Geopolitical Risk Update

January 23, 2024

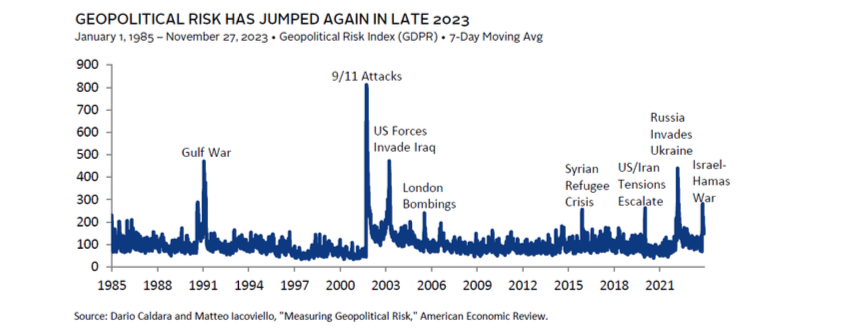

Serious global events have historically caused markets to become more volatile in the short term. Geopolitical risk rose in late 2023, triggered by events in the Middle East. This followed up the spike in risk during 2022 when Russia invaded Ukraine:

From an investment perspective, what matters more to us is both the impact on markets and how we can address geopolitical risks in a portfolio. Heightened geopolitical risk has historically increased short term volatility for risk assets. This is because global events tend to increase fears about economic recession. In general, equities tend to fall, the price of oil rises (if the event occurs in the Middle East), gold rises and the US Dollar appreciates.

Major Geopolitical Risks- 2024

At the beginning of every year, Dr. Ian Bremmer of Eurasia Group releases his top geopolitical concerns. Here is an excerpt of his top three risks for 2024:

- Russia-Ukraine–is getting worse. Ukraine now stands to lose significant international interest and support. For the United States in particular, it’s become a distant second (and increasingly third or lower) policy priority.

- Israel-Gaza–is getting worse. There’s no obvious way to end the fighting, and whatever the military outcome, a dramatic increase in radicalization is guaranteed.

- United States–the biggest challenge in 2024. The world’s most powerful country faces critical challenges to its core political institutions: free and fair elections, the peaceful transfer of power, and the checks and balances provided by the separation of powers.

Portfolio Impact of Geopolitical Risk

a. Equities

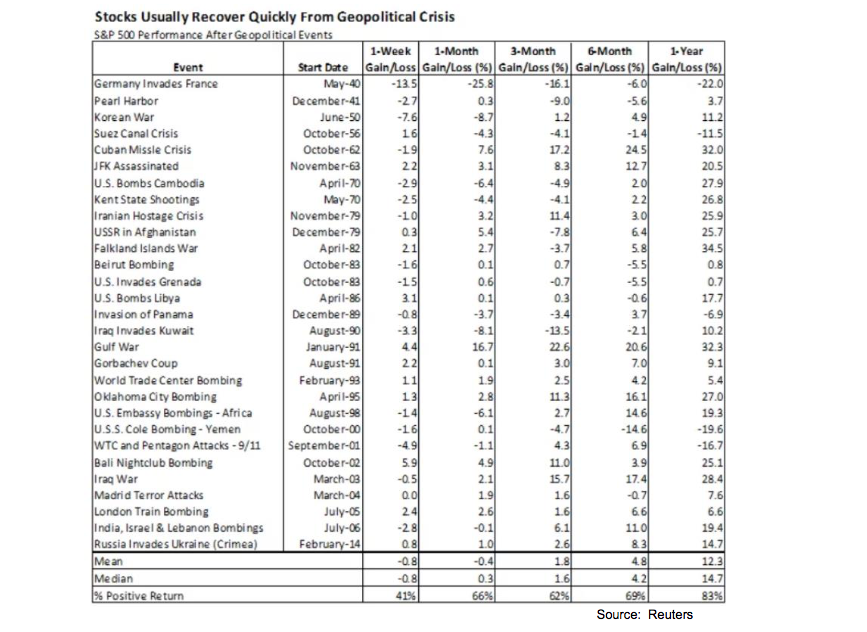

Equities are strongly affected by sentiment in the short run. As a result, the worry caused by geopolitical events tend to cause volatility to increase quickly. Below is a table of how US equities have reacted to global events from 1940 to 2018:

History has shown that equity markets move down when the event occurs. It is usually an emotional response due to uncertainty which triggers short term volatility. As markets assess the fundamental impact the decline has tended to recover in short order. The reason is that the long term earnings power of stocks is not affected by the geopolitical event.

b. Oil

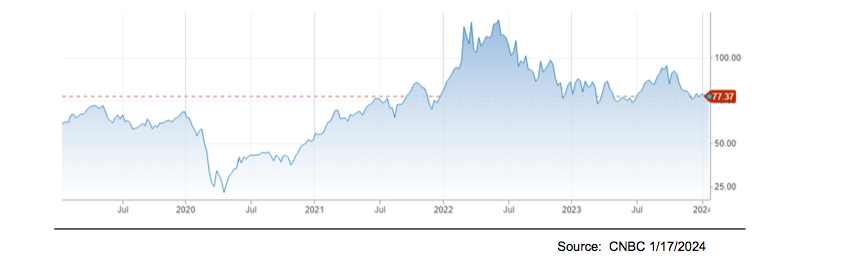

Oil is a critical resource for the economy. As result, potential disruption can move financial markets. For example, the price of oil rose quickly after Russia invaded Ukraine at the beginning of 2022 because Russia is one of the world’s largest exporters. Initially oil prices rose due to Russia’s significance to the oil market. However, by the end of 2022, Brent oil prices had fallen back to nearly where it began the year as the price spike dissipated, as seen:

Similarly the price of oil rose initially last fall when Israel invaded Gaza, spreading fears of a larger Middle East conflict. However, the price of oil has fallen back to pre-invasion levels. Recently, the Houthis in Yemen have attacked shipping in the Red Sea. This has not caused a significant move for oil, either. Oil has not reacted as in the past, for example during Arab oil embargo of the 1970s. This might be due to the global economy being less energy intensive, the diversification of energy sources (such as solar and wind) and strong US production. Similar to equity, the price increase has been short-lived.

The Houthis attacks have caused an increase in shipping costs, particularly from Asia to Europe. Will that be an inflation triggering event that will change the Federal Reserve’s monetary policy? Unlikely. The Nobel Prize winning economist, Paul Krugman, stated that shipping costs have a very small lasting impact on inflation. Moreover, most goods that the US imports are from Asia and do not go through the Red Sea. Perhaps there might be an inflationary impact to Europe, but not the US. As a result, US rates have not reacted to it.

c. US Dollar

The US Dollar initially appreciated after the Russian invasion. This is due to the flight-to-quality during times of geopolitical stress. However, the driver of the strong dollar appreciation in 2022 is more likely the result of aggressive Federal Reserve monetary policy to quell inflation, not geopolitical risk.

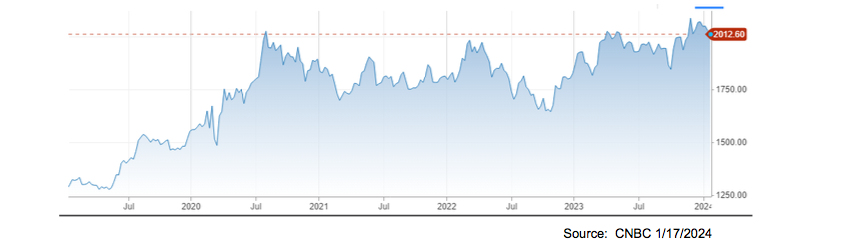

d. Gold

Historically gold is one of the strongest performing assets during times of heightened geopolitical stress. Gold posted a strong return in both 1Q-2022 after Russia’s invasion of Ukraine and in fall of 2023 with Israel’s invasion of Gaza. However, the volatility in between events might be more due to Federal Reserve policy.

Putting it all Together

Historically geopolitical events have caused short term increases in volatility due to worsening sentiment. It does not affect the structural economic growth rate, long term corporate earnings power, inflation expectations and monetary policy. While sentiment to the event can cause short term prices to move, geopolitical risk does not affect an asset’s intrinsic value.

However, the increase in volatility surrounding these events, even if temporary, can be unsettling. For those who want to “smoothen the ride” during stress events, hedge fund volatility strategies and core bonds are particularly appealing. Core bond yields offer flight-to-quality given its higher allocation to AAA US Treasury bonds and mortgage backed securities, along with high quality investment grade bonds. With inflation falling, core bonds have an attractive real yield. Most of all, core bonds can offer peace of mind when volatility spikes. A well-diversified portfolio consisting of high quality investments is one of the best ways to ride out the volatility of geopolitical risk events.

DISCLAIMER

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. Certain hypothetical market situations herein are based on historical data.

Certain statements contained herein may constitute “forward-looking statements.” Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. All investment involves the risk of loss.

Information contained herein has been obtained from sources we believe to be reliable, but we do not guarantee its completeness or accuracy. The information contained herein does not constitute legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.