Commodities and Renewable Energy: Who Knew?

September 20, 2021

After a decade-long slumber, commodities have finally awoken. In the previous decade, in our opinion, commodities languished due to a combination of anemic demand and excess supply. This new decade is starting to see a revival of commodity demand fueled by renewable energy and electric vehicles.

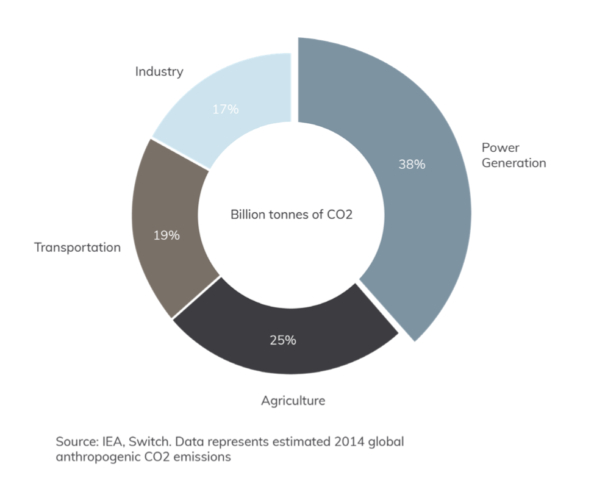

The new catalyst underpinning this demand driver is powerful, in our opinion. According to the UN’s 2021 Climate Report, immediate action is required in reducing CO2 emissions to prevent temperatures from rising 2o degrees Celsius by the end of the century. The U.N. Secretary-General, António Guterres, called the report a “code red for humanity.” Nearly 60% of man-made carbon dioxide is produced by power generation and transportation as seen in the chart below from the International Energy Agency (IEA). All this to say, decarbonization has become a critical multi-decade tailwind.

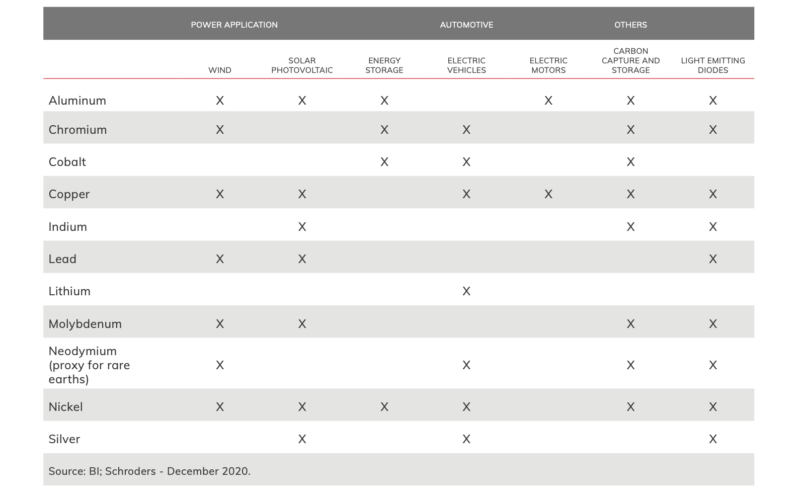

The switch to renewable energy (such as solar and wind power) and electric vehicles will require significant amounts of commodities. The chart at the bottom from Schroders shows the wide range of commodities needed for electric vehicles, power generation and other clean applications.

The switch to renewable energy (such as solar and wind power) and electric vehicles will require significant amounts of commodities. The chart at the bottom from Schroders shows the wide range of commodities needed for electric vehicles, power generation and other clean applications.

The growth in electric vehicles (EVs) is expected to grow significantly this decade. According to CNBC, the total number of EVs on the road is over 11 million. The IEA expects that number to hit 145 million by 2030. According to the IEA’s Global Electric Vehicle Outlook, if governments ramp up their efforts to meet climate goals, the global EV size could reach 230 million by the end of the decade. The demand for commodities will be significant.

The growth in electric vehicles (EVs) is expected to grow significantly this decade. According to CNBC, the total number of EVs on the road is over 11 million. The IEA expects that number to hit 145 million by 2030. According to the IEA’s Global Electric Vehicle Outlook, if governments ramp up their efforts to meet climate goals, the global EV size could reach 230 million by the end of the decade. The demand for commodities will be significant.

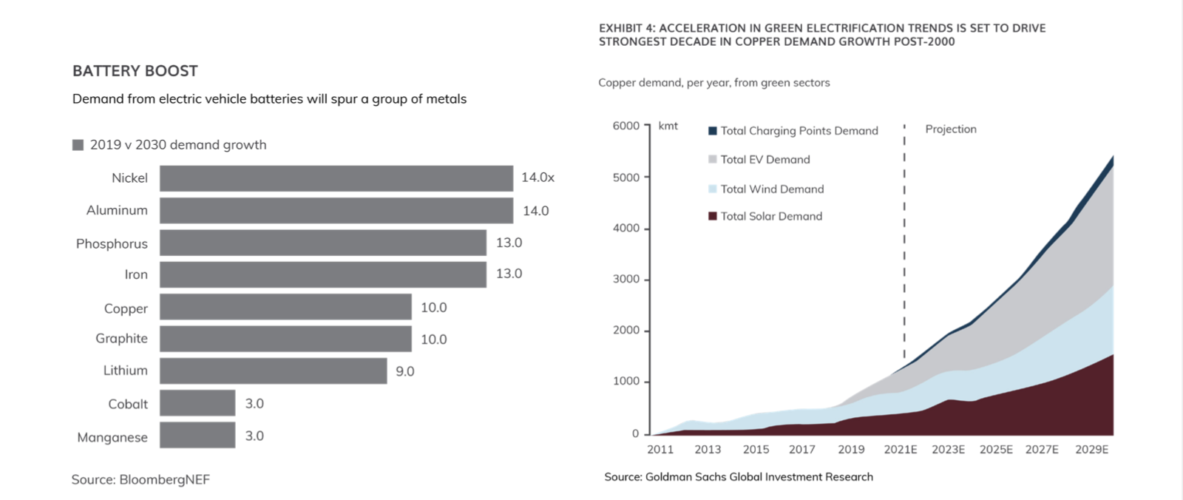

Electric vehicles have a different makeup of commodities than conventional ones. As an example, take the case of copper. According to the Copper Development Association, while conventional cars have 18-49 pounds of copper, hybrid electric vehicles contain approximately 85 pounds, plug-in hybrid electric vehicles use 132 pounds, and battery electric vehicles contain 183 pounds. As a result, as electric vehicle sales rise, the need for copper will rise significantly. The growth in EVs will also increase demand for a wide range of commodities as seen in the left- hand chart from Bloomberg.

Frost & Sullivan’s analysis “Growth Opportunities from Decarbonization in the Global Power Market, 2019-2030” shows a significant increase in renewable energy, particularly solar and wind. This is supported by falling costs and renewable-friendly energy policies adopted by governments globally.

As a result, solar photovoltaic and wind capacity additions are expected to grow significantly this decade. Frost & Sullivan estimate $2.72 trillion will be invested in wind and solar so that by 2030, 37.9% of installed capacity will be a combination of solar and wind. Both will be a source of commodity demand as seen in the chart from Goldman Sachs.

WE Family Offices generally recommends clients utilize a two-pronged approach to seek to ride this mega-trend. The first is investing in renewable energy infrastructure. The second is investing in resources.

In our opinion, renewable energy infrastructure is able to capitalize on the increased global demand for electricity and the increase in renewables (e.g. solar and wind) to generate that increased electricity supply. Technological advances, significantly reduced costs and decarbonization commitments are driving and accelerating the transition to cleaner energy sources. The need for clean energy is very high—in order to decarbonize, tackling energy is essential. The shift to electric vehicles will increase the demand for electricity, particularly from clean sources. Clean energy grids are the key enabling infrastructure.

This new economic and market cycle will be different than the previous one for commodities/ resources, in our opinion. The past decade was a difficult cycle for resources. This new cycle, which has recently begun, should be one better due to a higher level of commodity-intensive government investment in infrastructure and new demand from alternative energy. Moreover, commodity producers generally have had restrained capacity for a decade with the result that the supply compared to demand is much tighter. In our opinion, valuation of both resources and commodities are attractive versus equities and bonds. Additionally, we believe both resources and commodities can perform well in an environment of higher inflation.

This green industrial revolution is only now beginning. According to Mark Lewis, chief sustainability strategist at BNP Paribas Asset Management, “the next three decades are likely to bring a super-cycle in investments in clean energy infrastructure, clean transportation and everything else that is required to make the green transition possible.” The growing demand for renewable energy and clean technologies may be a new and powerful long-term driver of commodities.

Click here to download the PDF.

Disclaimer

This document contains our current opinions and commentary that are subject to change without notice. Our commentary is distributed for informational and educational purposes only and does not consider the specific investment objective, financial situation, or particular needs of any recipient. Information contained herein has been obtained from sources we believe to be reliable, but we do not guarantee its completeness or accuracy. The information contained herein does not constitute legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.