The New Regime: The Path Forward

December 6, 2022

Summary Points

- The investment landscape over the past 40 years has been generally conducive.

- Over that time period, the macro environment was underpinned by increasing globalization, falling interest rates, accommodative monetary policy and low inflation.

- We expect the new regime over the secular horizon to be characterized by less globalization, higher inflation, low economic growth and higher macro volatility.

- US equity returns expectations of mid- to upper-single-digits is realistic and value is appealing.

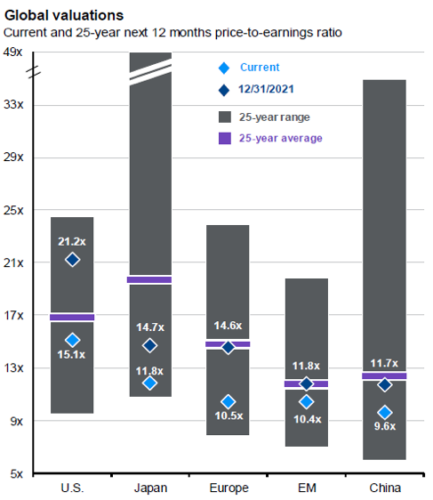

- Non-US equities have attractive valuation, both absolutely and relatively.

- Core fixed income yields, particularly muni-bonds and investment-grade credit, are attractive.

- Real assets, especially commodities and infrastructure, have strong tailwinds.

- Portfolio construction utilizing a full toolbox of investment strategies is important.

1. Economic Outlook – New Economic Regime

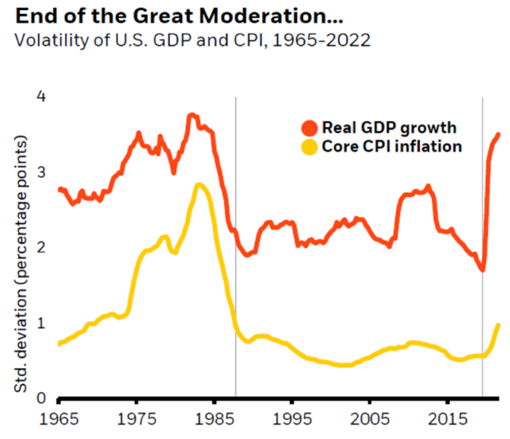

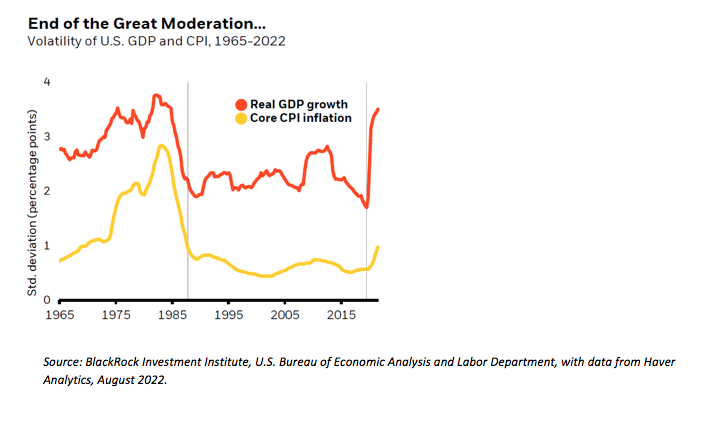

Asset volatility has increased significantly this year. We believe that a major cause of the volatility is that the economy is in the midst of a regime change, which will have significant effects on investments. The drivers of the past 40 years, disinflation, falling interest rates and globalization, resulted in a strong investment climate for traditional assets. These positive tailwinds led to very low volatility in both economics and markets. The road forward will be different.

Inflation is the major catalyst causing the regime shift. It is rooted in insufficient supply – labor, energy investment, housing, and capital investment. Lesser globalization is a major cause. The result is that monetary policy will no longer be accommodative as in the past few decades.

The new regime of higher inflation, higher interest rates, less monetary accommodation and less globalization will result in a change in the investment environment that will present more favorable opportunities in certain sectors and less favorable ones in others. In general, the result is that compared to the past few decades, the upcoming era looks to have lower returns and higher volatility. Economic growth, which has been coming down for a few decades, is expected to fall further. As a result, future returns will be driven much more by fundamental drivers, leading to more modest returns in traditional assets than in the previous decade.

Inflation

Inflation has been falling for the past forty years, particularly during the Great Moderation of 2010-2020, which was characterized by low inflation. This was greatly benefitted by globalization, technology and low cost of raw materials. The era of low inflation has ended and is expected to be higher going forward than seen during the Great Moderation. We believe inflation in the new regime will approach the post-World War II average in the 3% range.

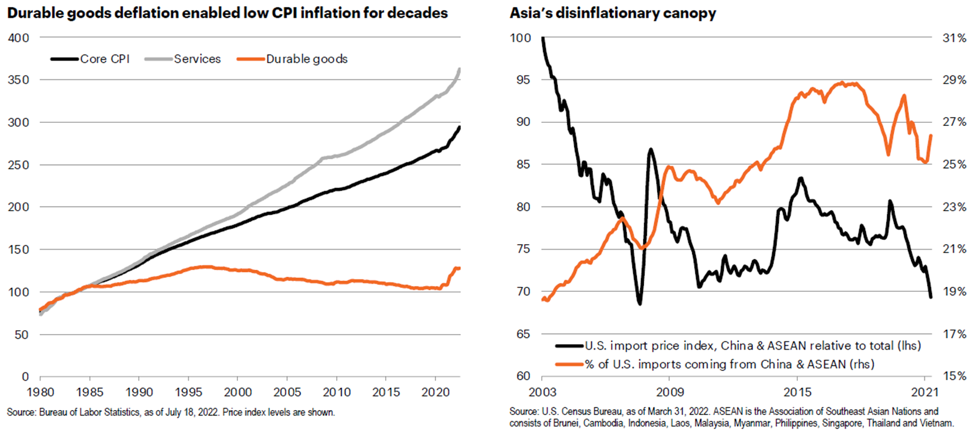

Lower globalization is a major reason for the higher inflation expectation. Globalization allowed for the import of purchases from the Far East, particularly for durable goods:

Moreover, supply-side insufficiency in labor, capital stock (capex) and traditional energy investment is likely to add to inflation. Curing it could take significant time. Globalization allowed the US economy to benefit from immigration and rely on the Far East for productive capacity. That is likely to change going forward.

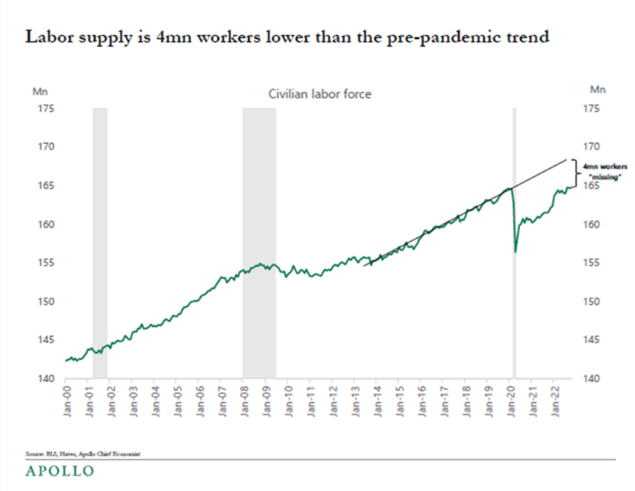

- Labor Insufficiency: The US labor force is smaller now than before the Covid-19 pandemic and the participation rate has fallen. Due to less immigration (compared to pre-2016 rates) and early retirements, the workforce is smaller. The competition for labor serves to raise wages.

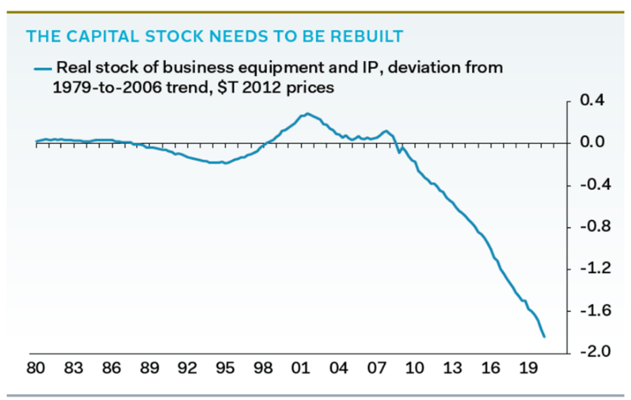

- Capital Stock Insufficiency: Investors rewarded the stocks of “capital lite” businesses. Companies that bought back stocks were preferred to those that reinvested in their capacity. As a result, most refrained from reinvesting and thereby depleting the capital stock. Lack of capacity to produce should also lead, all things being equal, to higher inflation.

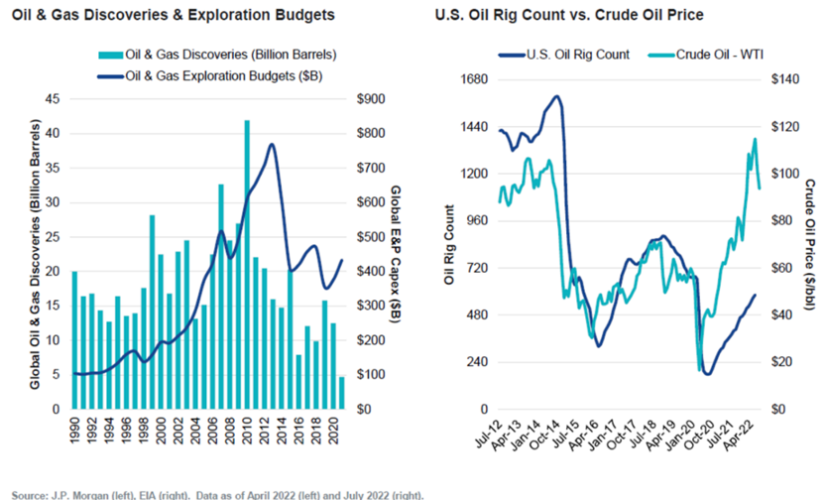

- Traditional Energy: Investment has fallen significantly largely due to shareholder pressure to restrain investment. Substituting with renewable energy takes a long time. As a result, supply has fallen.

We expect inflation to be significantly higher in the future than was seen during the Great Moderation. In addition to lesser globalization, the economy has supply challenges in labor, energy and capex investment. As a result, inflation in the 3% range for much of this decade is a reasonable expectation and nearly double the rate seen during the 2010-2020 period.

Economic Growth

The long-term economic outlook provides the environment that drives yields and earnings growth, which form the building blocks of return. Economic growth is expected to be lower during this decade compared to earlier periods and driven by growth in labor force and productivity.

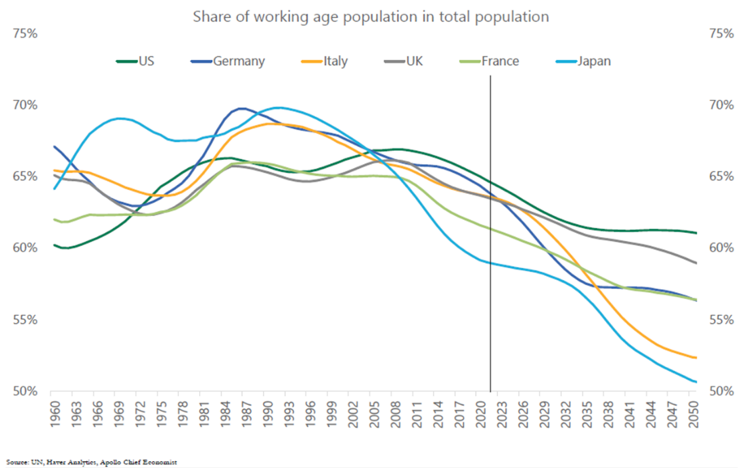

- Growth in Workers: The global workforce is expected to shrink going forward as seen in the following graph:

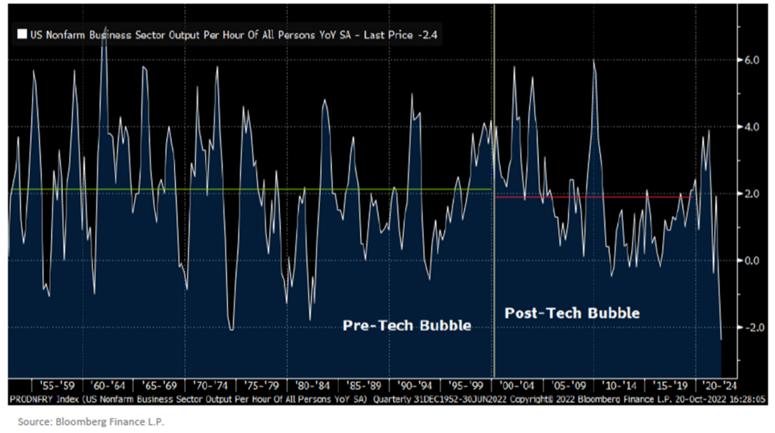

- Productivity: Due to the expected low growth in the labor force, productivity will be the key for economic growth. Productivity is important in driving profit margins and lowering inflation. Although there have been broad fluctuations in productivity, the average productivity over the past 70 years- in the eras both before and after the tech bubble- is nearly the same.

Growth in labor force and productivity are the engines of economic growth. JP Morgan estimates that the US labor force will grow 0.2% from 2020 to 2029 through a combination of low immigration and low native births. Productivity is expected to be slightly less than 2%. As a result, those two factors are pointing to a potential economic growth rate of sub 2% in this decade.

Globalization

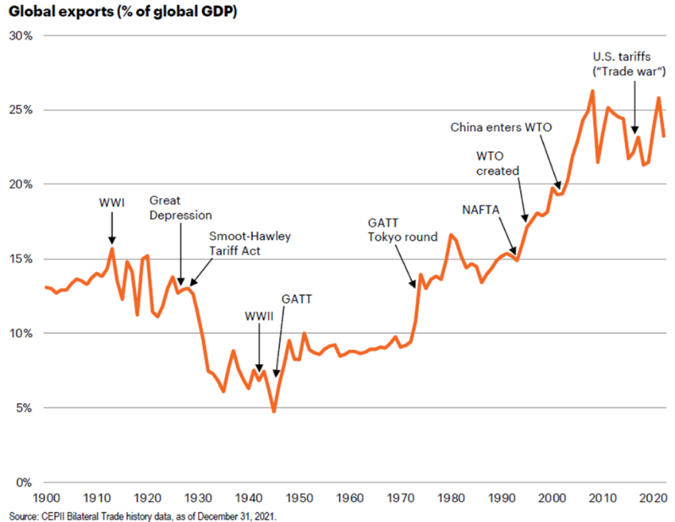

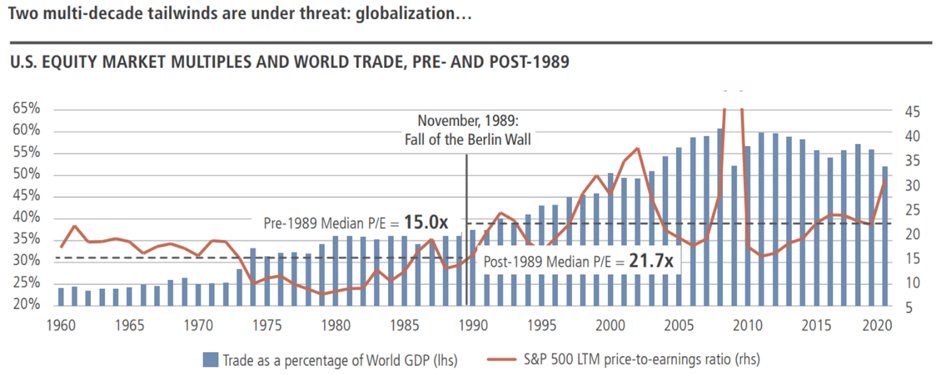

Globalization was a major factor driving asset market returns during the Great Moderation. Globalization allowed for corporations to increase their profit margins by lowering labor costs and accessing materials while increasing revenue with growing sales in new markets. However, the Covid-19 pandemic exposed the vulnerability of companies to extended overseas supply chains. Moreover, the Russian invasion of Ukraine shattered the calm in geopolitical risk. It is likely that companies and countries will start to assess their geopolitical vulnerabilities caused by interdependence.

Global trade peaked in 2008 and has been under strain due to increased political pressure by domestic constituents who were negatively affected. Foreign direct investment also buckled under the pressure. While globalization will not completely unwind, it is likely to slow or plateau.

Monetary Policy

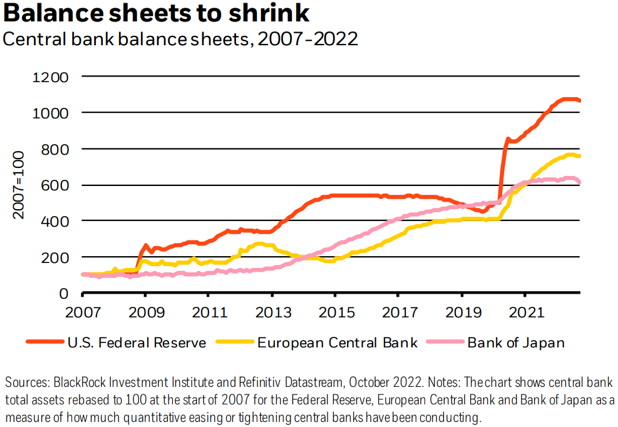

In 2009 the Federal Reserve began loosening monetary policy through the use of quantitative easing by buying bonds, both Treasury and mortgage-backed, and increasing its balance sheet. The result was increased money supply and lower interest rates, which significantly benefitted financial assets until 2021. Going forward, higher inflation should result in less supportive monetary policy as the Federal Reserve shrinks its balance sheet and raises interest rates.

Interest Rates

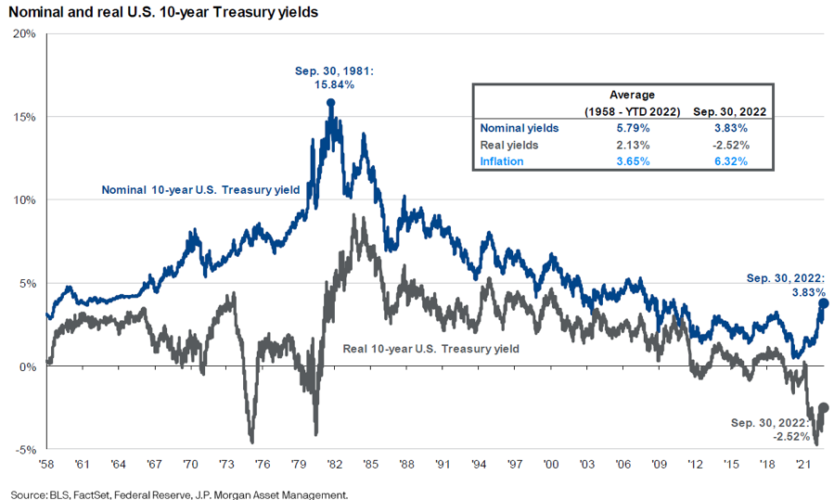

The 10-year US Treasury has increased significantly this year from 1.5% to 4.0%. As a result, the nominal yields have approached levels last seen in 2007.

Macro Volatility

Tighter monetary policy will increase the threshold for the “Fed Put.” As a result, the Federal Reserve will not be able to quickly support the economy as it did in the past. The reason is that higher inflation allows them less flexibility. The result is higher macro volatility which would then lead to higher asset class volatility.

2. Asset Class Implications

The economic drivers of the new regime will present new opportunities in equities, fixed income and real assets as we highlight below.

Long-Term Equity Outlook

In equities, value should do better in an environment of higher inflation and new spending in supply-deficient areas such as capex, energy and housing. International developed equities have valuation that is extremely attractive, particularly for globally oriented companies.

US Equities

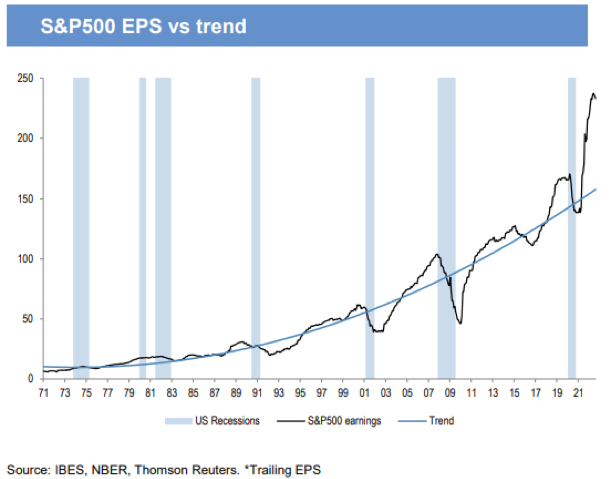

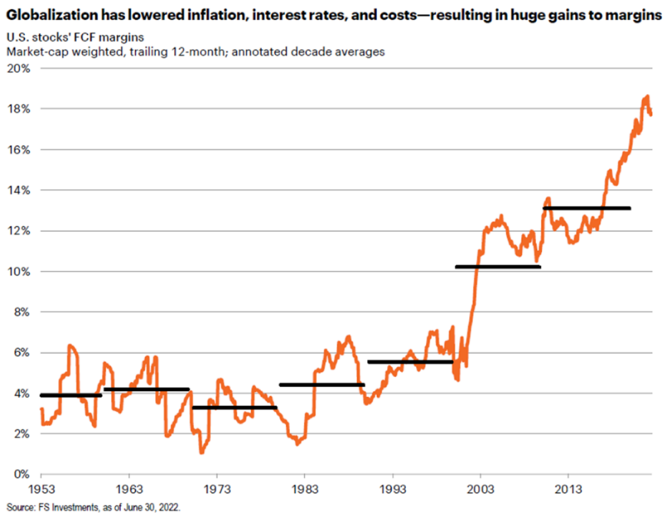

Forward returns in equity are driven by both earnings growth and valuation. Over the past forty years, globalization benefitted equities for both valuations and earnings. Monetary policy was very conducive as well due to falling inflation. Looking ahead, less conducive monetary policy and less globalization could act to produce lower returns than seen in the past.

- Valuation: Globalization has also been a tailwind to P/E multiples, in addition to benefitting profits. This was due to its effect in keeping inflation low and therefore interest rates low. Less globalization means that it will be harder to expand P/E multiples and might even contract them.

- Earnings Growth: Similarly, earnings growth was benefitted by globalization, as well. Globalization opened up new markets overseas for US companies. Accessing lower cost labor and materials were key for profit margins. US companies spent a few decades building extremely efficient supply chains which were a strong tailwind for equities. Earnings growth grew strongly over the past few decades as seen:

Improving margins, particularly through globalization, helped power earnings growth. A move to bring supply chains closer to home should raise costs and lower margins. Switching from “just in time” to “just in case” will lead to more spending and erode profit margins. Currently, US margins are high compared to history. As a result, it does not appear to be a tailwind for profit growth going forward.

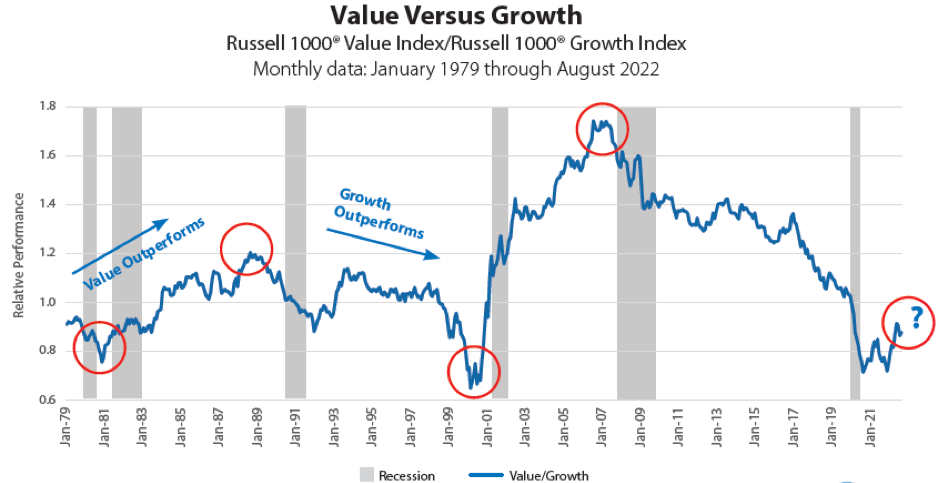

- Value Style: Value underperformed growth the past decade but has outperformed this year. Value and growth tend to go through cycles of leadership:

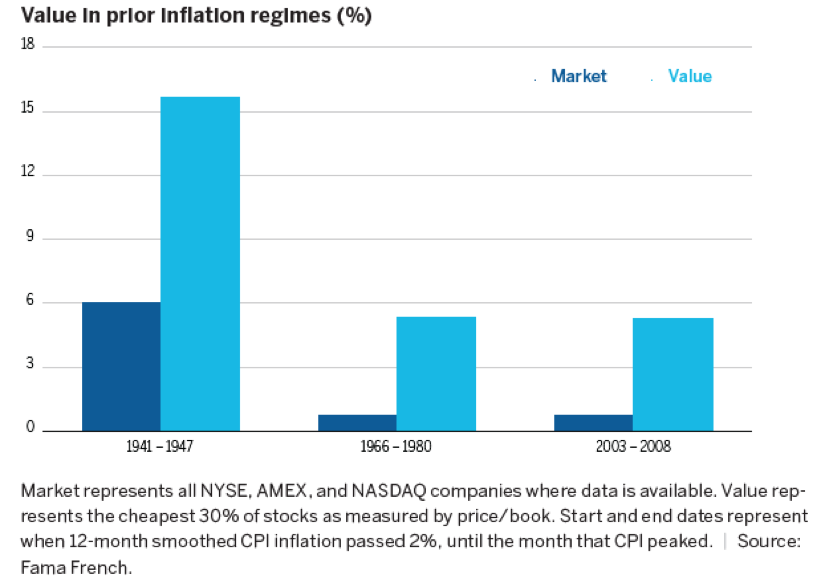

Value tends to perform well during times of higher inflation. The reason is that companies in sectors such as materials, energy and industrials are beneficiaries of rising costs. In the three previous inflation cycles since 1940, value performed better than the broader market:

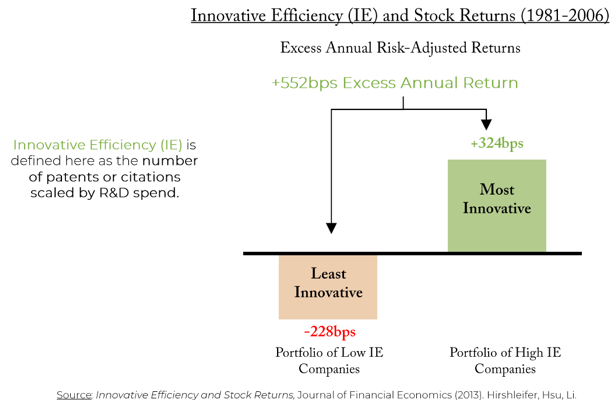

- Innovative growth: US companies have particularly fared well in both developing and using technology. In our opinion, innovative technology will be extremely important in raising US productivity which is necessary to offset higher inflation. Innovators have generally been well rewarded by the market:

Non-US Equities

Overseas equities in both developed and emerging markets are now attractively valued both absolutely and relatively:

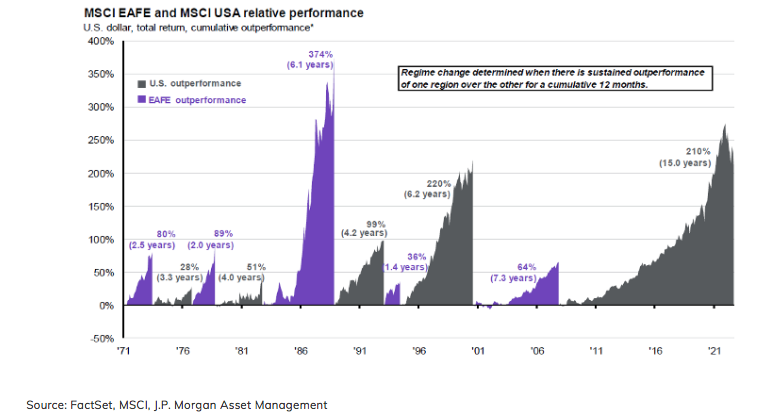

- International Developed Stocks: Since 1970, US and developed market (EAFE) equities have alternated leadership:

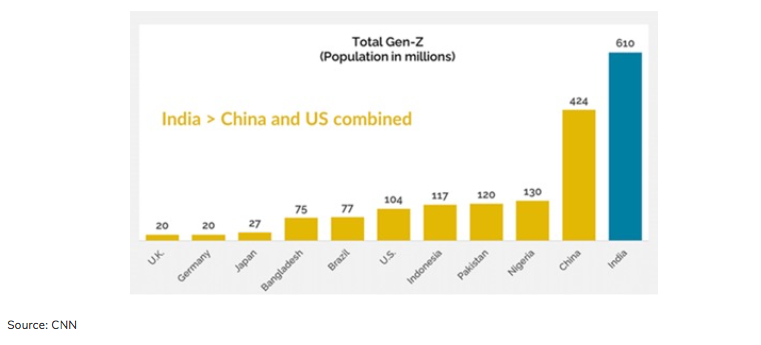

- Emerging Market Equities: Emerging market growth is underpinned by positive demographics, particularly in India. Gen-Z is only starting to consume. The combined population of Gen-Z in China and India exceed 1 billion people:

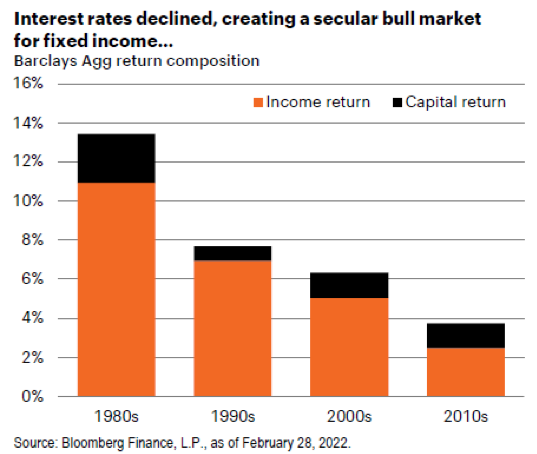

Long Term Fixed Income Outlook

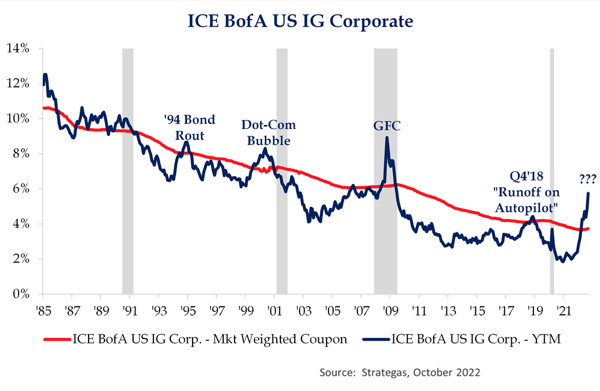

Over the past forty years, capital gain composed more bonds’ total return as interest rates steadily fell. Going forward that is likely to change. With rates having bottomed, capital gain potential return has fallen.

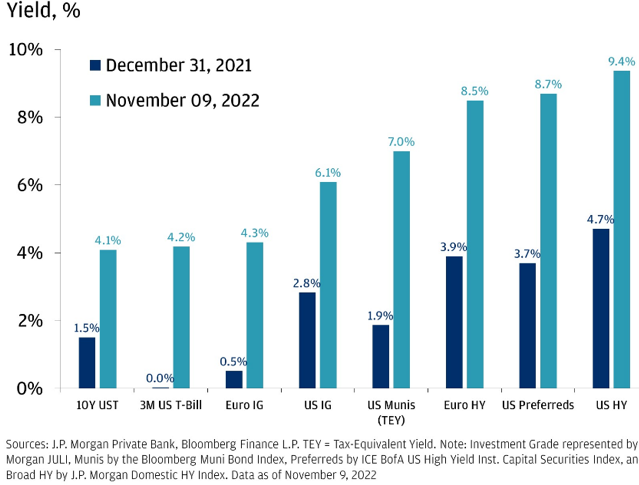

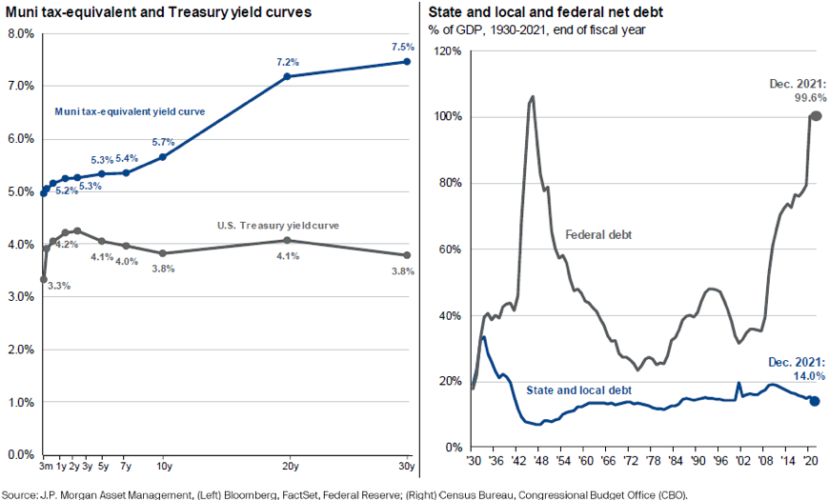

Fortunately, bond yields have risen significantly this year. Core bonds are at the highest yields in over a decade. Yields serve as an approximation of future expected return. In terms of return vs. risk, both muni-bonds and investment-grade corporates appear attractive. Market yields have improved materially this year:

- Muni-bonds: Muni-bonds are attractive with higher yields and favorable risk.

- Investment-Grade Credit: Investment grade is now attractive due to the market dislocation this year. Overall yields are the highest in fifteen years.

Long-Term Real Asset Outlook

Real assets, particularly commodities and infrastructure, are areas where we believe that future secular returns will be better than seen in the 2010-2020 time period due to increased growth prospects. Both commodities and infrastructure have climate change acting as a strong catalyst for that growth.

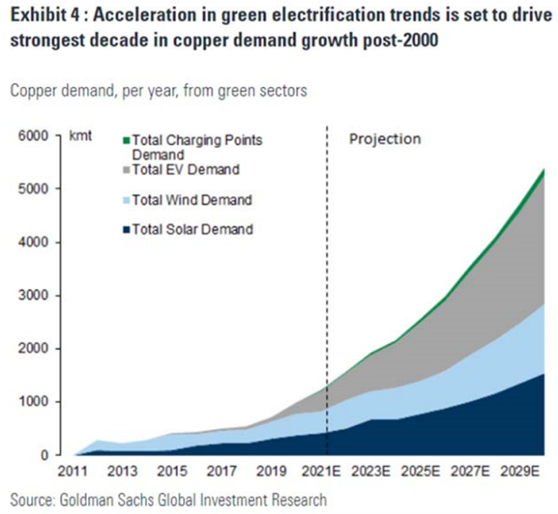

After more than a decade of weak demand, a new commodity cycle is in the early stages based on increasing long-term demand drivers. New demand from electric vehicles and alternative energy are very commodity intensive.

Moreover, producers have restrained capacity for a decade with the result that the supply vs demand is much tighter. It takes significant time to build new capacity. As prices should be well supported going forward. In addition, due partly to climate change pressures, traditional energy (e.g. oil) has curtailed investment which will continue to support prices.

Commodities have positive attributes for asset allocation. Commodities have low betas to traditional stocks and bonds. The valuation of commodities is attractive versus equities and bonds, as well. Commodities can perform well in an environment of higher inflation because they can be a source of inflation.

A wide range of commodities are needed for electric vehicles, power generation and other clean applications. Higher demand and restrained supply will help provide strong tailwinds. The switch to renewable energy (for example, solar and wind power) and electric vehicles will require significant amounts of commodities, for example copper:

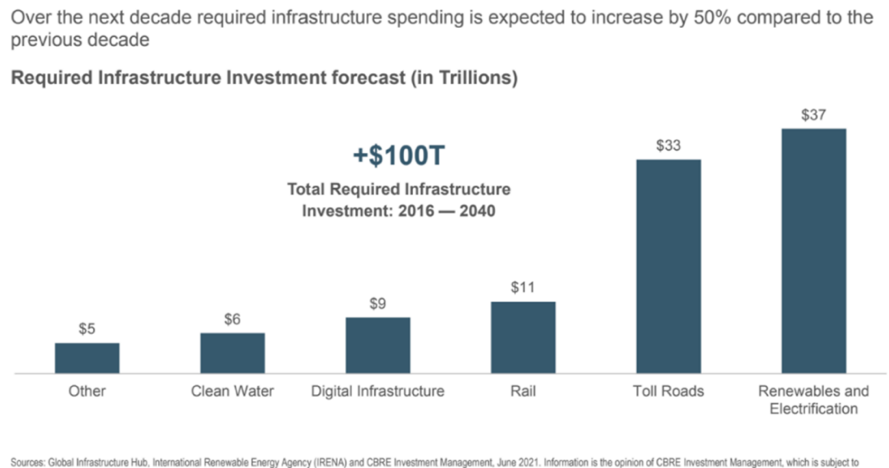

Infrastructure is also expected to have a strong growth runway with an expectation of $100 trillion in investment over the next twenty years, according to CBRE Investment Management. A significant amount of capital is needed globally to (1) modernize/repair aging assets, (2) facilitate a digital transformation as exponential growth in data requires more investment for storage and transmission, and (3) decarbonization, with energy decarbonization driving the shift to renewables.

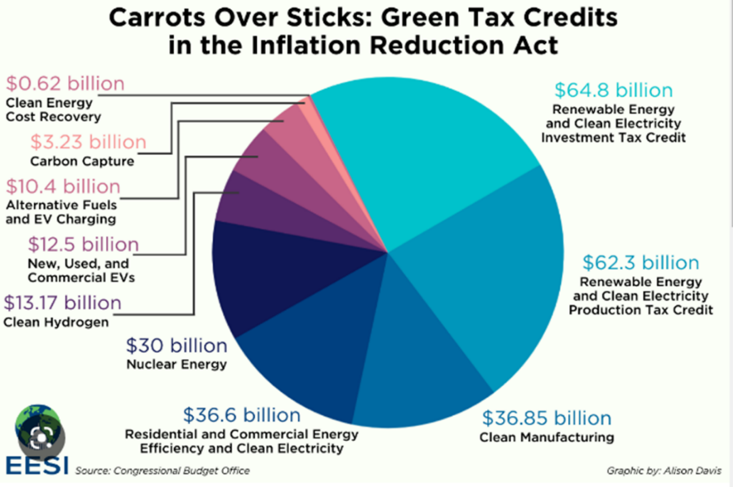

Moreover, the Inflation Reduction Act will provide a significant amount of capital to invest in green infrastructure.

3. Portfolio Construction

Due to higher fixed-income yields and equity multiples, the return outlook has improved. The new regime will likely be characterized by higher volatility for assets with a different correlation between asset classes. This will impact portfolio diversification. The new regime has markedly improved the environment for core bonds, value equity, commodities and infrastructure. The new environment could also lead to higher asset class volatility and less diversification benefit between stocks and bonds. As a result, portfolio construction will require a wider toolbox.

Capital Market Outlook

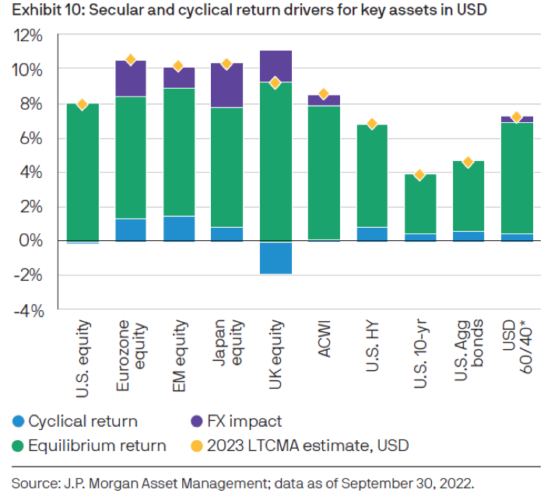

JPMorgan has updated its Capital Markets for the next 10 years:

In our opinion, the estimates of future returns over the next 10 years in the capital market assumptions are realistic. This is based on our outlook for economic growth and the fundamental building blocks of returns. The outlook, while not spectacular, requires us to reset our future return expectations.

Correlation

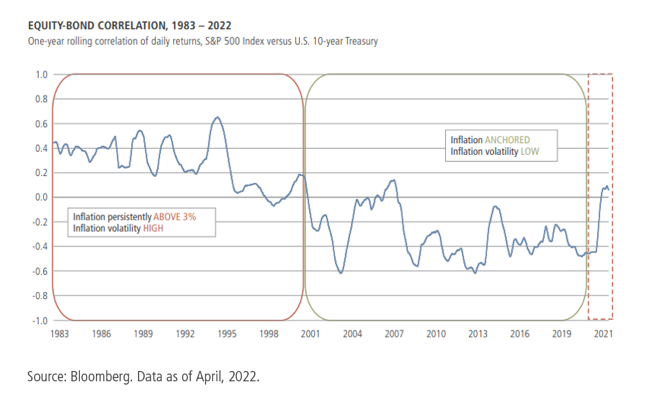

Low inflation benefitted correlations between fixed income and equity. Correlations in that environment have been negative, which provides a strong diversification benefit. However, when inflation rises, both stocks and bonds are negatively affected, leading to a positive correlation and a reduction in diversification benefit.

Asset Class Volatility

Falling inflation, rising globalization and conducive monetary and fiscal policies helped smooth the business cycle. It created a stable economic environment for the past forty years. That era is likely over, and higher expected macro volatility should lead to higher financial market volatility as well.

Diversification

Because there is a wide range of outcomes due to the high macro volatility, the best thing we can do is focus on being truly diversified. This means diversification across a variety of risk factors. In equity, those factors can include size, value, geography and beta. In fixed income, the risks often include interest rates and credit. Macro factors include economic growth, inflation and liquidity.

To diversify across risk factors, we look across public and private markets and within sub-asset classes. Diversifying across asset classes is beneficial because different assets react differently to adverse events. As a result, combining different asset classes can reduce a portfolio’s sensitivity to market swings because they have different correlations to each other and to macro risk factors.

4. Conclusion

The investment landscape over the past 40 years has been generally conducive. Over that time period, the macro environment was underpinned by increasing globalization, falling interest rates, accommodative monetary policy and low inflation.

However, we believe that times are changing and expect the new regime over the secular horizon to be characterized by less globalization, higher inflation, low economic growth and higher macro volatility.

In this new environment, portfolio construction utilizing a full toolbox of investment strategies is important.

Click here to download the PDF.

DISCLAIMER

This document contains our current opinions and commentary that are subject to change without notice. Our commentary is distributed for informational and educational purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient. Information contained herein has been obtained from sources we believe to be reliable, but we do not guarantee its completeness or accuracy. The information contained herein does not constitute legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.

As used herein, investment classification terms such as “real assets”, “private investments and “alternative investments” generally encompasses investments other than traditional stocks, bonds and cash, and includes hedge funds, funds of funds, private placements, private equity and real estate funds. These investments will often be less liquid than traditional investments and redemptions from such investments often involve holdbacks and other restrictions on the timing of the redemption. Private placements, limited partnerships, hedge funds, funds of funds, or other types of these investment vehicles are typically illiquid, often for long periods of time, i.e., years. The terms governing these investments generally provide for significant redemption notice periods, lock-up periods, and holdbacks upon redemption, resale restrictions, and other provisions that preclude prompt liquidation of these investments.

Certain statements contained herein may constitute “forward-looking statements.” Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. Certain hypothetical market situations herein are based on historical data.