WE Stands for Wealth Enterprise®

WE HELPS FAMILIES MANAGE THEIR WEALTH LIKE A WELL-RUN BUSINESS.

Over our decades of working with some of the world’s wealthiest families, we’ve observed that families who successfully sustain their wealth across multiple generations manage the family wealth as they would a business enterprise. They create a wealth enterprise®.

THE BENEFITS OF MANAGING WEALTH LIKE A WELL-RUN BUSINESS INCLUDE:

- A clear purpose for your wealth and a long-term strategy with which to manage it

- A clear understanding of everyone’s role in managing the family’s wealth

- Financial products that are right for you, purchased at the right price and from the right provider

- Easy-to-understand financial statements and reporting capabilities that allow you to measure progress toward your goals and make decisions with clarity and confidence

- An effective decision-making process with transparent governance structures in place

Where Do I Start?

The place to begin is to start thinking of your wealth as a business – beginning with an extensive mapping of all its components and answering a series of foundational questions:

Who are we as a family?

What do we own?

How do we own it?

Answering these questions serves as a starting place for your wealth enterprise®.

STEP 1: UNDERSTAND THE STATUS QUO

Ask any successful business owner what his profits and losses are, and it is likely he would be able to tell you precisely. Income statements, balance sheets, cash flows – all of these report and present critical information for any thriving business. Why shouldn’t a wealthy family use the same tools to manage the business of its wealth? The first step in building your wealth enterprise® is to gather a robust set of financial statements to gain a complete understanding of where you are, where you’re going and where you’d like to be.

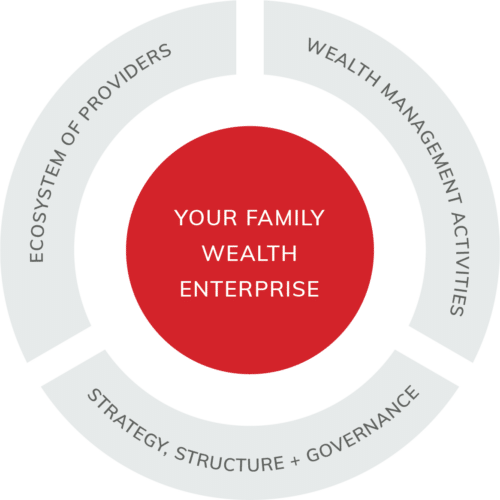

STEP 2: THREE PRIMARY COMPONENTS OF WEALTH MANAGEMENT

Aspects to consider would be: financial administration, financial planning, estate and tax planning, investment advisory and risk management.

Once you’ve identified all the most important pieces of information in your wealth enterprise®, it will make it easier to see what areas need to be addressed and improved.