Fixed Income Note

March 9, 2023

Fixed income is finally offering income. After enduring several years of low yields, liquid fixed income market yields are finally attractive. Moreover, with the economy expected to weaken due to Federal Reserve hikes, liquid fixed income can provide both shelter from a potential storm and a way to get paid to wait out the turbulence.

1. Market Environment

Source: Bloomberg, FactSet, Standard Poor’s, U.S. Treasury, J.P. Morgan Asset Management

In 2022, yields rose significantly across the fixed income space. The Federal Reserve raised interest rates significantly in order to quell inflation. Policy rates went from nearly zero to approaching 4.5% in one year. It was one of the most aggressive rate hike cycles in decades.

The result was that while fixed income suffered significant losses in 2022, it also set up yields that are attractive for 2023. Yields for the benchmark US Aggregate went up nearly 2.5x. Yields across sectors rose two to three times in one year.

The economic environment remains very volatile. Many expect that the economy will enter a recession due to the aggressive Federal Reserve rate hikes. However, the current economy is still quite strong. Inflation, while having fallen since its peak last June, has been stubborn in receding further. This has resulted in high macro volatility.

Two risks that we see are a potential default of US Treasury bonds and higher interest rates. The debt ceiling has been reached and the Congressional Budget Office estimates that the ceiling will have to be raised by the third quarter in order to avoid default. The debt ceiling issue appears to us more about political theatrics than an ability to pay. Even if the political brinkmanship is pushed all the way to the edge, we expect a deal will be reached before default. However, markets are likely to become more volatile as we move through the spring. The second risk is that interest rates rise beyond what is forecasted due to rising inflation. While inflation has come down since peaking last June, it has proven to be stickier than expected. In fact, recent inflation reads have month-over-month inflation actually rising. It will still take time for inflation to recede, and as a result, interest rates may stay lower for longer or continue to rise. For this reason, we are still cautious on extending duration risk.

2. Allocation

While yields have risen, it is important to assemble a liquid fixed income portfolio that provides all the functions necessary in a portfolio—safety (capital preservation), stability, and income. Moreover, strategies that provide inflation protection and tax benefits are also critical as both factors are likely to rise in the future. The following strategies are used to build a liquid fixed income allocation:

- Government: Provides safety utilizing both federal and municipal debt. The debt is backed by the governments’ ability to raise taxes to generate the revenue that services its debt obligations. Municipals generally offer tax

- Corporate: Provides income utilizing both high grade and high yield (covering bonds and loans). High grade is lending to companies of investment-grade quality that have a high degree of meeting principal and interest payments on time and in the full High yield provides return enhancement through the higher yields of lending to below-investment-grade companies. Yields have become more attractive due to both an increase in spreads and base interest rates. While private credit has attracted significant flows the past few years and has a role to play in a portfolio, liquid credit is now much more compelling.

- Securitized: Provides stability and yield utilizing mortgage-backed (MBS) and asset-backed securities (ABS). Securitization entails bundling cash flows from various types of loans (e.g. mortgage payments, car payments and credit card payments) and repackaging to investors as bonds. Agency mortgage backed provide safety since it is backed by Fannie Mae. ABS provides diversification due to being composed of thousands of

- Real Asset: Provides inflation protected yield by investing in both real estate and infrastructure debt Both are highly levered sectors that provide stable cashflows. Infrastructure will require significant funding over the next few decades to rebuild traditional infrastructure and alternative energy infrastructure. While non-traded REITs have attracted significant flows the past few years and have a role to play in a portfolio, real estate credit is now much more compelling. In fact, it has yields similar to core non-traded REITs while being higher in the capital structure.

- International: Provides diversification by investing in foreign bonds, both international and These countries generally have economic cycles driven by different mix of monetary and fiscal policies than those of the United States.

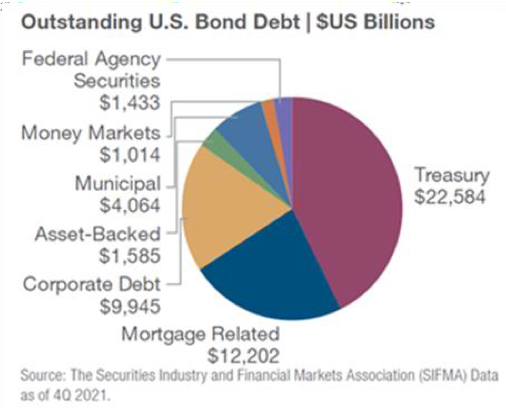

For many years, investors refrained from investing much in liquid bond strategies. The investment opportunity in bonds is large due to the enormous size of the US bond market, which is more than $50 trillion according to McKay Shields. It provides deep liquidity, and due to last year’s extremely large increase in interest rates, attractive opportunities have emerged across sectors. In order to construct a liquid fixed income portfolio, it is recommended to use both core funds (e.g. total return and strategic income), which allocate across many fixed income sectors and single sector funds. Core is investment grade and acts as a ballast to a portfolio. Essentially, it would entail maintaining core strategies at the center with single strategies as satellites.

For many years, investors refrained from investing much in liquid bond strategies. The investment opportunity in bonds is large due to the enormous size of the US bond market, which is more than $50 trillion according to McKay Shields. It provides deep liquidity, and due to last year’s extremely large increase in interest rates, attractive opportunities have emerged across sectors. In order to construct a liquid fixed income portfolio, it is recommended to use both core funds (e.g. total return and strategic income), which allocate across many fixed income sectors and single sector funds. Core is investment grade and acts as a ballast to a portfolio. Essentially, it would entail maintaining core strategies at the center with single strategies as satellites.

The rationale is that core funds provide diversification across sectors. It provides value by assessing relative value among sectors and adapts as market conditions change. Sector-focus funds specialize within a particular area. That expertise allows it to provide better return vs. risk within a strategy. We also recommend that active funds be used due to the wide number of risks associated in fixed income, including interest rate, rate volatility and reshaping, credit, prepayment and foreign exchange. It requires active management of those risks and aligning potential return with risk.

A critical point is that core fixed income finally offers optionality. It has become more valuable because the economic environment is very opaque. If the economy goes into recession, core acts as a ballast. If the economy does not go into recession, its yield is now attractive. As a result, liquid fixed income has become a more attractive part of a portfolio.

Click here to download the PDF.

DISCLAIMER and RISK DISCLOSURES

This document contains our current opinions and commentary that are subject to change without notice. Our commentary is distributed for informational and educational purposes only and is not investment advice and does not consider the specific investment objective, financial situation, or particular needs of any recipient.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. Certain hypothetical market situations herein are based on historical data.

Certain statements contained herein may constitute “forward-looking statements.” Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. All investment involves the risk of loss.

Information contained herein has been obtained from sources we believe to be reliable, but we do not guarantee its completeness or accuracy. The information contained herein does not constitute legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.

Investments in fixed income securities are subject to legal and other restrictions on transfers for which no liquid market may exist. The sale of restricted and illiquid securities often requires higher brokerage charges or dealer discounts and other selling expenses than the sale of securities eligible for trading on national securities exchanges or in the over-the-counter markets. The principal markets in which clients expect to invest, are generally less liquid than are other securities (e.g., stocks). As a result, calculating the fair market value of the security holdings may be difficult, and in any event, subjective. Market prices if available for such securities tend to be volatile and investors may not be able to realize what it perceives to be their fair value in the event of a sale. Credit risk may arise through a default by one of several large institutions that are dependent on one another to meet their liquidity or operational needs, so that a default by one institution causes a series of defaults by the other institutions. The value of fixed rate securities in which investors may invest generally will have an inverse relationship with interest rates. Accordingly, if interest rates rise the value of such securities may decline. In addition, to the extent that the receivables or loans underlying specific securities are pre-payable without penalty or premium, the value of such securities may be negatively affected by increasing prepayments, which generally occur when interest rates decline.