Cut Through the Clutter! How to Read the Form ADV (Part 4)

June 7, 2014

Once a family evaluates all available wealth management options and decides they’d like to seek an independent financial advisor, there are still challenges ahead. Not all advisors – even fiduciary advisors – are the same, nor are they all independent or conflict–free. The critical challenge for a family looking for an independent advisor is learning where to look for potential and actual conflicts of interest between the advisor and its clients, and most importantly, how to read the Form ADV. How should a UHNW family research advisor firms? What questions should they ask, and where can they find the answers they need?

THE RIA DESIGNATION: WHAT DOES IT MEAN?

One important threshold question about an advisor is whether it is a “registered investment adviser” or RIA? RIA firms are registered with, and regulated by, the U.S. Securities & Exchange Commission. All RIAs owe their clients a fiduciary duty. Generally, RIAs with more than $100 million in assets under management are required to register with, and are regulated by, the U.S. Securities and Exchange Commission (“SEC”). Many other smaller RIAs are regulated by a state regulator – although some states, such as Wyoming, do not regulate investment advisers. Simply because of the amount of their investable assets, ultra-high net-worth families seeking an adviser are likely to find themselves comparing SEC-registered RIAs rather than state-registered, or unregistered ones.

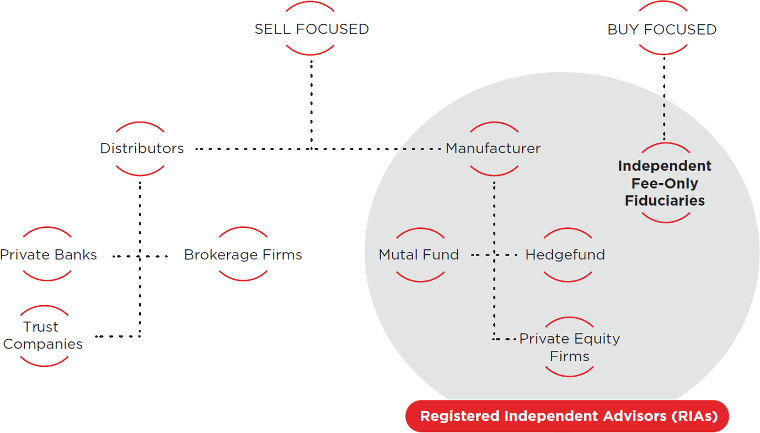

In this Cut Through The Clutter series, we have identified three types of financial advisors – Manufacturers, Distributors and Independent, Fee-only Fiduciaries (IFOFs). Some advisors in each of these categories are also RIAs. All IFOFs are RIAs, and Manufacturers typically either are RIAs themselves, or are advised by an RIA. And certain Distributors have affiliates that are RIAs, in particular the large financial service companies that sell financial products and services through, among other outlets, affiliates that are broker-dealers and RIAs (i.e., fee-based accounts). Even among “RIAs” there are often affiliations with Manufacturers or Distributors that could lead to potential conflicts of interest. The following diagram depicts the relationship between the three types of financial advisors and the “RIA” designation.

Once a family evaluates all available wealth management options and decides they’d like to seek an independent financial advisor, there are still challenges ahead. Not all advisors – even fiduciary advisors – are the same, nor are they all independent or conflict–free. The critical challenge for a family looking for an independent advisor is learning where to look for potential and actual conflicts of interest between the advisor and its clients. How should a UHNW family research advisor firms? What questions should they ask, and where can they find the answers they need?

FORM ADV IS A RICH SOURCE OF INFORMATION ABOUT AN RIA

The SEC requires each RIA to file a public disclosure document on Form ADV which discloses information about the RIA, including any actual and potential conflicts of interest. The Form ADV is updated at least annually. Because the government requires RIA firms to disclose a great deal of fundamental information in the ADV about their business organization, practices, and service offerings, it is a great source for information that tends to be more objective and “just the facts” than firm-designed materials such as a marketing piece or a website.

The Form ADV consists of two parts. Part 1 is in a “check the box” format and includes basic

information about the RIA’s business, ownership, clients, employees, business practices, affiliations, and any disciplinary events of the adviser or its employees. Part 2 of the form requires each RIA to prepare a narrative brochure written in plain English that contains more detailed information on topics such as the types of advisory services offered, the advisor’s fee schedule, disciplinary information, conflicts of interest, and the educational and business background of management and key advisory personnel of the advisor. The ADV brochure – written as a plain English narrative – provides very useful information to current and prospective investors about the RIA and its key business practices.

HOW DO I FIND AN RIA’S FORM ADV?

Obtaining an RIA’s Form ADV on the internet is easy:

- Go to the SEC’s Investment Adviser Search website http://www.adviserinfo.sec.gov/IAPD/Content/Search/iapd_Search.aspx

- Look up the adviser by firm name.

- After clicking the link for the RIA firm, click the “SEC” link (or the link of the state in question, if the RIA is registered at the state level instead of with the SEC).

- For Part 1 of the ADV, look to the menu on the left hand side of your screen. Under the “Sections of ADV” box, click “View All.” This will load the entire Part 1 of the form

into a single document which makes it easier to review. - For Part 2 of the ADV, at the initial screen that loads once you click the “SEC” link in step 3, scroll down the menu on the left side of the screen and click “Part 2 Brochures.”

- Click the link for the most recent Brochure filed.

WHERE DO I LOOK IN THE ADV FOR USEFUL INFORMATION?

Use the following guide to pinpoint where the ADV provides information about the adviser firm’s:

Independence & Conflicts of Interest — Is the RIA independent? Is it a manufacturer or distributor of financial products and services, or is it affiliated with a manufacturer or distributor? Such affiliations can lead to conflicts because the adviser – or its affiliates – may have an economic interest in selling you particular products and services, as opposed to only providing independent investment advice.

To determine whether an advisor is independent, or has actual or potential conflicts of interests, look at:

- Form ADV Part 1, items 6, 7 and 8, which require disclosure about the RIA’s other lines of business, and its financial industry affiliations;

- Schedules A and C, which require disclosure about the RIA’s ownership structure; and

- Brochure item 10 (Other Financial Industry Activity and Affiliations), and item 12 (Brokerage Practices).

Is the firm owned, in whole or in part by a large financial service company, or affiliated with another company that sells any financial products or services, e.g., a “private fund”? If so, it’s especially important to look at items 6, 7 and 8 to see whether the firm has business affiliations or lines other than providing investment advice through the RIA (items 6 & 7), and whether it has a proprietary interest in anything it buys, sells or recommends to clients, i.e., proprietary funds — see (item 8).

Fees — Finding out how the adviser is compensated is critical – i.e., how, and how much, does the adviser charge for his/her services (e.g., a percentage of advised assets, flat fee, performance fee, etc.) – and whether they are compensated any other way (commissions or other fees). This information is listed in Part 1 of the ADV at item 5(E). And there is additional detail on the adviser’s compensation in the Brochure, at item 5 (Fees and Compensation), item 6 (Performance Fees) and item 14 (Client Referrals and Other Compensation) – Does the adviser disclose any financial interest in selling particular money managers’ products?

Service and Business Model — What services does the RIA offer? (e.g., if you’re paying 1% per year, are you getting comprehensive financial planning? Or does the adviser just offer portfolio management, and clients pay extra for other financial planning services?). Take a look at the ADV part 1, item 5(G) detailing the RIAs advisory activities, and in Brochure item 4 (Overview of the RIA’s Services). It will also be very important to carefully review any advisory agreement you are considering signing to see what services are included (and what are not) in the scope of the agreed relationship.

Investment Advisory Style & Process — The adviser’s process for making investments or recommending particular investments to its clients (i.e., how they pick investments and how they allocate between those investments). Is the adviser’s investment strategy and process consistent with your goals and risk tolerances? The best place to look for information about this topic is in the narrative ADV Brochure, at item 8 (Methods of Analysis, Investment Strategies and Risk of Loss).

Past Bad Conduct by the Adviser or Its Personnel — Check ADV Part 1, item 11 (Disclosure Information) and Brochure item 9 (Disciplinary Information) for any disclosures of misconduct or other reportable events by the adviser. If there are any, be sure to gather as much information from independent sources as you can before moving forward with your selection.

CONCLUSION

Reviewing an RIA’s Form ADV Part 2 should not be the only research you do on the adviser, but it’s an excellent way to:

- get a good understanding of the fundamentals of the RIAs business model and practices; and

- check for things that could eliminate the adviser from your consideration (e.g., lack of independence or a sales agenda likely to cloud the investment advice; past inappropriate conduct; significant conflicts of interests; fees that are too high; a high minimum asset level to qualify as a client; an investment approach that’s very different from yours; or services that do not fit your needs).