Fixed Income— U.S. Debt Dynamics

November 10, 2023

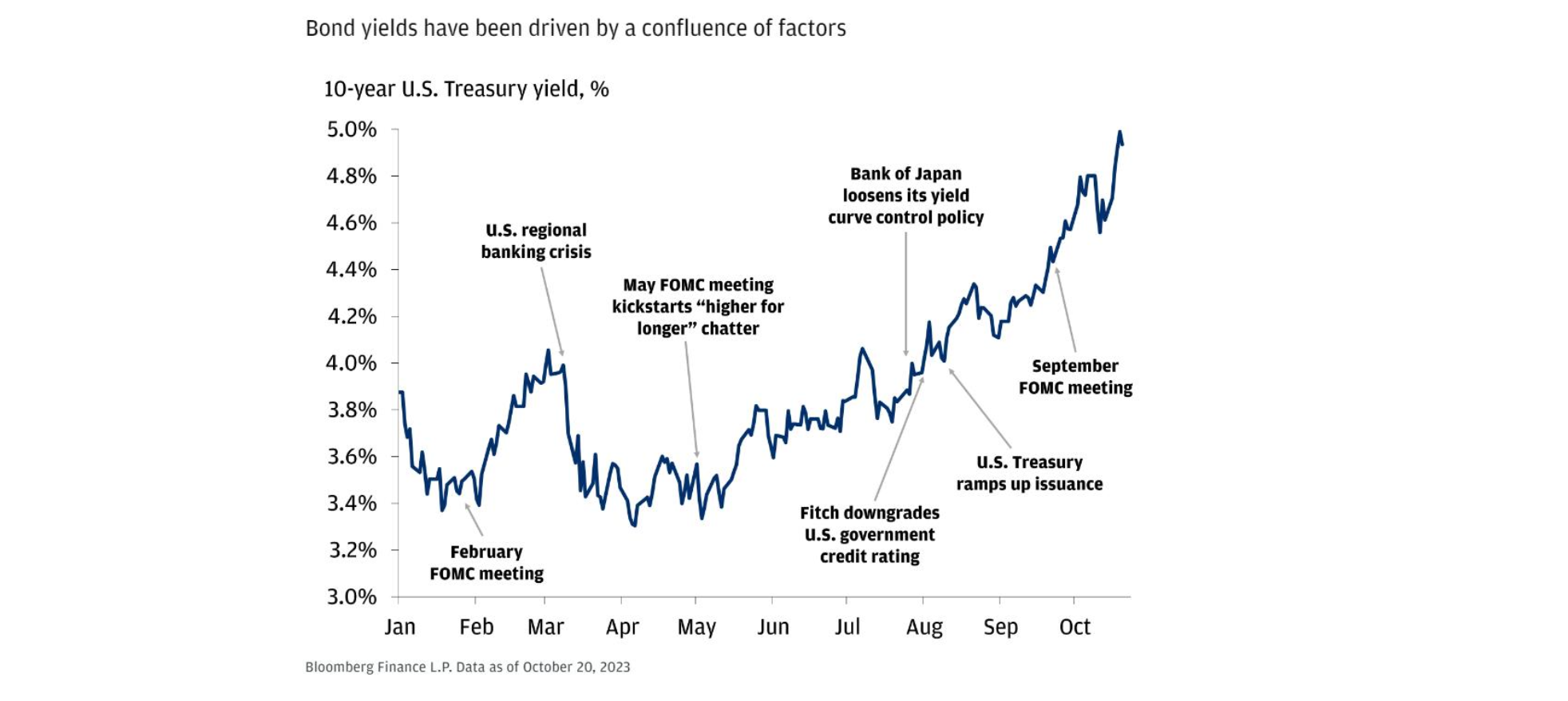

Since the summer, we have been recommending high-quality core bonds (which include short-dated U.S. Treasuries). Although down the past few days, interest rates have risen throughout the year and weighed on bond market returns. Rates have risen this year for a host of reasons:

Yields are determined by three primary factors: policy rate (real economic growth and inflation), supply vs. demand (liquidity) and the term premium. Generally, it is the first factor that is most important.

Policy Rate

Over the past year and a half, the Federal Reserve has aggressively raised rates to cool off inflation. Aggressive policy has been a major reason yields rose through August after the FOMC raised rates 25 bps at the July meeting. During that time, the Fed raised rates over 500 bps, and headline inflation fell significantly. As a result, the Fed’s rate tightening might be nearing an end as they paused at the September and October meetings. However, interest rates are likely to remain higher for longer due to the stubbornness of core inflation, which is above the Fed’s long-term target.

In addition to Fed policy, the third quarter saw economic data come in better than expected. Solid economic numbers helped support rates, in our view. U.S. September composite PMI moved up to 50.0, led by an improvement in services PMI. U.S. industrial production rose by 0.3% in September. Moreover, retail sales were also favorable, led by strong household consumption. As a result, U.S. GDP rose 4.9% annually in the third quarter, the fastest pace since 2021. It is a strong acceleration from the second quarter’s 2.1% pace.

The U.S. Treasury 10-year has tracked economic growth fairly well through September, as expected. The chart below shows how U.S. Treasury 10-year yields tracked economic growth.

However, the economy has recently started to see some signs of weakness. Manufacturing activity in the U.S. contracted more than expected in October. The ISM manufacturing index declined to 46.7—in contraction territory. The Atlanta Fed GDP Tracker reflects the slowdown, which provides a useful pulse of economic growth.

However, the economy has recently started to see some signs of weakness. Manufacturing activity in the U.S. contracted more than expected in October. The ISM manufacturing index declined to 46.7—in contraction territory. The Atlanta Fed GDP Tracker reflects the slowdown, which provides a useful pulse of economic growth.

The Treasury Department forecasted that the pace of growth likely will tumble to 0.7% in the fourth quarter and just 1% for the full year in 2024. In September, the Federal Reserve’s Statement of Economic Projections put expected GDP growth at 1.5% in 2024. As a result, U.S. Treasury yields should have fallen.

But in October, the U.S. Treasury 10-year yields appear to have diverged from the Fed’s growth tracker, as seen in the above chart. Moreover, one would have expected U.S. yields to have fallen due to the higher geopolitical risk in the third quarter. Historically, when geopolitical risks rise, U.S. Treasury markets would have rallied due to flight to safety, resulting in falling yields. Instead, yields rose throughout the month.

We suspect that the cause of higher yields was related to U.S. political and debt dynamics, particularly Treasury liquidity. Leadership issues in the U.S. House of Representatives throughout October could have soured sentiment. But the major factor, in our opinion, is the supply-demand imbalance that has been occurring in the Treasury market. U.S. debt dynamics have pushed up yields and will impact the bond markets for the foreseeable future. In the next section, we will provide an overview of the U.S. debt factors that will continue to affect yields.

Treasury Bond Supply vs Demand

Like any traded asset, price is where supply and demand clears. The same occurs in the Treasury market. Treasury yields are largely determined at auctions where buyers (investors) and sellers (U.S. Treasury) interact. This is where the U.S. deficit is funded.

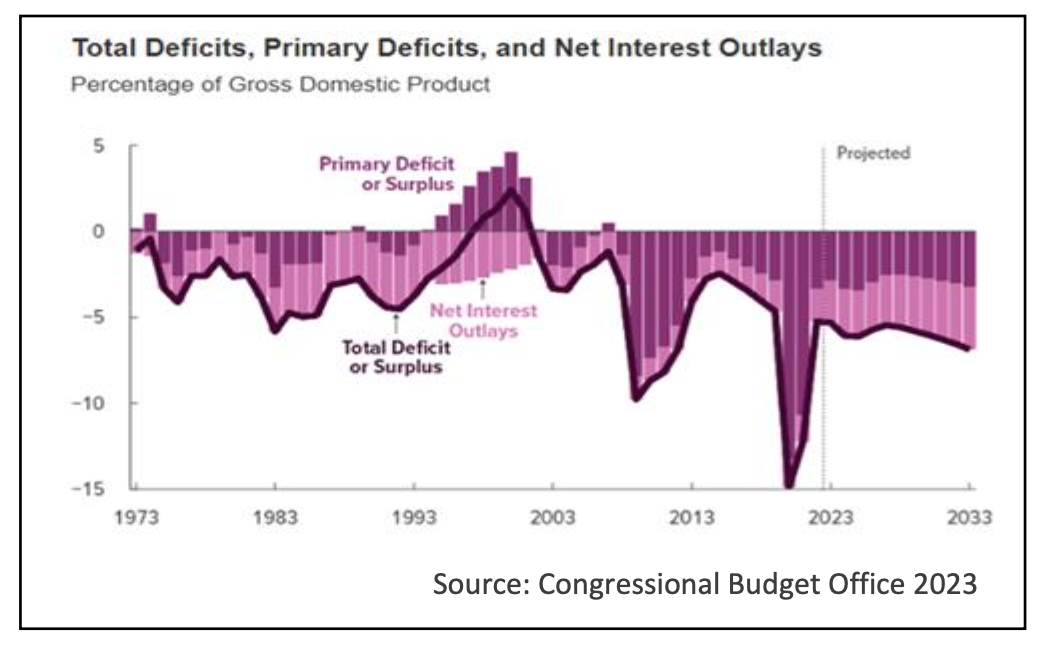

Historically, the U.S. deficit has averaged 3% of GDP in normal times (i.e., peacetime with no recessions). It rose significantly during COVID-19. According to the non-partisan Congressional Budget Office, that annual deficit is expected to increase to approximately 7% annually for the next decade as interest expense rises.

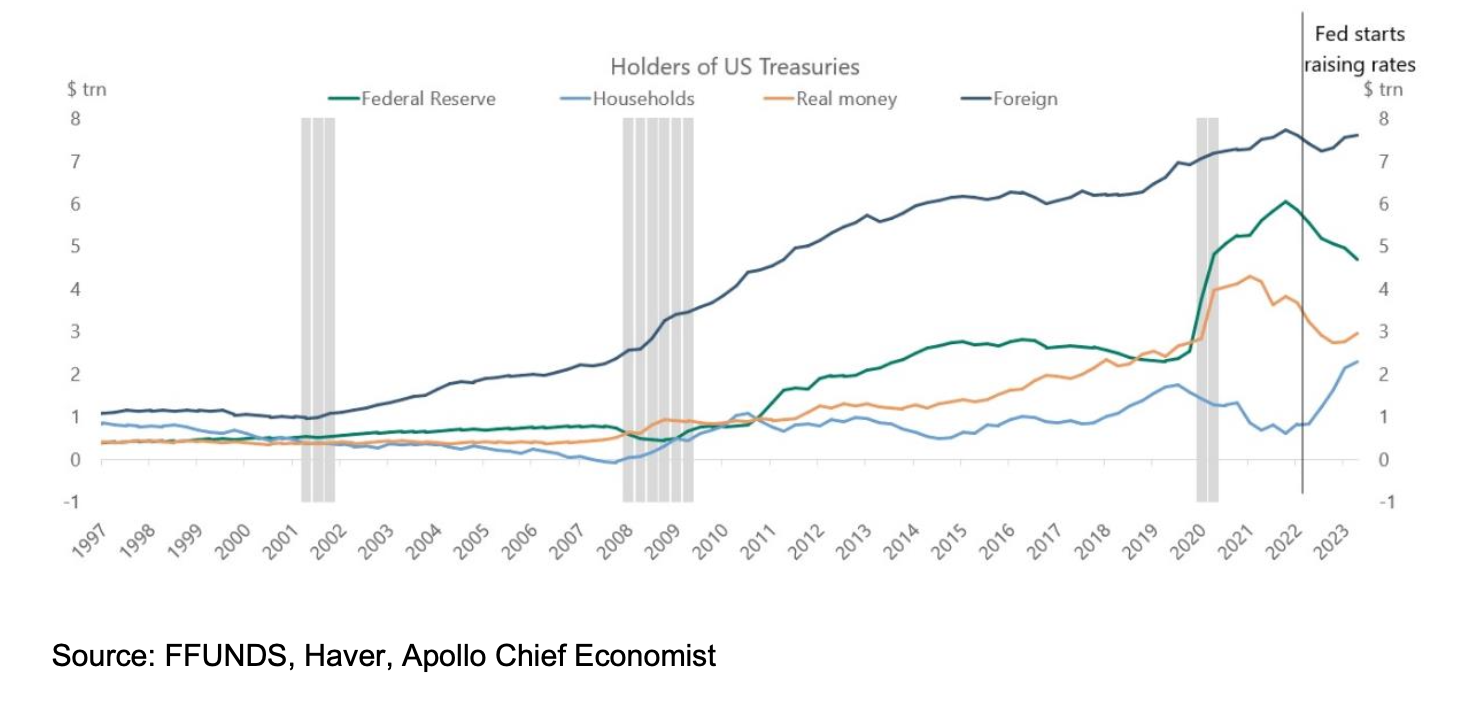

A major problem is that the two largest investor groups have pulled back. Foreign investors (especially Japanese and Chinese investors) have slowed purchases, and the Federal Reserve has been selling $60 bn/ month of its holdings as part of quantitative tightening.

More buyers are needed this decade to fund the larger deficits. Higher rates are needed to coax them to buy more, and as a result, rates will stay high. With the 2023 deficit higher at approximately $2 trillion, supply-demand appears to have been a major cause of the yield rise. We believe this is likely to be the case going forward.

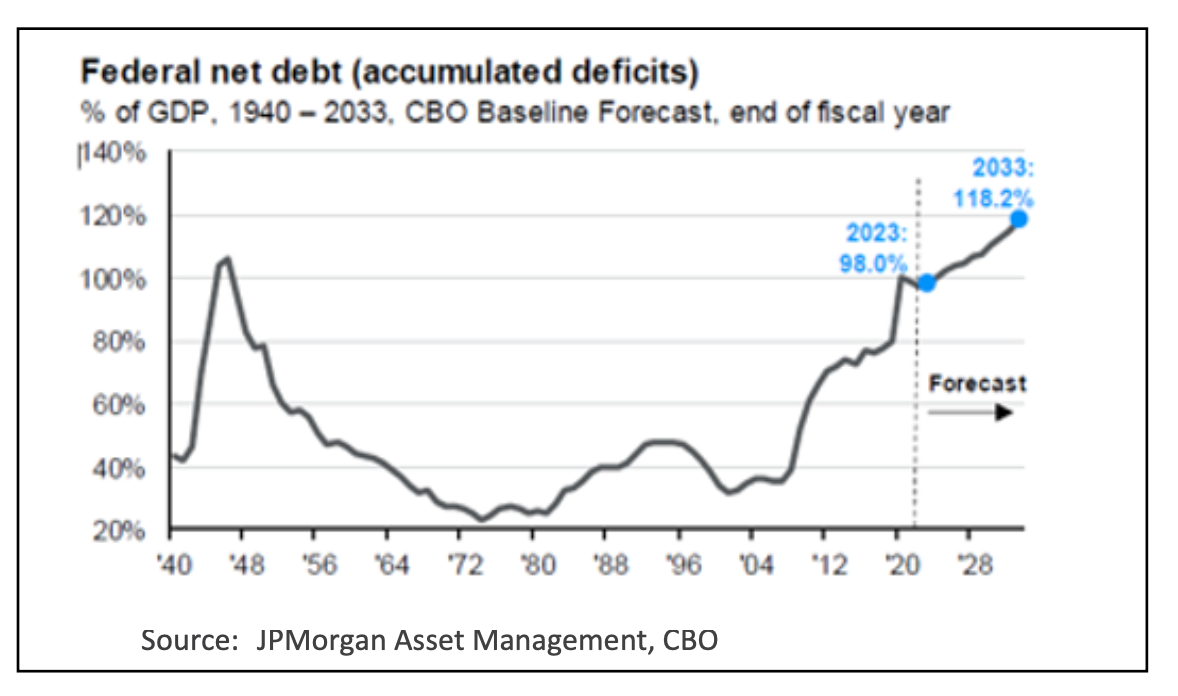

U.S. debt (held by the public) is nearly 100% and is expected to rise throughout the decade. It means more buyers are needed. The debt trajectory is also likely to sharpen the political debate.

In the first half of this year, we faced the risk of the debt ceiling not being raised, potentially causing a debt default. This type of political gridlock might be a more frequent event, in our view.

Term Premium

The U.S. is not at risk of defaulting on its debt. The country is very wealthy and has the ability to meet its debt obligations. However, the willingness to repay due to political polarization could cause interest rates to become more volatile.

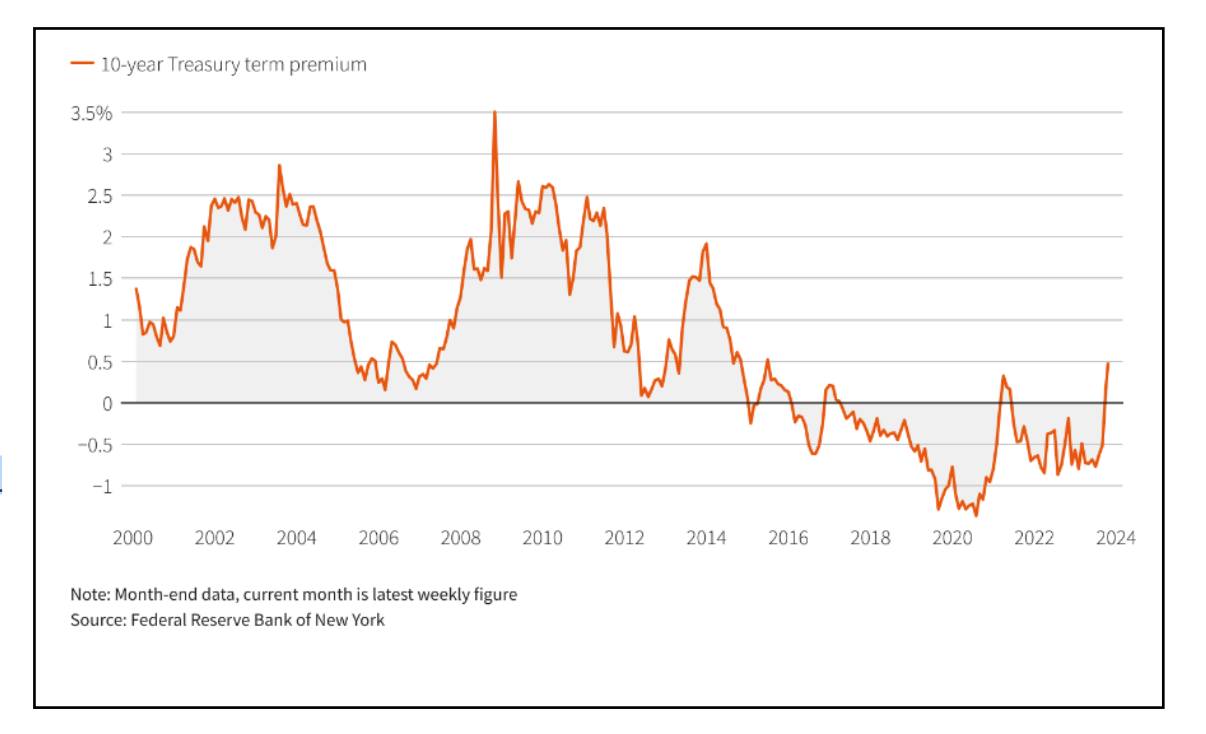

As a result, investors will need to be compensated for the higher risk through a higher term premium. The term premium spiked in 2013 when political risk rose. It has also risen this year. Going forward, the term premium might continue to rise.

Beyond politics, there is an economic impact. The larger the debt burden combined with higher interest rates, the more funds are directed to the payment of interest rather than productive growth investment. The crowding out of investment could lower future U.S. economic growth.

Implications for Investing

So, what does this actually mean for investing? The effect on markets is likely to be secularly higher bond yields, higher volatility, lower growth and a weaker U.S. dollar. Its impact on investments is broad:

- Bond yields are likely to be higher than otherwise due to the need to find new buyers and reflect the higher term premium. It makes the yields of shorter-duration core fixed bonds more attractive.

- In addition to higher yields, higher volatility should increase the discount rate for all risk assets.

- U.S. equities should face increased headwinds due to a higher discount rate and lower corporate earnings. Higher interest rates reduce corporate earnings and lower economic growth causes revenues to slow. This will be a challenge for equity returns, given the current high valuations.

- Higher volatility makes macro hedge fund strategies attractive.

- A weaker U.S. dollar should help boost returns for unhedged foreign assets. A weaker dollar should also benefit gold.

Conclusion

Despite the debt dynamics, we continue to be optimistic about the outlook for core fixed income- yields are attractive and up significantly over the past year, perform well after the Fed ends its rate hiking cycle, and are not exposed to reinvestment risk to the extent of short-dated treasury bills, provides a counter-balance to equities and we believe it is attractively valued compared to equities.

Click here to download the PDF.

DISCLAIMER

This document contains our current opinions and commentary that are subject to change without notice. Our commentary is distributed for informational and educational purposes only and is not investment advice and does not consider the specific investment objective, financial situation, or particular needs of any recipient.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. Certain hypothetical market situations herein are based on historical data.

Certain statements contained herein may constitute “forward-looking statements.” Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. All investment involves the risk of loss.

Information contained herein has been obtained from sources we believe to be reliable, but we do not guarantee its completeness or accuracy. The information contained herein does not constitute legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.