Asset Allocation – Combining Private and Public Real Estate

January 2, 2024

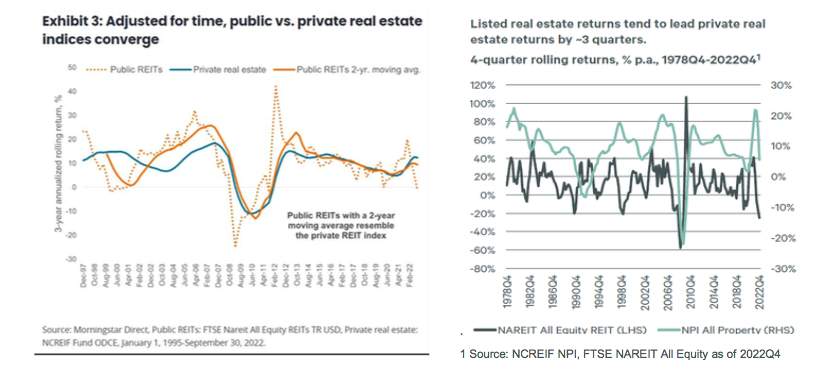

Real estate is a large and diverse asset class. Investing in both public and private markets is beneficial. Over the long term, both strategies reach the same point, they just move differently through the cycle due to liquidity variances. Combining both public and private leads to a better overall allocation through the cycle. Historically, the public REIT market tends to lead private markets by three quarters:

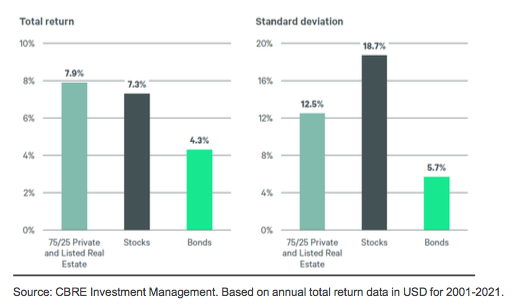

Historically, a 75% private/25% public allocation performed well. The combination works better through the cycle and gives more complete exposure to the overall real estate market.

The blended approach performs well compared to both stocks and bonds. Moreover, the return vs. risk (standard deviation) is better than stocks and bonds.

DISCLAIMER

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. Certain hypothetical market situations herein are based on historical data.

Certain statements contained herein may constitute “forward-looking statements.” Due to various risks and uncertainties, actual events or results or the actual performance may differ materially from those reflected or contemplated in such forward-looking statements. All investment involves the risk of loss.

Information contained herein has been obtained from sources we believe to be reliable, but we do not guarantee its completeness or accuracy. The information contained herein does not constitute legal or tax advice to any person. Please consult with your tax advisor regarding any taxation implications of the information presented in this presentation.