Public Real Estate (REIT) Market Update

January 4, 2024

As publicly listed stocks, REITs are moved by emotions in the short term and, therefore, highly volatile because they are daily traded stocks on the equity exchanges. It then looks ahead to changes in fundamentals (price discovery). Despite the high volatility, REITs currently have several favorable characteristics.

Due to the rise of interest rates, REITs have declined significantly, with the FTSE NAREIT All Equity REIT Index down -25.0% in 2022 and -9.4% in 2023 through October 31. As a result, much of the decline has been felt, and REITs are well positioned, in our opinion.

- Attractive valuations historically due to the rate shock—properties have already declined

- Earnings growth has stabilized and dividends have been attractive

- Lower leverage than historically witnessed

- Financing locked in for a long period of time

- High exposure to growing sectors such as data centers, industrials, healthcare and life sciences

- REITs historically have performed well in a rate pause and tend to lead an equity market recovery

1. Valuation

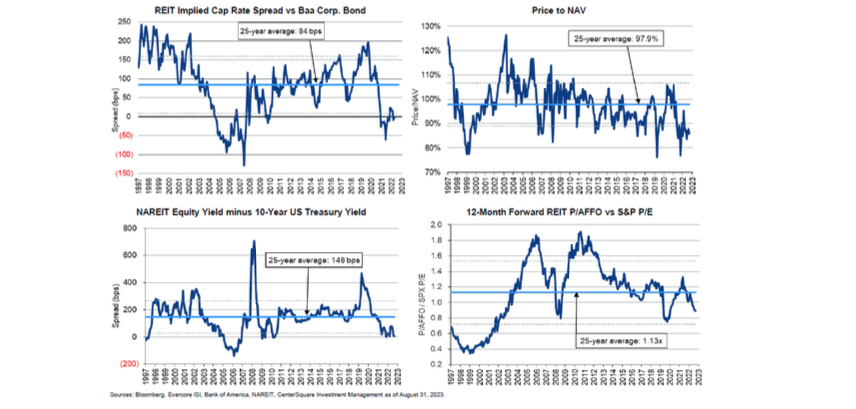

The public REIT market has already priced at or below more realistic values reflective of the new rate environment. We believe that most of the downside from financing costs is now priced into markets and global central banks are toward the end of their rate hiking cycles. Multiple valuation metrics show the attractiveness of REITs compared to history:

Financing costs have risen 300+ basis points since early 2022, with an associated rise in implied cap rates into the mid-6% range or higher. This has led to global real estate trading at a 10% discount to NAV.

2. Fundamentals

Being a publicly traded equity, REIT earnings and dividends are key. REIT earnings growth peaked in late 2021 and has corrected to a normalized level.

Despite the significant valuation de- rating seen in the REIT market in the last few years, the operational performance of major REITs has generally been strong. Earnings have stabilized to pre-COVID levels. 2023 is estimated to be a year of mid-single-digit earnings growth.

The combination of continued earnings growth with share price declines means public REIT valuations have become more attractive, in our opinion.

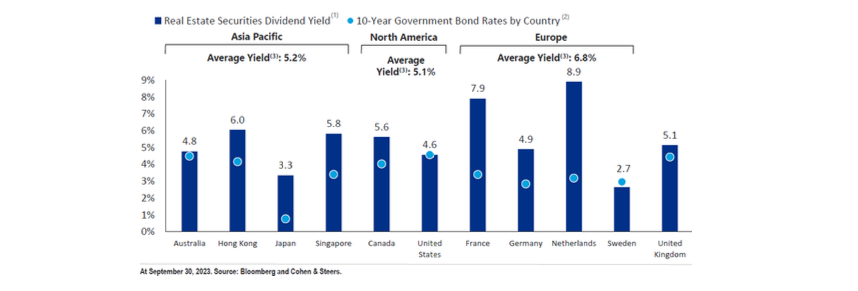

Although global REIT share prices have declined by more than 35%, REIT cash flows per share have grown by approximately 13% (per UBS). High-quality REITs, for the most part, have defensive cash flows tied to long lease terms, with decent pricing power in many sectors. This provides a strong operating position to pay dividends. Globally, REIT dividend yield is attractive:

Moreover, pricing power also stands to benefit from limited new supply. One benefit of higher interest rates is that higher financing costs have resulted in less new development.

3. Leverage and Financing

Global balance sheets are healthy as leverage continues to remain low. According to UBS, US REIT leverage (e.g., loan-to-value) is currently 34.8% compared to a historical average of 38.4%. European REIT leverage is also at levels below the historical average. In the US REIT space, over 80% of debt is fixed for an average of the next 5.9 years per Green Street. Moreover, much of REIT financing is through the public debt markets. As a result, the reduction of debt lending by US regional banks is not a significant issue facing REITs.

4. REIT Market – Growth Sectors

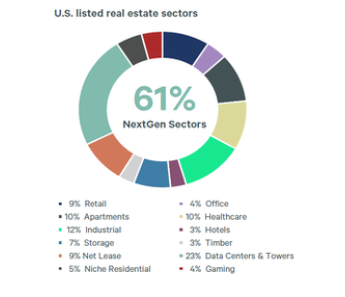

Source: CBRE Investment Management. FTSE Nareit All Equity REIT Index as of 12/31/2022, NCREIF NFI ODCE as of Q3 2022

Public REITs have greater exposure to alternative and faster-growing areas (“Next Generation”) of the real estate market, such as data centers, logistics, storage and healthcare. Pricing power is aided by steady demand, such as senior housing, manufactured homes and data centers. For example, with strong demand meeting with limited new supply, data centers have increased their rents by an average 15% nationally over the past year, according to CBRE.

“Next Generation” sectors now represent 61% of the $1.1 trillion US REIT market. These sectors—data centers, industrial, cell towers, senior housing and self-storage—have strong demand drivers. The outlook for these sectors is very strong. For example, industrials benefit from reshoring. Data centers have become critical infrastructure in a tech-driven economy.

In earlier years, office and retail dominated public REIT allocations. No longer—office is only 4% of the index while retail is 9%, per CBRE.

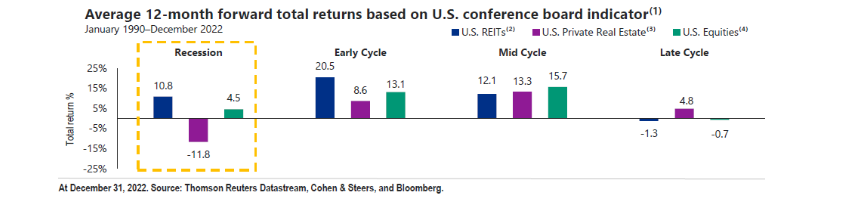

5. REIT Market Cycle – Recovery

Public REITs were one of the hardest hit sectors over the past two years by the significantly higher interest rates. We believe that the hawkish policy cycle by global central banks is nearing an end. In a more stable interest rate environment, REITs can perform well. Historically, REITs perform poorly in the late cycle as rates rise due to policy tightening. However, they perform extremely well in the early cycle and begin to rebound during a recession. With global economies currently soft and starting to lose momentum, we believe the time to start investing in public real estate securities is approaching.

Conclusion

EITs have attractive valuations, having adjusted to higher interest rates, increased exposure to high growth sectors, improving fundamentals and a tendency to lead equity market recoveries.

DISCLAIMER

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. Certain hypothetical market situations herein are based on historical data.

Certain statements contained herein may constitute “forward-looking statements.” Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. All investment involves the risk of loss.

Information contained herein has been obtained from sources we believe to be reliable, but we do not guarantee its completeness or accuracy. The information contained herein does not constitute legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.