energy transition to renewables will also require significant raw materials to generate. 2022 made it clear that the transition will take time and cannot be executed without keeping fossil fuels as an integral part of the transition.

Infrastructure: Midstream projects and development are needed to transport fossil fuels, and clean energy infrastructure is in a nascent stage. Investments in these areas can provide long-term stable yields.

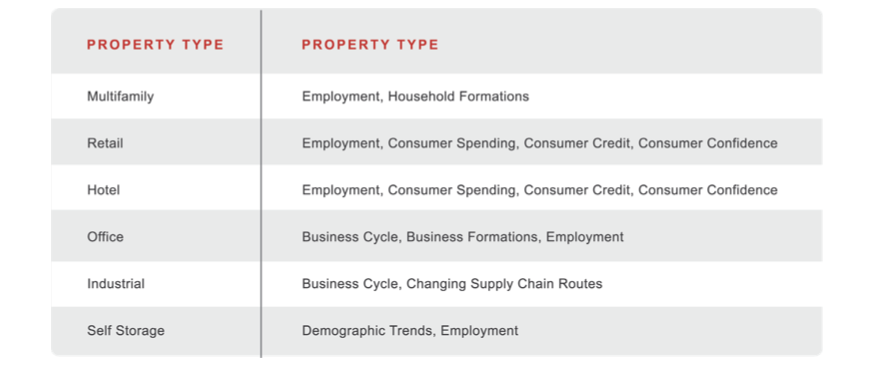

Real Estate: Real estate tends to outperform post interest rate increases while allowing for diversification amongst macro factors. There may also be sources of inflation-linked rental adjustments. Looking ahead, it will be important to weigh potential exposures in the table below.

Other Real Assets: Additional diversification to real asset portfolio and unique return streams, from maritime, aircraft, and mineral royalties for example.

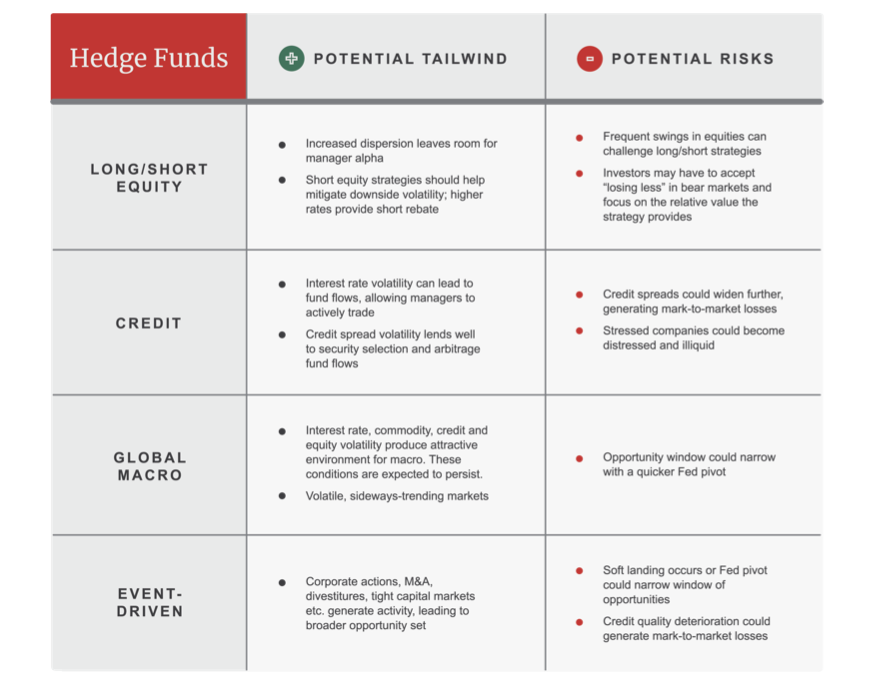

3. Overweight global macro and long/short credit. With volatility expected to continue for the foreseeable future, hedge funds can cushion against drawdowns, take advantage of passive fund flows and capture unique return streams while adding to portfolio diversification.

Global Macro: Macro tends to outperform during periods of elevated equity, credit spread, currency, interest rate, and commodity volatility. With expected volatility and sideways trending markets, macro should continue to outperform.

Long/Short (LS) Credit: LS credit offers a low volatility approach to holding bonds and loans, offering a hedge to eroding credit quality, arbitraging passive fund flows, and credit selection.

4. Investing in innovation. Demographics and an aging population produce the need for innovation across many sectors, including manufacturing, healthcare and tech.

- Aging demographic with low immigration will require greater levels of efficiency and productivity.

- Covid-19 also spurred a wave of onshoring and rethinking of global supply chains, shifting focus from “just in time” to “just in case”.

- Both will require technological innovations in manufacturing.

- Aging demographic and advances in machine learning continue to produce new opportunities in biotech.

5. Selective focus on assets/strategies with tailwinds. As always, manager selection is key, as is the need to target strategies seeking to capitalize on longer-term trends.

- Manager selection. Over the previous few years, many managers enjoyed markets in which returns were fairly easy to come by. As we enter a higher rate, lower growth, less liquid environment with higher asset price dispersion, investors will discover how good managers actually are.

- Focus on strategies that have tailwinds seeking to capitalize on longer-term themes and trends. Healthcare, for instance, makes up nearly 20% of GDP in 2018(1) with an aging population. Meeting the rising demand will require innovation, onshoring and adjustments to supply chains. The energy transition and onshoring of manufacturing and supply chains will also require new investment.

6. Opportunistic credit can provide a countercyclical balance to the portfolio. With a hawkish Fed and sticky inflation, a prolonged higher rate environment should produce a longer window of opportunities both domestically and abroad.

- While credit dislocation funds performed fairly well in the early days of Covid, the opportunity set was a narrow window due to monetary policy and significant investor dry powder.

- Tightening of credit in capital markets and traditional lenders create opportunities for stricter terms, higher coupons, OID and fees.

- Diversify from traditional US corporate credit, casting a broad net across US and Europe, corporate credit, asset-based credit, structured credit and others.

Click here to download the PDF.

(1) Source: https://www.cms.gov/research-statistics-data-and-systems/statistics-trends-and- reportsnationalhealthexpenddata/nhe-fact-sheet

Important Information and Disclosures

This document is confidential, is intended only for the person to whom it has been provided and under no circumstances may a copy be shown, copied, transmitted or otherwise given to any person other than the authorized recipient without the prior written consent of WE Family Offices LLC (“WE”). WE is under no obligation to update the information contained herein. Certain information has been obtained from sources WE believes to be reliable, but we do not warrant or guarantee the information’s completeness or accuracy.

The views, opinions and recommendations expressed here are subject to change without notice and is for informational purposes only and should not be considered as investment advice or an offer of any security or service for sale. This material does not consider the specific investment objective, financial situation or particular needs of any recipient. WE and its representatives are not your investment advisers unless entered into a written advisory services agreement.

When WE provides tailored investment advice to its clients, there is a chance that such investment advice and investment recommendations will not be successful or will not meet expectations and that subjective decisions made by WE that may cause a client to incur losses or to miss profit opportunities. Some asset classes may be less liquid or provide less protection against various risks than other asset classes.

Certain statements contained herein may constitute “forward-looking statements,” which can be identified by the use of forward- looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variation thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions.

All allocations and performance statements contained herein are hypothetical and do not constitute the actual performance of an investment portfolio. Such allocations and hypothetical performance statements are for illustrative purposes only and do not reflect actual performance or allocation of client accounts.

This presentation does not constitute the provision of investment, legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.