We came into 2025 with a view that the year would see high uncertainty due to new policy leading to higher market volatility with fatter tails. Despite the potential for volatility caused by policy to rise, we thought that the economic landscape would still be constructive for embracing investment risk in 2025. In spite the higher economic uncertainty, markets performed far better than we had expected.

In terms of the economy we believed the impact of new policies would have been more inflationary. It appears that businesses absorbed much more of the tariff impact and the tariff rate was also less than expected. In addition, US economic growth was also much more resilient than we expected. The major reason is that we underestimated growth was the impact of AI capex spending. According to the OECD, without AI capex spending the US economy would have been in a recession in the first half of 2025. This created a two tier economy where the AI sectors did very well and the rest of the economy struggled, contributing to a ‘K-shaped’ economy.

As far as the markets, we expected international economies and markets would be hit much harder by the tariff impact. But international equity markets, both developed and emerging, delivered very strong returns, outperforming US equities by the largest amount in decades. Policymakers in both Europe and Asia showed decisiveness in enacting bold new stimulus programs which caused price-to-earnings multiples to rerate. While volatility spiked in April after “Liberation Day”, it was also surprising how quickly the US equity market moved on from the tariff issue. It appeared that one of the most significant shocks to hit the global trading system in the past eighty years had only a temporary (but sharp) impact.

Looking ahead at 2026 we are constructive on both the global economy and risk assets due to less policy uncertainty (compared to 2025), supportive fiscal and monetary policies, and higher capex spending. The three main risks we are looking at are a potential AI bubble, inflation picking up and a more hawkish Federal Reserve.

Economic Outlook

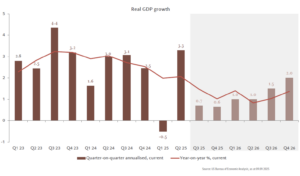

US economic growth is expected to pick up through next year. The economic environment appears to be transitioning from a stagflationary one in 2025 toward one of inflationary growth in 2026.

Although consumption by lower income households should still be weighed down by tariffs, the increase in capital expenditures, particularly AI related, can offset much that softness. The economy should be further supported by the fiscal stimulus provided by OBBA. As a result, higher capex spending plus fiscal stimulus should equal improving 2026 GDP growth. Growth could surprise on the upside.

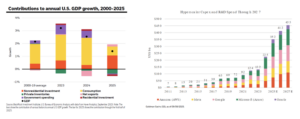

Historically two thirds of US economic growth is usually driven by consumption. However, consumption has been a smaller part of economic growth this year as tariffs have hurt purchasing power. According to the Peterson Institute, tariffs are estimated to have been essentially a tax of $2k for the average family. The economy benefitted from higher capital expenditures which have become a powerful cylinder of economic growth and is expected to increase.

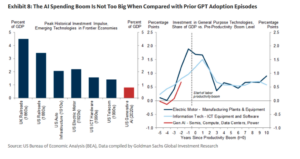

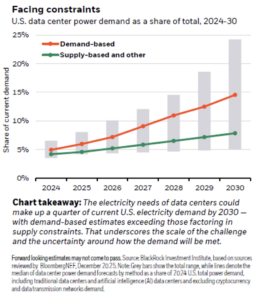

AI capex is in the early stages of a supercycle. Goldman Sachs (and other banks) estimates global AI-related infrastructure spending could reach $3 trillion to $4 trillion by 2030. A concern is that there is an overinvestment in AI. However, during previous technological revolutions, large amounts of capital have been needed for transformational change. Historical examples of technological breakthroughs requiring massive capital outlays are railroads, electrification, internal combustion engines and IT. These episodes have also seen over-investment as well. But today we are at the beginning stages of the AI revolution and much more investment is required. As a result, there does not appear to be an AI capex bubble.

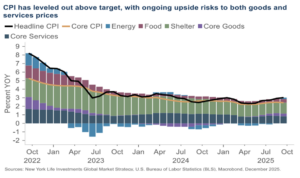

A major risk we are paying attention to is inflation coming in higher than expected. In 2025 tariffs have caused inflation to rise as core good prices have risen. Corporations have borne most of the burden and did not pass along the full amount, however, businesses could start to pass more of the tariffs to consumers.

A major risk we are paying attention to is inflation coming in higher than expected. In 2025 tariffs have caused inflation to rise as core good prices have risen. Corporations have borne most of the burden and did not pass along the full amount, however, businesses could start to pass more of the tariffs to consumers.

There is an expectation in the market that inflation might near the Fed’s target in late 2026, particularly driven by a fall in owner’s equivalent rent. However, inflation might prove stickier than expected. Consumer expectations of both 5 year ahead and 1 year ahead are elevated according the University of Michigan Survey. In addition, stricter immigration could tighten the labor market causing a rise in wages. Another factor driving the inflation outlook is that the Fed could loosen policy more than is needed and will let inflation burn hotter.

Employment is the second part of the Fed’s mandate. The jobs market appears to be soft. In 2025 1.1 mn layoffs have been announced and continuing unemployment claims is at 1.9 mn. But the number of jobs opening is at 7.7 mn showing that businesses are still looking for labor. Moreover initial jobless claims, an early indicator of the job market, is in a healthy range. Retail sales have held up better than expected indicating that labor market is stable. With an improved economic growth outlook the job market should stay intact in 2026.

The Federal Reserve lowered rates by 25 bps at each of the September, October and December 2025 FOMC meetings. The market expects two cuts in 2026. Chairman Powell’s term is ending in 2026 and we expect that the new chairman will be inclined to a looser monetary policy.

Equities

Global equity markets, particularly non-US, have performed well in 2025. The S&P 500, Eurostoxx 600 and Nikkei 225 all set new all-time highs.

Mag 7 stocks drove US market performance in 2025 based on the outlook for AI. An inflationary growth environment is supportive of equities. We are constructive on US stocks for 2026 based on a solid earnings growth outlook and supportive liquidity. Toward the end of 2025 we saw the rally start to broaden which we believe will continue through 2026. Profit margins are strong and at 3Q-2025 was the highest in 25 years and revenue growth was the best in three years. Margins are also expected to improve in 2026 which should support 2026 earnings growth.

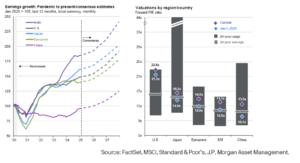

Mag 7 has produced very strong earnings growth this year. Next year it is expected to slowdown but still be favorable. The other 493 S&P 500 stocks saw weak earnings growth this year as the economy slowed. However, the 493’s earnings are expected to pick up in 2026.

Markets have become concerned about valuation. However, valuation today for both Magnificent 7 and the equal weight is nearly the same as nearly a decade ago. However, Mag 7 ilarger weight in the S&P 500 which is reason the cap weighted S&P 500 P/E is higher today than 10 years ago due to being a weighted average.

Markets have become concerned about valuation. However, valuation today for both Magnificent 7 and the equal weight is nearly the same as nearly a decade ago. However, Mag 7 ilarger weight in the S&P 500 which is reason the cap weighted S&P 500 P/E is higher today than 10 years ago due to being a weighted average.

Despite the market’s concern on valuation over the years, the market nevertheless performed well– in 2016 the S&P 500 was approximately 2,100 and today it is 6,800.

Worries are emerging about a potential bubble in AI related stocks. Since the launch of Chat GPT three years ago technology stocks have performed well. This has led to comparisons about the dotcom bubble in the mid to late 1990s. Similar to today, tech stocks performed well as the new technology of the internet became established. Human emotions later took over and sentiment drove prices to bubble territory. But there are very significant differences between the dotcom bubble and today—for the most part today’s technology returns are based mostly on actual strong earnings growth while the dotcom era was the hope for earnings. Earlier technological breakthroughs saw price bubbles in railroad and auto stocks as well. That may well happen one day with AI stocks—but that does not seem like the case today.

Case in point– both Cisco in the 1990s and Nvidia today played central roles in the infrastructure of their eras. Both saw strong price returns. But there is a significant difference—valuation. Cisco’s stock price was inflated by earnings assumptions that were wildly over-optimistic. Nvidia’s price has been driven by earnings. Cisco is a classic example of a price bubble while Nvidia’s stock price is backed by fundamentals.

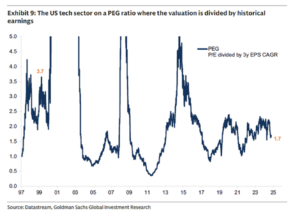

One valuation method to apply to higher growth companies is the PEG ratio which compares valuation to its earnings growth rate. Generally, the P/E ratio is higher for a company with a higher growth rate. As a result the P/E ratio would make high-growth tech stocks appear overvalued relative to the market. But the PEG ratio today of 1.7x for the tech sector is much more reasonable than in the 4x in late 1990s.

One valuation method to apply to higher growth companies is the PEG ratio which compares valuation to its earnings growth rate. Generally, the P/E ratio is higher for a company with a higher growth rate. As a result the P/E ratio would make high-growth tech stocks appear overvalued relative to the market. But the PEG ratio today of 1.7x for the tech sector is much more reasonable than in the 4x in late 1990s.

All investments have risks. Two primary risks we are watching concerning AI are excess leverage and disruptions to earnings growth underpinning valuation.

During the dotcom bubble newly formed companies with limited operating histories and untested business models borrowed money. When revenues failed to meet projections, credit problems began. Today the major investors in AI have strong balance sheets, long track records and are financially sound overall. Tech companies have recently been tapping the debt market to fund their AI investments having used cashflow the past few years. Due to the fact that the infrastructure needs to be built upfront and revenues come later, companies need to use debt due to the significant funding needs. The peak of capex/cashflow is 2025 and 2026 when the growth rates are the highest. Despite the debt issuance, those hyperscalers will still have very low leverage:

The valuations of AI stocks are contingent that earnings expectations will be met. The major threat underpinning that valuation is that earnings will fall short. Earnings growth could fall short due is supply-side bottlenecks in the form of insufficient electricity. This is one of the largest risks in the AI sector, in our opinion. Although the risk of power shortages is on the horizon, perhaps a few years away, the answer of increasing power supply takes a very long time to build. Markets might begin to price that risk ahead.

2025 was a very strong year for equities outside of the US. Non-US equities, both developed and emerging markets, performed extremely well in 2025 and outperformed US equities by the largest amount in years. Much of the reason was multiple expansion and a weaker US dollar. European stocks benefitted from approval of new fiscal stimulus for higher defense and infrastructure spending. Emerging market stocks, particularly in South Korea and Taiwan, re-rated on the back of the AI narrative, as both countries produce advanced technology hardware. New stimulus was also passed in Japan and China is also looking to support its real estate sector. As a result, we believe solid economic growth, a softer dollar and reasonable valuations should support international equities in 2026.

Core Bonds

The Barclays Aggregate Bond Index performed well in 2025. However, an environment of inflationary growth is not positive for core bonds. Given a distinct possibility that in 2026 economic growth can be stronger and inflation more sticky than expected, we advise caution.

In 2025 extremely high policy uncertainty drove the high volatility in the rates market. Based on the outlook for growth, inflation and worries over indebtedness (i.e. term premium) we estimate that a reasonable target range for the US 10 Year rate is 4.0% +/- 0.50%. However, there is an additional risk in 2026 that yields could rise higher than the range due to changes at the Federal Reserve that could lead to potentially higher inflation. Moreover, yields in both Europe and Japan provide a competition for capital and can provide a floor for rates. Both Europe and Japan are embarking on further fiscal stimulus requiring more capital. The rate cutting cycle by the ECB has nearly ended and the Bank of Japan is likely to further raise rates.

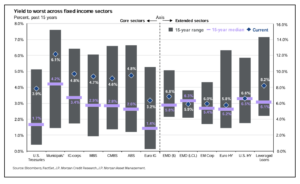

Yields are well above the 15-year average across a broad range of sectors. There is enough cushion to absorb a meaningful yield rise, but given a higher probability of risk tilting toward the upside, a more neutral stance is warranted, in our opinion. The yield curve is prone to steepening as the short end falls as the Fed lowers rates which makes cash less attractive. However, in the event of potentially adverse geopolitical shocks or equity market drawdowns, there is a role for core bonds to play as a risk hedge so we would also caution of being underweight, as well.

Diversification is advised for a core fixed income portfolio. Muni bonds are quite attractive due to its yield rising in 2025 on very high issuance. In addition, a stable to growing economy should support ABS and investment grade corporates, despite the latter’s tight spread.

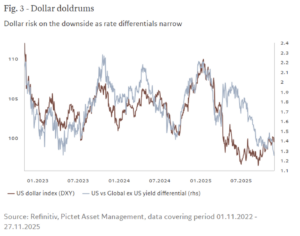

US Dollar

The US dollar weakened in 2025. The dollar can further depreciate in 2026 as the Fed Reserve continues to reduce rates while the ECB holds rates and the Bank of Japan raises rates. A weaker USD provides a “kicker” to unhedged dollar based investors.

The US dollar weakened in 2025. The dollar can further depreciate in 2026 as the Fed Reserve continues to reduce rates while the ECB holds rates and the Bank of Japan raises rates. A weaker USD provides a “kicker” to unhedged dollar based investors.

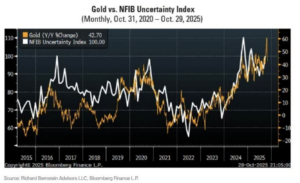

Gold

Gold performs well during periods of high uncertainty. In 2025 policy uncertainty was very high and gold has returned over 60% YTD. Uncertainty should continue to be high in 2026 as well, although we believe not to the same extent as in 2025.

The overall outlook of higher economic growth with stickier/higher inflation is favorable for global equities and real assets while the environment is generally neutral for fixed income. In all three asset classes, we recommend broad diversification to both capture a range of opportunities and to spread out risk exposures.

DISCLAIMER

Important Information and Disclosures

This document is confidential, is intended only for the person to whom it has been provided and under no circumstances may a copy be shown, copied, transmitted, or otherwise given to any person other than the authorized recipient without the prior written consent of WE Family Offices LLC (“WE”). WE is under no obligation to update the information contained herein. This material does not consider the specific investment objective, financial situation, or particular needs of any person.

The views, opinions and recommendations expressed here are subject to change without notice, are for information purposes only and should not be considered as investment, tax or legal advice, or a recommendation or offer of any security, asset, or service for sale. WE and its representatives are not your investment advisers unless you and WE have entered into a written advisory services agreement. Information contained herein has been obtained from sources we believe to be reliable, but we do not guarantee its completeness or accuracy.

As used herein, the investment classification “Alternative Assets” generally encompasses investments other than traditional stocks, bonds and cash, and includes hedge funds, funds of funds, private placements, private equity and real estate funds and investments. Certain Alternative Assets, e.g., private placements, limited partnerships, hedge funds, funds of funds, or other types of these investment vehicles are typically illiquid, often for long periods of time, i.e., years. The terms governing these investments generally provide for significant redemption notice periods, lock-up periods, and holdbacks upon redemption, resale restrictions, and other provisions that preclude prompt liquidation of these investments.

Certain statements contained herein may constitute “forward-looking statements” under the U.S. federal securities laws. Without limitation, words such as

“outlook”, “anticipate”, “believe”, “could” “expect”, “may” and “would” are indicative of forward-looking statements. Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Opinions and estimates offered here constitute our judgment and are subject to change without notice and will not be updated, as are statements of financial market trends, which are based on current market conditions. Certain hypothetical market situations herein are based on historical data. Past performance of an asset, asset class, or strategy, is not indicative of future results.

In accordance with the rules of Treasury Department Circular 230, any information in this presentation pertaining to federal taxation and using such terms such as “tax planning” is not intended or written to be used and cannot be used by you or any other person, for the purpose of (i) avoiding any penalties that may be imposed by the Internal Revenue Code, and (i) promoting, marketing or recommending to another party any transaction or matter addressed herein.

This presentation does not constitute the provision of investment, legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.