2022 has been a difficult year so far for investors. As of 9/30/2022 the Barclays Aggregate Bond Index is down -14.6% while the S&P 500 is down -23.9%. The Federal Reserve has raised interest rates significantly and signaled an aggressive posture to tamp down inflation. Both equity and bonds markets has sold off in response. Due to the high level of uncertainty, we strongly advise clients to maintain their positions and stay the course. We now find that short and medium duration core bonds have become more attractive and can act as a ballast against equity market volatility. In addition, alternative strategies are also attractive in volatile markets.

Inflation

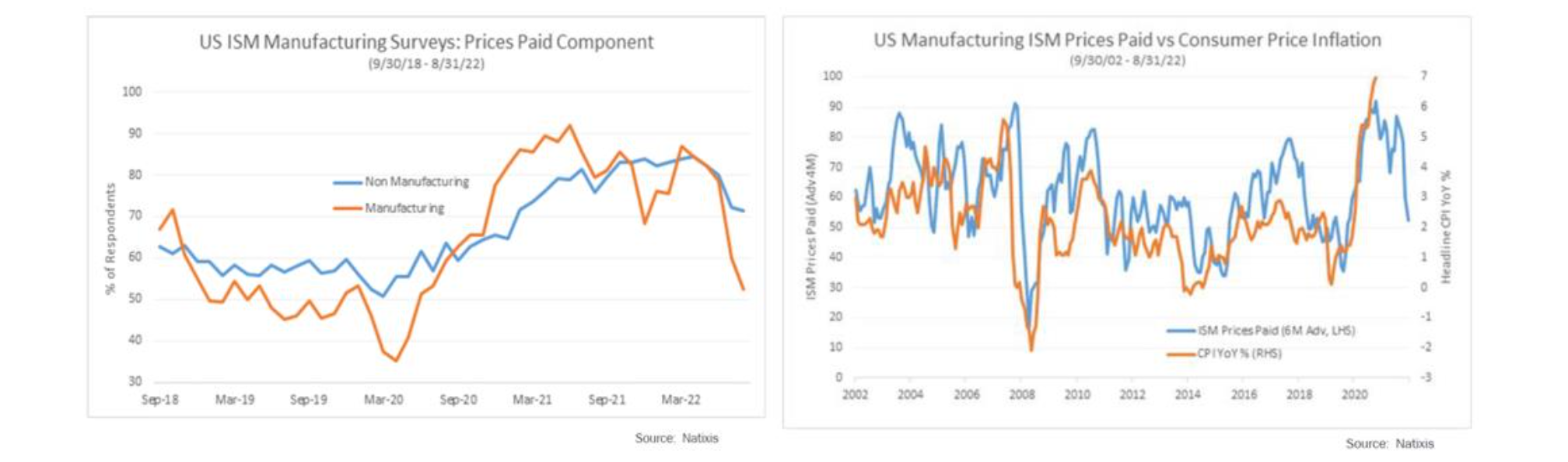

Inflation holds the key for financial markets. The economy has been gripped by an inflationary shock. However, we are seeing signs that inflation is starting to peak. Both ISM Manufacturing and Non-manufacturing appear to have peaked (left hand chart) as have a large number of other data points such as Fed regional surveys, shipping costs, and rents. Consumer Price Inflation (CPI) has historically tracked ISM data but with a lag as seen in the right hand chart:

The Fed is attempting to cool inflation by restraining demand through increasing the cost of money. The result of interest rates has hammered the bond market in the process. The crux of the problem is that the causes of inflation are supply driven while the Fed only has tools addressing demand. As a result, inflation going forward to likely to be stickier and slower to come down. The major risk is that inflation does not fall and rates rise more.

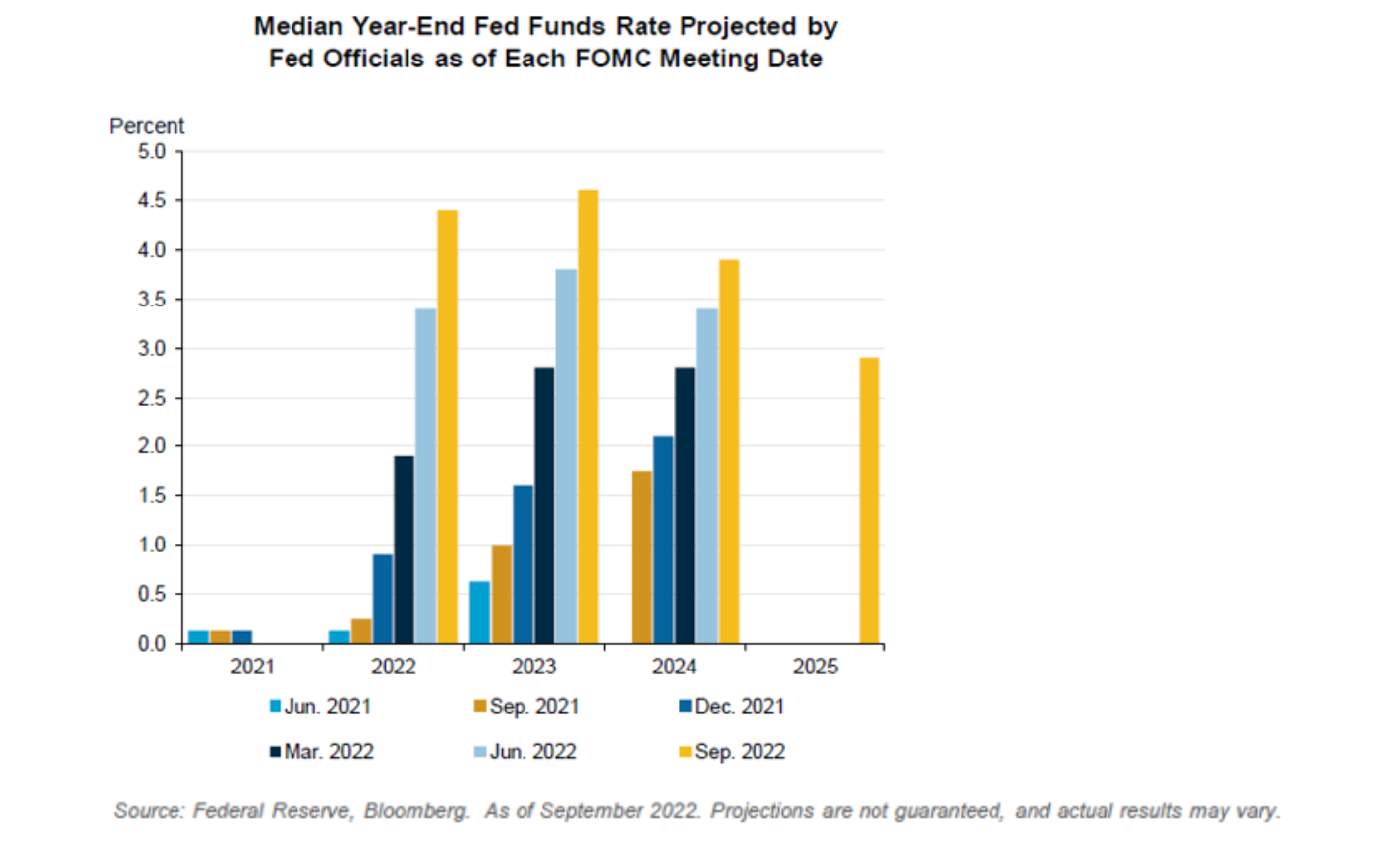

At the beginning of this year the fixed income market had priced in a very dovish Federal Reserve. Markets believed in the inflation is “transitory” argument. As the year progressed, it became evident that inflation was becoming more deeply rooted. As a result the Federal Reserve became more hawkish and raised rates. Before this year the most hawkish Fed rate hike was in 1994 when policy rates were raised by 50 bps at one meeting. In 2022 the Fed hiked rates 75 bps at several meeting and is expected to do so again at the November meeting. The following chart shows how the Fed has become more aggressive as this year progressed:

Fixed Income Markets

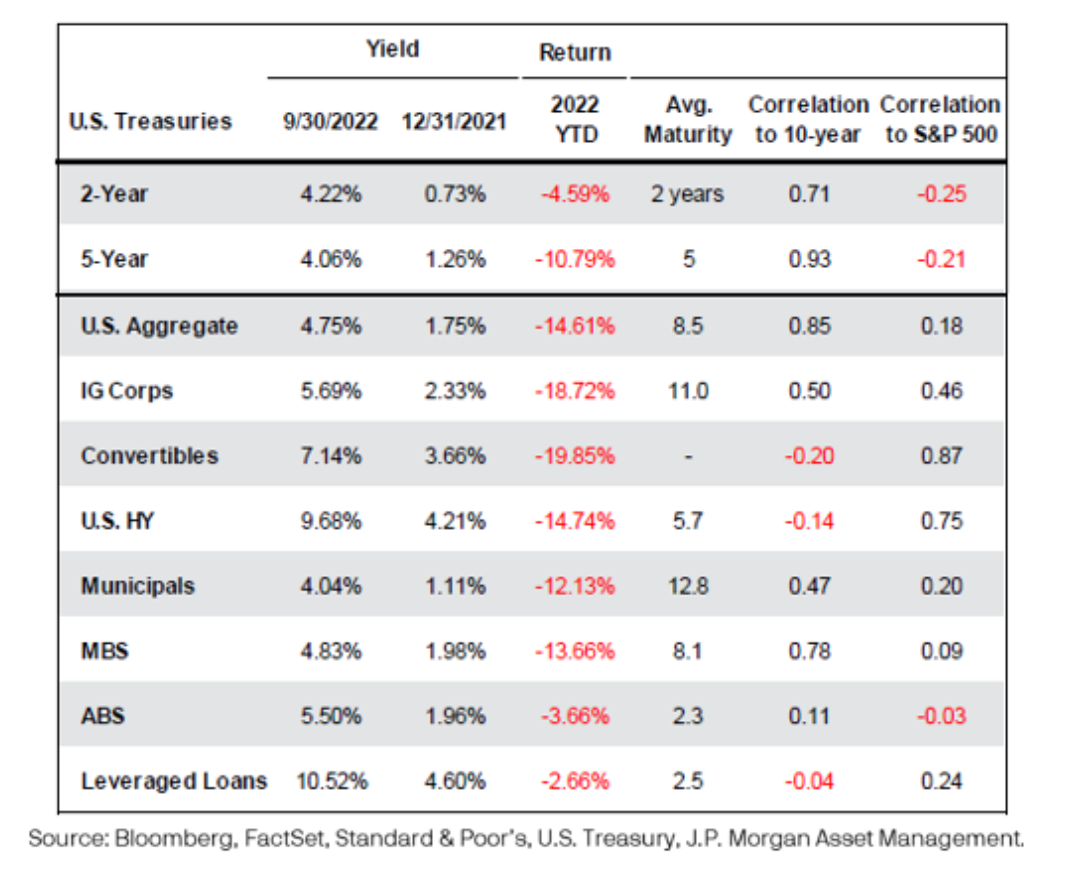

The commitment to combat inflation by the Federal Reserve has caused interest rates to rise significantly. Higher rates have caused the Barclay’s Aggregate Bond Index to drop more than 14% year-to-date. It is rare for the bond market to have a negative year. In fact, the index has been down in only 5 calendar years since 1972 with worst year being 1994 when the Barclays Aggregate was down -2.9%. At this stage yields are looking favorable:

In our opinion, bond markets have already priced in a more hawkish monetary policy by the Federal Reserve order to tamp down inflation. The result is that yields are significantly higher now than at the beginning of the year as seen in the above chart. Fixed income is finally offering income. Much of fixed income return is generated from reinvestment which is now occurring at a higher level. As a result, fixed income now offers a better balance between risk and return. For investors this is the wrong time to sell holdings and we advise clients to hold on to positions. Moreover, core fixed income now offers safety in the event the US economy goes into recession. We recommend short and medium duration and avoid long duration fixed income.

Equity Markets

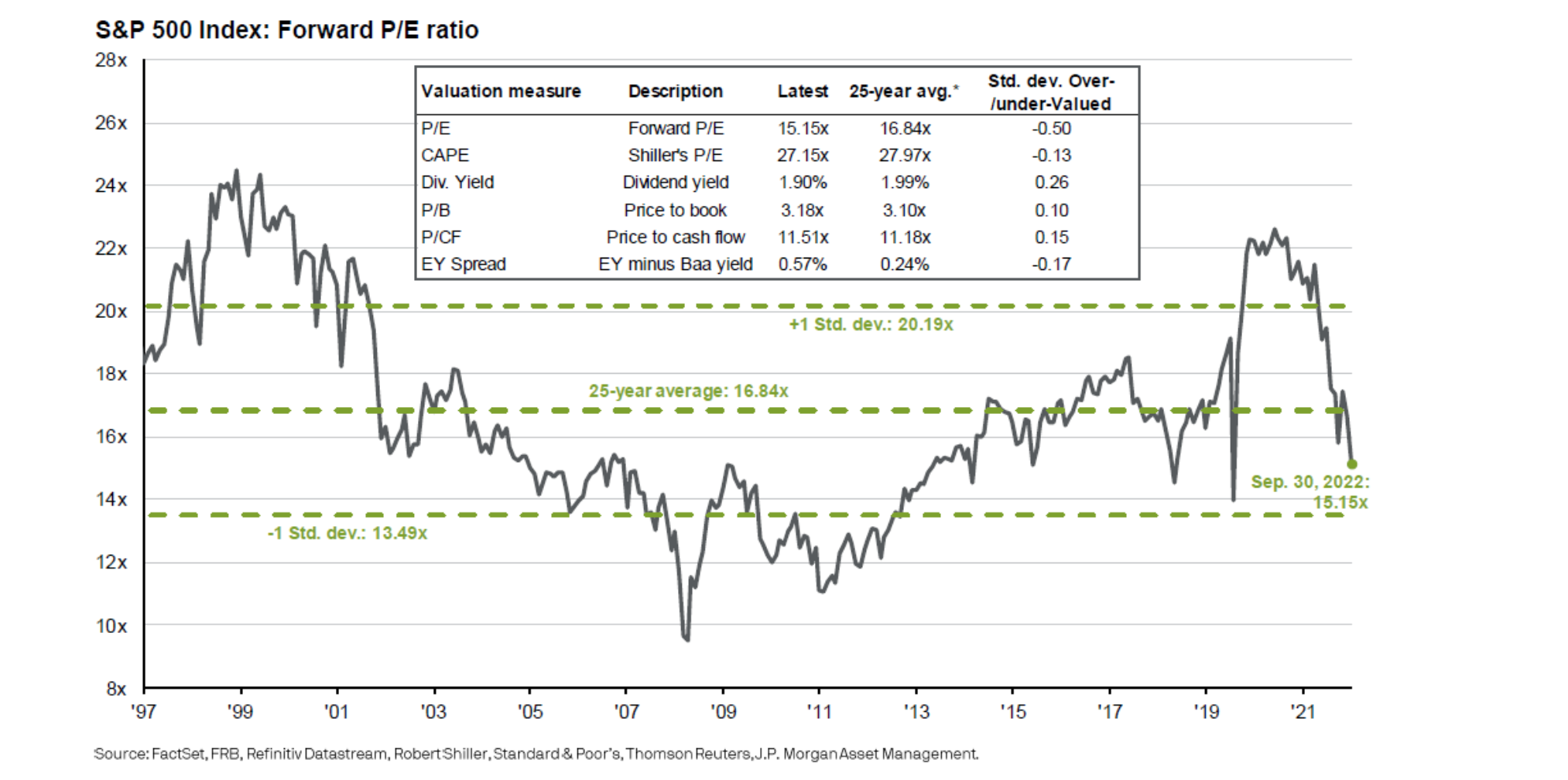

The equity market has also been negatively affected by higher interest caused by Federal Reserve monetary policy tightening. Higher interest rates have caused valuation multiples to derate. The S&P 500 forward P/E ratio has gone from 22x at the beginning of the year to 15x currently. This accounts for the -24% return this year. As a result of the derating, valuation multiples across a broad number are near their 25 year averages.

The large part of the multiple contraction has largely occurred, in our opinion. However, it should be noted that the P/E has typically dropped to 13x in a recession. We still advise caution, since equity markets are likely to remain volatile.

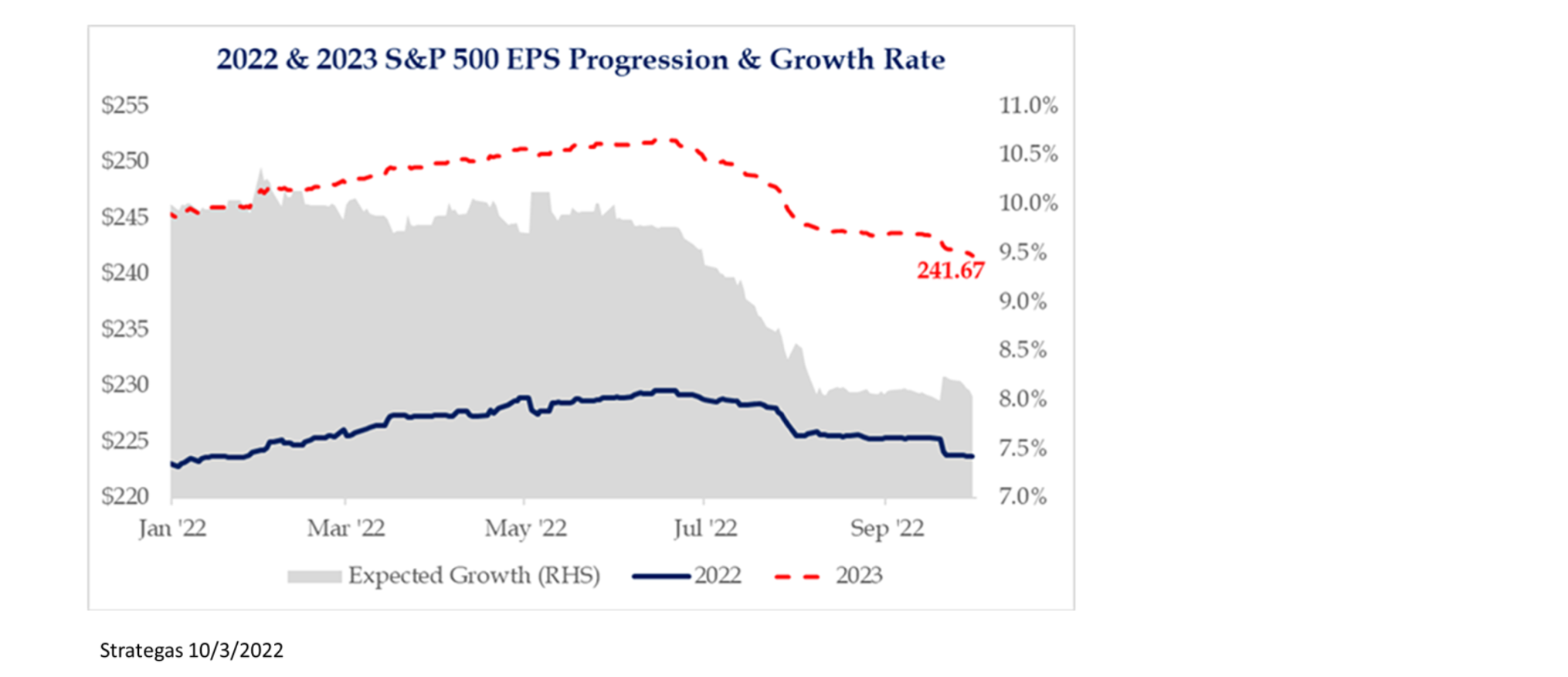

Another major risk is that the Federal Reserve tightening will cause the economy to slow down and potentially fall into a recession. U.S. recessions have always been accompanied by declines in corporate profits. This downside risk is still ahead of us, in our estimation. Moreover, equity markets have only recently started to build in a lower earnings growth estimate for next year:

The 8% expected earnings growth rate appears too optimistic in either a slowdown or recession scenario. As the economy slows down, it could lead to another down leg in the equity market. As a result, we recommend utilizing high quality managers. However, we also caution about being out of the equity market, as well. Last summer we witnessed a market rally in July and are seeing a bounce at the start of October. History has shown that some of the largest market up days occurring during a bear market.

Alternative Strategies

In this market environment, there are several attractive alternative strategies:

Opportunistic Private Credit – there could be an opportunity in special situations/distressed credit in both US and Europe. As interest rates rise and corporate earnings slow, we could see increased dispersion and pockets stress in the corporate credit space. In Europe, as winter arrives the increased energy costs and slowing economy could give rise to corporate distress.

Venture – although high growth companies have experienced write downs year to date, over the long term companies will need innovation and technology to increase productivity. Globalization drove some companies to offshore seeking lower cost labor while underinvesting in technology. As we see de-globalization and onshoringvof supply chain, particularly in pharma and computer chips, the need for innovation will continue. We see attractive pricing and deal structures returning creating an attractive entry point to continue investing in innovation.

Long/Short Credit Hedge Fund – as we expect to see continued dispersion in the public credit space, active management that can offer fundamental and technical capabilities should continue to add alpha to portfolios. We expect pockets of stress in corporates, therefore requiring skillful fundamental credit analysis to select quality credits. We also expect to see continued flows in and out of passive credit strategies due to continued interest rate hikes and credit spread volatility. Tactical managers who can trade around the flows while supporting trades with solid credits could lead to continued manager alpha as we have seen year to date.

Uncorrelated Semi-Liquid Alternative Investments – with a wide range of potential outcomes from increased interest rates and slowing economy, investors could benefit from uncorrelated, semi-liquid, cash flow yielding strategies. The uncorrelated assets would add a diversification benefit, and the semi-liquid nature generally offers liquidity over the course of a year (depending on strategy). The cash flow component could offer a somewhat reliable return stream while reducing capital at risk in an environment where we expect continued volatility. Investors should consider real assets as a component of the strategy, given the inflation hedging ability of some strategies.

Conclusion

The key to our outlook is the path of inflation which drives Federal Reserve policy and the trajectory of interest rates. Rising rates have caused both fixed income and equity markets to suffer so far this year. We have seen signs that inflation could start to fall in months ahead. As a result, we believe that most of the rate increase has already occurred and that clients maintain their positions. Core fixed income now offers income and also acts as a ballast against equity market volatility. It is likely that equity markets will still be volatile as earnings adjust to a slower economy. We also recommend several alternative strategies that are attractive in these volatile markets. Most of all patience is a significant asset.

DISCLAIMER

This document contains our current opinions and commentary that are subject to change without notice. Our commentary is distributed for informational and educational purposes only and is not investment advice and does not consider the specific investment objective, financial situation, or particular needs of any recipient.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. Certain hypothetical market situations herein are based on historical data.

Certain statements contained herein may constitute “forward-looking statements.” Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. All investment involves the risk of loss.

Information contained herein has been obtained from sources we believe to be reliable, but we do not guarantee its completeness or accuracy.

The information contained herein does not constitute legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.